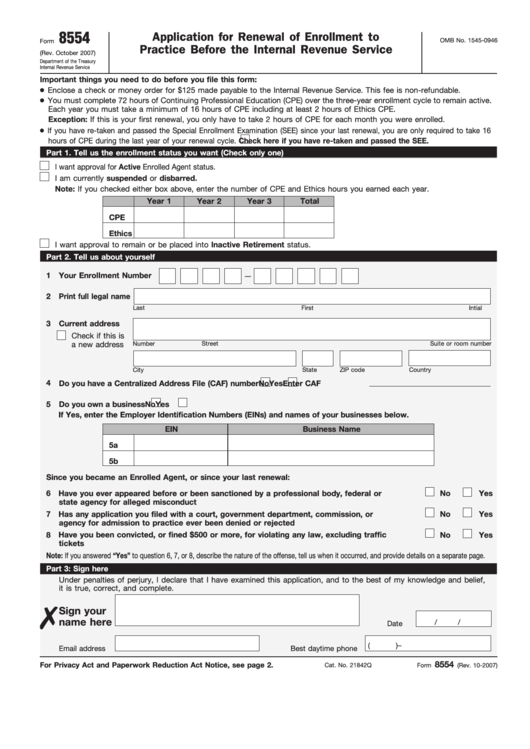

8554

Application for Renewal of Enrollment to

OMB No. 1545-0946

Form

Practice Before the Internal Revenue Service

(Rev. October 2007)

Department of the Treasury

Internal Revenue Service

Important things you need to do before you file this form:

Enclose a check or money order for $125 made payable to the Internal Revenue Service. This fee is non-refundable.

You must complete 72 hours of Continuing Professional Education (CPE) over the three-year enrollment cycle to remain active.

Each year you must take a minimum of 16 hours of CPE including at least 2 hours of Ethics CPE.

Exception: If this is your first renewal, you only have to take 2 hours of CPE for each month you were enrolled.

If you have re-taken and passed the Special Enrollment Examination (SEE) since your last renewal, you are only required to take 16

hours of CPE during the last year of your renewal cycle.

Check here if you have re-taken and passed the SEE.

Part 1. Tell us the enrollment status you want (Check only one)

I want approval for Active Enrolled Agent status.

I am currently suspended or disbarred.

Note: If you checked either box above, enter the number of CPE and Ethics hours you earned each year.

Year 1

Year 2

Year 3

Total

CPE

Ethics

I want approval to remain or be placed into Inactive Retirement status.

Part 2. Tell us about yourself

1

Your Enrollment Number

—

2

Print full legal name

Last

First

Intial

3 Current address

Check if this is

a new address

Number

Street

Suite or room number

City

State

ZIP code

Country

4

Do you have a Centralized Address File (CAF) number

No

Yes Enter CAF

5

Do you own a business

No

Yes

If Yes, enter the Employer Identification Numbers (EINs) and names of your businesses below.

EIN

Business Name

5a

5b

Since you became an Enrolled Agent, or since your last renewal:

6 Have you ever appeared before or been sanctioned by a professional body, federal or

No

Yes

state agency for alleged misconduct

7 Has any application you filed with a court, government department, commission, or

No

Yes

agency for admission to practice ever been denied or rejected

8 Have you been convicted, or fined $500 or more, for violating any law, excluding traffic

No

Yes

tickets

Note: If you answered “Yes” to question 6, 7, or 8, describe the nature of the offense, tell us when it occurred, and provide details on a separate page.

Part 3: Sign here

Under penalties of perjury, I declare that I have examined this application, and to the best of my knowledge and belief,

it is true, correct, and complete.

Sign your

name here

/

/

Date

(

)

–

Email address

Best daytime phone

8554

For Privacy Act and Paperwork Reduction Act Notice, see page 2.

Cat. No. 21842Q

Form

(Rev. 10-2007)

1

1