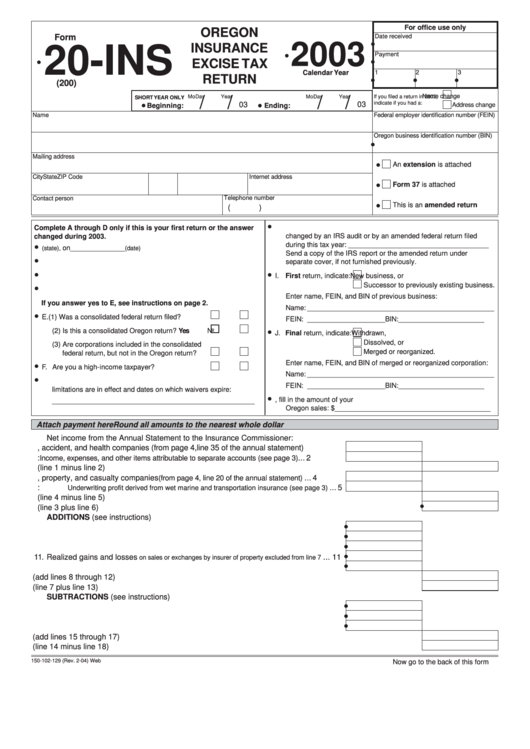

Form 20-Ins - Oregon Insurance Excise Tax Return - 2003

ADVERTISEMENT

For office use only

OREGON

Date received

Form

•

2003

INSURANCE

20-INS

•

Payment

•

•

EXCISE TAX

Calendar Year

1

2

3

RETURN

•

•

•

(200)

Name change

If you filed a return in 2002,

Mo

/

Day

/

Year

Mo

/

Day

/

Year

SHORT YEAR ONLY

•

•

indicate if you had a:

03

03

Address change

Beginning:

Ending:

Name

Federal employer identification number (FEIN)

Oregon business identification number (BIN)

•

Mailing address

•

An extension is attached

City

State

ZIP Code

Internet address

•

Form 37 is attached

Telephone number

Contact person

•

This is an amended return

(

)

•

H. List the tax years for which your federal taxable income was

Complete A through D only if this is your first return or the answer

changed by an IRS audit or by an amended federal return filed

changed during 2003.

•

during this tax year: ____________________________________

A. Incorporated in ______________

on ______________

(state),

(date)

Send a copy of the IRS report or the amended return under

•

B. State of commercial domicile ______________________________

separate cover, if not furnished previously.

•

•

C. Date business activity began in Oregon ______________________

I. First return, indicate:

New business, or

Successor to previously existing business.

•

D. Business Activity Code from federal return ___________________

Enter name, FEIN, and BIN of previous business:

If you answer yes to E, see instructions on page 2.

Name: ________________________________________________

•

E. (1) Was a consolidated federal return filed? ............

Yes

No

FEIN: ____________________ BIN: ______________________

•

(2) Is this a consolidated Oregon return? ................

Yes

No

J. Final return, indicate:

Withdrawn,

Dissolved, or

(3) Are corporations included in the consolidated

Merged or reorganized.

federal return, but not in the Oregon return? .....

Yes

No

Enter name, FEIN, and BIN of merged or reorganized corporation:

•

F. Are you a high-income taxpayer? ...........................

Yes

No

Name: ________________________________________________

•

G. List the tax years for which federal waivers of the statute of

FEIN: ____________________ BIN: ______________________

limitations are in effect and dates on which waivers expire:

•

K. If you did not complete Schedule AP, fill in the amount of your

____________________________________________________

Oregon sales: $ ________________________________________

Attach payment here

Round all amounts to the nearest whole dollar

Net income from the Annual Statement to the Insurance Commissioner:

1. Life, accident, and health companies (from page 4, line 35 of the annual statement) .... 1

2. Less:

... 2

Income, expenses, and other items attributable to separate accounts (see page 3)

3. Subtotal (line 1 minus line 2) .......................................................................................................................... 3

4. Fire, property, and casualty companies

... 4

(from page 4, line 20 of the annual statement)

5. Less:

... 5

Underwriting profit derived from wet marine and transportation insurance (see page 3)

6. Subtotal (line 4 minus line 5) .......................................................................................................................... 6

•

7. Total (line 3 plus line 6) ................................................................................................................................... 7

ADDITIONS (see instructions)

•

8. Federal income taxes deducted in arriving at line 7 .................................................... 8

•

9. State income taxes deducted in arriving at line 7 ........................................................ 9

•

10. Penalty interest on prepayment of loans ................................................................... 10

•

11. Realized gains and losses

... 11

on sales or exchanges by insurer of property excluded from line 7

•

12. Decreases in certain reserves ................................................................................... 12

13. Total additions (add lines 8 through 12) ........................................................................................................ 13

14. Income after additions (line 7 plus line 13) ................................................................................................... 14

SUBTRACTIONS (see instructions)

•

15. Amortization of past service credits ........................................................................... 15

•

16. Increases in certain reserves ..................................................................................... 16

•

17. Depreciation in excess of annual statement allowance ............................................. 17

18. Total subtractions (add lines 15 through 17) ................................................................................................. 18

19. Income before net loss deduction (line 14 minus line 18) ............................................................................. 19

150-102-129 (Rev. 2-04) Web

Now go to the back of this form

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4