Form Dr-144 - Gas And Sulfur Production Quarterly Tax Return - 2003

ADVERTISEMENT

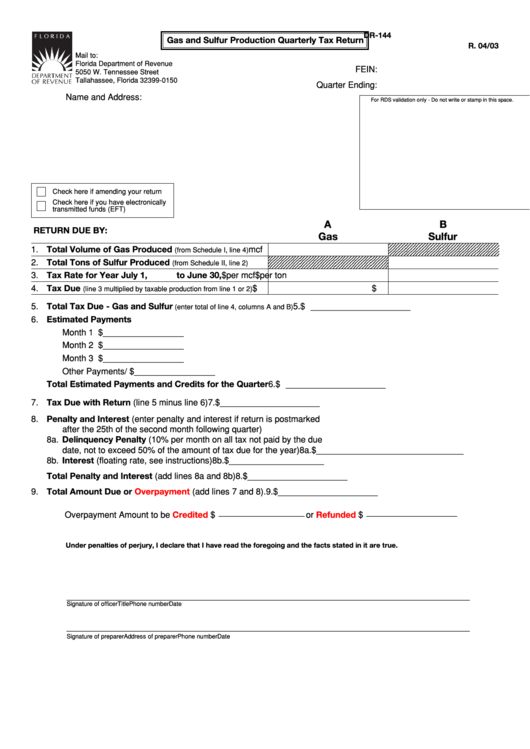

DR-144

Gas and Sulfur Production Quarterly Tax Return

R. 04/03

Mail to:

Florida Department of Revenue

FEIN:

5050 W. Tennessee Street

Tallahassee, Florida 32399-0150

Quarter Ending:

Name and Address:

For RDS validation only - Do not write or stamp in this space.

Check here if amending your return

Check here if you have electronically

transmitted funds (EFT)

A

B

RETURN DUE BY:

Gas

Sulfur

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

1. Total Volume of Gas Produced

mcf

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

(from Schedule I, line 4)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0

2. Total Tons of Sulfur Produced

(from Schedule II, line 2)

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 0 1 2 1 2 3 4 5 6 7 8 9 0

3. Tax Rate for Year July 1,

to June 30,

$

per mcf

$

per ton

4. Tax Due

$

$

(line 3 multiplied by taxable production from line 1 or 2)

5. Total Tax Due - Gas and Sulfur

5. $ _____________________

(enter total of line 4, columns A and B)

6. Estimated Payments

Month 1 ................................. $ _________________

Month 2 ................................. $ _________________

Month 3 ................................. $ _________________

Other Payments/Credits ........ $ _________________

Total Estimated Payments and Credits for the Quarter

6. $ _____________________

7. Tax Due with Return (line 5 minus line 6)

7. $ _____________________

8. Penalty and Interest (enter penalty and interest if return is postmarked

after the 25th of the second month following quarter)

8a. Delinquency Penalty (10% per month on all tax not paid by the due

date, not to exceed 50% of the amount of tax due for the year)

8a. $ _______________________________

8b. Interest (floating rate, see instructions)

8b. $ ____________________

Total Penalty and Interest (add lines 8a and 8b)

8. $ _____________________

9. Total Amount Due or

Overpayment

(add lines 7 and 8).

9. $ _____________________

$ __________________ or

$ ___________________

Overpayment Amount to be

Credited

Refunded

Under penalties of perjury, I declare that I have read the foregoing and the facts stated in it are true.

____________________________________________________________________________________________

Signature of officer

Title

Phone number

Date

____________________________________________________________________________________________

Signature of preparer

Address of preparer

Phone number

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2