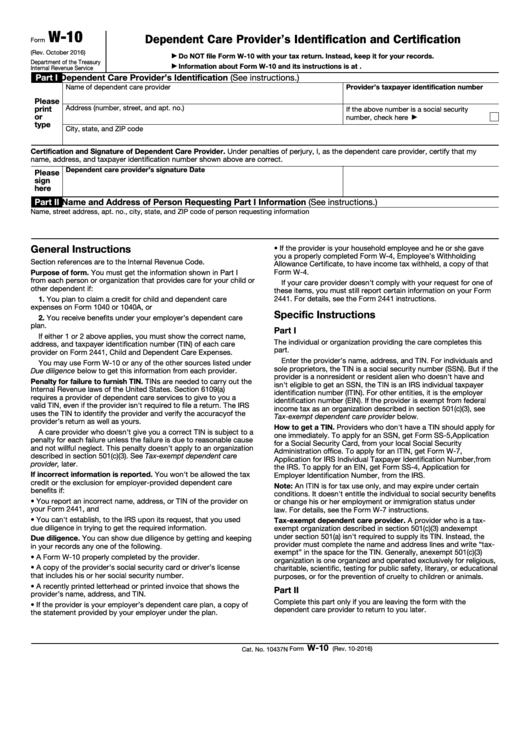

W-10

Dependent Care Provider’s Identification and Certification

Form

(Rev. October 2016)

Do NOT file Form W-10 with your tax return. Instead, keep it for your records.

▶

Department of the Treasury

Information about Form W-10 and its instructions is at

▶

Internal Revenue Service

Part I

Dependent Care Provider’s Identification (See instructions.)

Name of dependent care provider

Provider’s taxpayer identification number

Please

Address (number, street, and apt. no.)

print

If the above number is a social security

or

number, check here

.

.

.

.

.

.

▶

type

City, state, and ZIP code

Certification and Signature of Dependent Care Provider. Under penalties of perjury, I, as the dependent care provider, certify that my

name, address, and taxpayer identification number shown above are correct.

Dependent care provider’s signature

Date

Please

sign

here

Part II

Name and Address of Person Requesting Part I Information (See instructions.)

Name, street address, apt. no., city, state, and ZIP code of person requesting information

General Instructions

• If the provider is your household employee and he or she gave

you a properly completed Form W-4, Employee’s Withholding

Section references are to the Internal Revenue Code.

Allowance Certificate, to have income tax withheld, a copy of that

Purpose of form. You must get the information shown in Part I

Form W-4.

from each person or organization that provides care for your child or

If your care provider doesn't comply with your request for one of

other dependent if:

these items, you must still report certain information on your Form

1. You plan to claim a credit for child and dependent care

2441. For details, see the Form 2441 instructions.

expenses on Form 1040 or 1040A, or

Specific Instructions

2. You receive benefits under your employer’s dependent care

plan.

Part I

If either 1 or 2 above applies, you must show the correct name,

The individual or organization providing the care completes this

address, and taxpayer identification number (TIN) of each care

part.

provider on Form 2441, Child and Dependent Care Expenses.

Enter the provider’s name, address, and TIN. For individuals and

You may use Form W-10 or any of the other sources listed under

sole proprietors, the TIN is a social security number (SSN). But if the

Due diligence below to get this information from each provider.

provider is a nonresident or resident alien who doesn't have and

Penalty for failure to furnish TIN. TINs are needed to carry out the

isn't eligible to get an SSN, the TIN is an IRS individual taxpayer

Internal Revenue laws of the United States. Section 6109(a)

identification number (ITIN). For other entities, it is the employer

requires a provider of dependent care services to give to you a

identification number (EIN). If the provider is exempt from federal

valid TIN, even if the provider isn't required to file a return. The IRS

income tax as an organization described in section 501(c)(3), see

uses the TIN to identify the provider and verify the accuracy of the

Tax-exempt dependent care provider below.

provider’s return as well as yours.

How to get a TIN. Providers who don't have a TIN should apply for

A care provider who doesn't give you a correct TIN is subject to a

one immediately. To apply for an SSN, get Form SS-5, Application

penalty for each failure unless the failure is due to reasonable cause

for a Social Security Card, from your local Social Security

and not willful neglect. This penalty doesn't apply to an organization

Administration office. To apply for an ITIN, get Form W-7,

described in section 501(c)(3). See Tax-exempt dependent care

Application for IRS Individual Taxpayer Identification Number, from

provider, later.

the IRS. To apply for an EIN, get Form SS-4, Application for

If incorrect information is reported. You won't be allowed the tax

Employer Identification Number, from the IRS.

credit or the exclusion for employer-provided dependent care

Note: An ITIN is for tax use only, and may expire under certain

benefits if:

conditions. It doesn't entitle the individual to social security benefits

• You report an incorrect name, address, or TIN of the provider on

or change his or her employment or immigration status under U.S.

your Form 2441, and

law. For details, see the Form W-7 instructions.

• You can't establish, to the IRS upon its request, that you used

Tax-exempt dependent care provider. A provider who is a tax-

due diligence in trying to get the required information.

exempt organization described in section 501(c)(3) and exempt

under section 501(a) isn't required to supply its TIN. Instead, the

Due diligence. You can show due diligence by getting and keeping

provider must complete the name and address lines and write “tax-

in your records any one of the following.

exempt” in the space for the TIN. Generally, an exempt 501(c)(3)

• A Form W-10 properly completed by the provider.

organization is one organized and operated exclusively for religious,

• A copy of the provider’s social security card or driver’s license

charitable, scientific, testing for public safety, literary, or educational

that includes his or her social security number.

purposes, or for the prevention of cruelty to children or animals.

• A recently printed letterhead or printed invoice that shows the

Part II

provider’s name, address, and TIN.

Complete this part only if you are leaving the form with the

• If the provider is your employer’s dependent care plan, a copy of

dependent care provider to return to you later.

the statement provided by your employer under the plan.

W-10

Form

(Rev. 10-2016)

Cat. No. 10437N

1

1