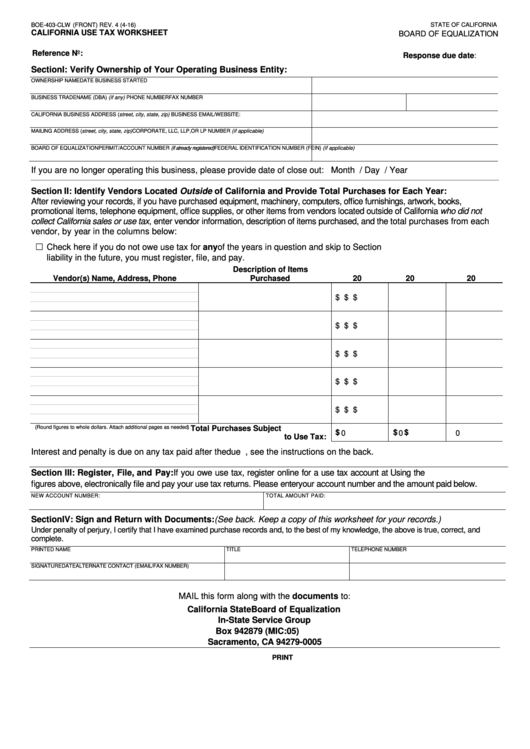

BOE-403-CLW (FRONT) REV. 4 (4-16)

STATE OF CALIFORNIA

CALIFORNIA USE TAX WORKSHEET

BOARD OF EQUALIZATION

Reference No:

Response due date:

Section I: Verify Ownership of Your Operating Business Entity:

OWNERSHIP NAME

DATE BUSINESS STARTED

BUSINESS TRADE NAME (DBA) (if any)

PHONE NUMBER

FAX NUMBER

CALIFORNIA BUSINESS ADDRESS (street, city, state, zip)

BUSINESS EMAIL/WEBSITE:

MAILING ADDRESS (street, city, state, zip)

CORPORATE, LLC, LLP, OR LP NUMBER (if applicable)

BOARD OF EQUALIZATION PERMIT/ACCOUNT NUMBER (if already registered)

FEDERAL IDENTIFICATION NUMBER (FEIN) (if applicable)

If you are no longer operating this business, please provide date of close out: Month

/ Day

/ Year

Section II: Identify Vendors Located Outside of California and Provide Total Purchases for Each Year:

After reviewing your records, if you have purchased equipment, machinery, computers, office furnishings, artwork, books,

promotional items, telephone equipment, office supplies, or other items from vendors located outside of California who did not

collect California sales or use tax, enter vendor information, description of items purchased, and the total purchases from each

vendor, by year in the columns below:

☐ Check here if you do not owe use tax for any of the years in question and skip to Section IV. If you incur a use tax

liability in the future, you must register, file, and pay.

Description of Items

Vendor(s) Name, Address, Phone

Purchased

20

20

20

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

(Round figures to whole dollars. Attach additional pages as needed.)

Total Purchases Subject

$

$

$

0

0

0

to Use Tax:

Interest and penalty is due on any tax paid after the due date. For more information, see the instructions on the back.

Section III: Register, File, and Pay: If you owe use tax, register online for a use tax account at Using the

figures above, electronically file and pay your use tax returns. Please enter your account number and the amount paid below.

NEW ACCOUNT NUMBER:

TOTAL AMOUNT PAID:

Section IV: Sign and Return with Documents: (See back. Keep a copy of this worksheet for your records.)

Under penalty of perjury, I certify that I have examined purchase records and, to the best of my knowledge, the above is true, correct, and

complete.

PRINTED NAME

TITLE

TELEPHONE NUMBER

SIGNATURE

DATE

ALTERNATE CONTACT (EMAIL/FAX NUMBER)

MAIL this form along with the documents to

:

California State Board of Equalization

In-State Service Group

P.O. Box 942879 (MIC:05)

Sacramento, CA 94279-0005

CLEAR

PRINT

1

1 2

2