Form Atf F 5620.8 - General Instructions

ADVERTISEMENT

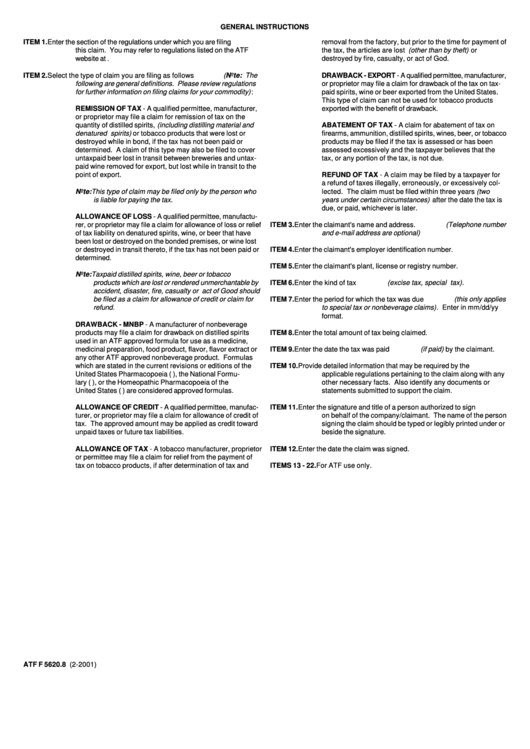

GENERAL INSTRUCTIONS

ITEM 1.

Enter the section of the regulations under which you are filing

removal from the factory, but prior to the time for payment of

this claim. You may refer to regulations listed on the ATF

the tax, the articles are lost (other than by theft) or

website at

destroyed by fire, casualty, or act of God.

ITEM 2.

Select the type of claim you are filing as follows (Note: The

DRAWBACK - EXPORT - A qualified permittee, manufacturer,

following are general definitions. Please review regulations

or proprietor may file a claim for drawback of the tax on tax-

for further information on filing claims for your commodity) :

paid spirits, wine or beer exported from the United States.

This type of claim can not be used for tobacco products

REMISSION OF TAX - A qualified permittee, manufacturer,

exported with the benefit of drawback.

or proprietor may file a claim for remission of tax on the

quantity of distilled spirits, (including distilling material and

ABATEMENT OF TAX - A claim for abatement of tax on

denatured spirits) or tobacco products that were lost or

firearms, ammunition, distilled spirits, wines, beer, or tobacco

destroyed while in bond, if the tax has not been paid or

products may be filed if the tax is assessed or has been

determined. A claim of this type may also be filed to cover

assessed excessively and the taxpayer believes that the

untaxpaid beer lost in transit between breweries and untax-

tax, or any portion of the tax, is not due.

paid wine removed for export, but lost while in transit to the

point of export.

REFUND OF TAX - A claim may be filed by a taxpayer for

a refund of taxes illegally, erroneously, or excessively col-

Note:This type of claim may be filed only by the person who

lected. The claim must be filed within three years (two

is liable for paying the tax.

years under certain circumstances) after the date the tax is

due, or paid, whichever is later.

ALLOWANCE OF LOSS - A qualified permittee, manufactu-

rer, or proprietor may file a claim for allowance of loss or relief

ITEM 3.

Enter the claimant's name and address. (Telephone number

of tax liability on denatured spirits, wine, or beer that have

and e-mail address are optional)

been lost or destroyed on the bonded premises, or wine lost

or destroyed in transit thereto, if the tax has not been paid or

ITEM 4.

Enter the claimant's employer identification number.

determined.

ITEM 5.

Enter the claimant's plant, license or registry number.

Note:Taxpaid distilled spirits, wine, beer or tobacco

products which are lost or rendered unmerchantable by

ITEM 6.

Enter the kind of tax (excise tax, special tax).

accident, disaster, fire, casualty or act of Good should

be filed as a claim for allowance of credit or claim for

ITEM 7.

Enter the period for which the tax was due (this only applies

refund.

to special tax or nonbeverage claims) . Enter in mm/dd/yy

format.

DRAWBACK - MNBP - A manufacturer of nonbeverage

products may file a claim for drawback on distilled spirits

ITEM 8.

Enter the total amount of tax being claimed.

used in an ATF approved formula for use as a medicine,

Enter the date the tax was paid (if paid) by the claimant.

medicinal preparation, food product, flavor, flavor extract or

ITEM 9.

any other ATF approved nonbeverage product. Formulas

which are stated in the current revisions or editions of the

ITEM 10.

Provide detailed information that may be required by the

United States Pharmacopoeia (U.S.P.), the National Formu-

applicable regulations pertaining to the claim along with any

lary (N.F.), or the Homeopathic Pharmacopoeia of the

other necessary facts. Also identify any documents or

United States (H.P.U.S.) are considered approved formulas.

statements submitted to support the claim.

ALLOWANCE OF CREDIT - A qualified permittee, manufac-

ITEM 11.

Enter the signature and title of a person authorized to sign

turer, or proprietor may file a claim for allowance of credit of

on behalf of the company/claimant. The name of the person

tax. The approved amount may be applied as credit toward

signing the claim should be typed or legibly printed under or

unpaid taxes or future tax liabilities.

beside the signature.

ALLOWANCE OF TAX - A tobacco manufacturer, proprietor

ITEM 12.

Enter the date the claim was signed.

or permittee may file a claim for relief from the payment of

tax on tobacco products, if after determination of tax and

ITEMS 13 - 22. For ATF use only.

ATF F 5620.8 (2-2001)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1