Instructions For Completing The Asd-21 - Department Of State Treasurer

ADVERTISEMENT

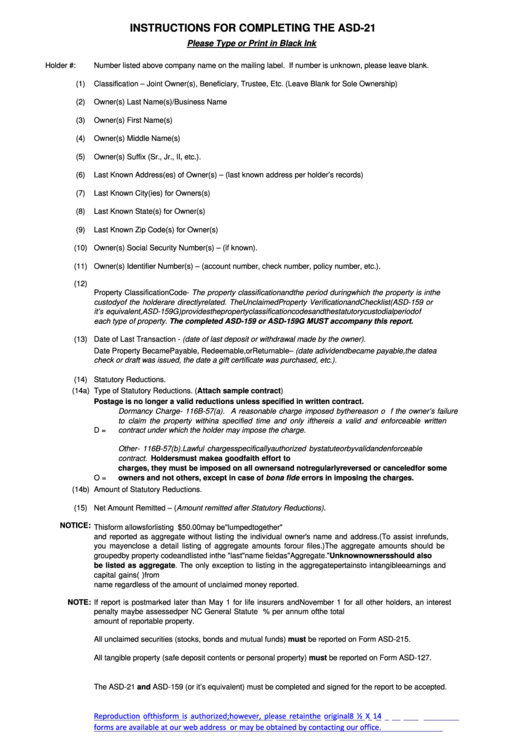

INSTRUCTIONS FOR COMPLETING THE ASD-21

Please Type or Print in Black Ink

Holder #:

Number listed above company name on the mailing label. If number is unknown, please leave blank.

(1)

Classification – Joint Owner(s), Beneficiary, Trustee, Etc. (Leave Blank for Sole Ownership)

(2)

Owner(s) Last Name(s)/Business Name

(3)

Owner(s) First Name(s)

(4)

Owner(s) Middle Name(s)

(5)

Owner(s) Suffix (Sr., Jr., II, etc.).

(6)

Last Known Address(es) of Owner(s) – (last known address per holder’s records)

(7)

Last Known City(ies) for Owners(s)

(8)

Last Known State(s) for Owner(s)

(9)

Last Known Zip Code(s) for Owner(s)

(10)

Owner(s) Social Security Number(s) – (if known).

(11)

Owner(s) Identifier Number(s) – (account number, check number, policy number, etc.).

(12)

Property Classification Code - The property classification and the period during which the property is in the

custody of the holder are directly related. The Unclaimed Property Verification and Checklist (ASD-159 or

it’s equivalent, ASD-159G) provides the property classification codes and the statutory custodial period of

each type of property. The completed ASD-159 or ASD-159G MUST accompany this report.

(13)

Date of Last Transaction - (date of last deposit or withdrawal made by the owner).

Date Property Became Payable, Redeemable, or Returnable – (date a dividend became payable, the date a

check or draft was issued, the date a gift certificate was purchased, etc.).

(14)

Statutory Reductions.

(14a)

Type of Statutory Reductions. (Attach sample contract)

Postage is no longer a valid reductions unless specified in written contract.

Dormancy Charge- 116B-57(a). A reasonable charge imposed by the reason of the owner’s failure

to claim the property within a specified time and only if there is a valid and enforceable written

D =

contract under which the holder may impose the charge.

Other- 116B-57(b). Lawful charges specifically authorized by statute or by valid and enforceable

contract. Holders must make a good faith effort to locate owners. If the holder imposes these

charges, they must be imposed on all owners and not regularly reversed or canceled for some

O =

owners and not others, except in case of bona fide errors in imposing the charges.

(14b)

Amount of Statutory Reductions.

(15)

Net Amount Remitted – (Amount remitted after Statutory Reductions).

NOTICE:

This form allows for listing multiple aggregate amounts. Any money under $50.00 may be "lumped together"

and reported as aggregate without listing the individual owner's name and address. (To assist in refunds,

you may enclose a detail listing of aggregate amounts for our files.) The aggregate amounts should be

grouped by property code and listed in the "last" name field as "Aggregate." Unknown owners should also

be listed as aggregate. The only exception to listing in the aggregate pertains to intangible earnings and

capital gains (i.e. dividends) from securities and mutual funds. These accounts should be listed by owner

name regardless of the amount of unclaimed money reported.

NOTE:

If report is postmarked later than May 1 for life insurers and November 1 for all other holders, an interest

penalty may be assessed per NC General Statute 116B-77. The current rate is 5% per annum of the total

amount of reportable property.

All unclaimed securities (stocks, bonds and mutual funds) must be reported on Form ASD-215.

All tangible property (safe deposit contents or personal property) must be reported on Form ASD-127.

The ASD-21 and ASD-159 (or it’s equivalent) must be completed and signed for the report to be accepted.

Reproduction of this form is authorized; however, please retain the original 8 ½ X 14 size. Additional

forms are available at our web address

If reporting more than 50 owners, holders are required to report electronically in NAUPA file format. Free

electronic reporting software is available at

.

MAIL REPORTING FORMS and REMITTANCE TO:

North Carolina Department of State Treasurer

Unclaimed Property Program

325 North Salisbury Street

Raleigh, North Carolina 27603-1385

Telephone: (919) 508-1000

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1