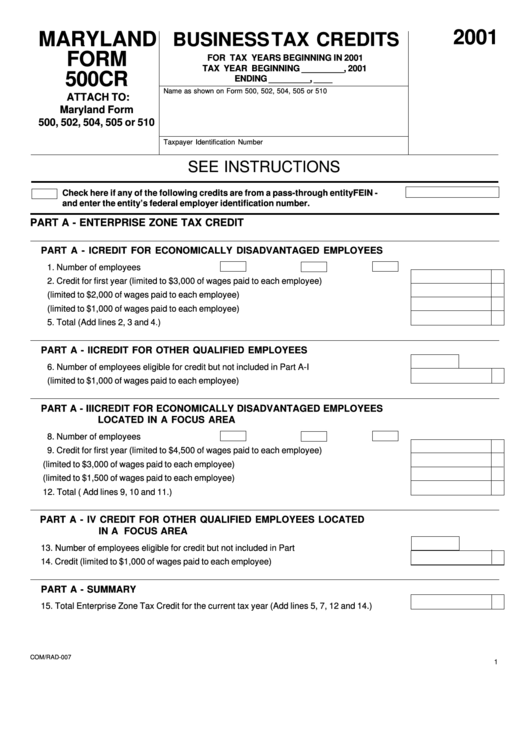

2001

MARYLAND

BUSINESS TAX CREDITS

FORM

FOR TAX YEARS BEGINNING IN 2001

TAX YEAR BEGINNING _________, 2001

500CR

ENDING _________, ____

Name as shown on Form 500, 502, 504, 505 or 510

ATTACH TO:

Maryland Form

500, 502, 504, 505 or 510

Taxpayer Identification Number

SEE INSTRUCTIONS

Check here if any of the following credits are from a pass-through entity

FEIN -

and enter the entity’s federal employer identification number.

PART A - ENTERPRISE ZONE TAX CREDIT

PART A - I CREDIT FOR ECONOMICALLY DISADVANTAGED EMPLOYEES

1. Number of employees eligible. First year

Second year

Third year

2. Credit for first year (limited to $3,000 of wages paid to each employee) ...................................

3. Credit for second year (limited to $2,000 of wages paid to each employee) ..............................

4. Credit for third year (limited to $1,000 of wages paid to each employee) ..................................

5. Total (Add lines 2, 3 and 4.) ......................................................................................................

PART A - II CREDIT FOR OTHER QUALIFIED EMPLOYEES

6. Number of employees eligible for credit but not included in Part A-I .........................................

7. Credit (limited to $1,000 of wages paid to each employee) .......................................................

PART A - III CREDIT FOR ECONOMICALLY DISADVANTAGED EMPLOYEES

LOCATED IN A FOCUS AREA

8. Number of employees eligible. First year

Second year

Third year

9. Credit for first year (limited to $4,500 of wages paid to each employee) ...................................

10. Credit for second year (limited to $3,000 of wages paid to each employee) ..............................

11. Credit for third year (limited to $1,500 of wages paid to each employee) ..................................

12. Total ( Add lines 9, 10 and 11.) .................................................................................................

PART A - IV CREDIT FOR OTHER QUALIFIED EMPLOYEES LOCATED

IN A FOCUS AREA

13. Number of employees eligible for credit but not included in Part A-III ........................................

14. Credit (limited to $1,000 of wages paid to each employee) ........................................................

PART A - SUMMARY

15. Total Enterprise Zone Tax Credit for the current tax year (Add lines 5, 7, 12 and 14.) ................

COM/RAD-007

1

1

1 2

2 3

3 4

4 5

5 6

6