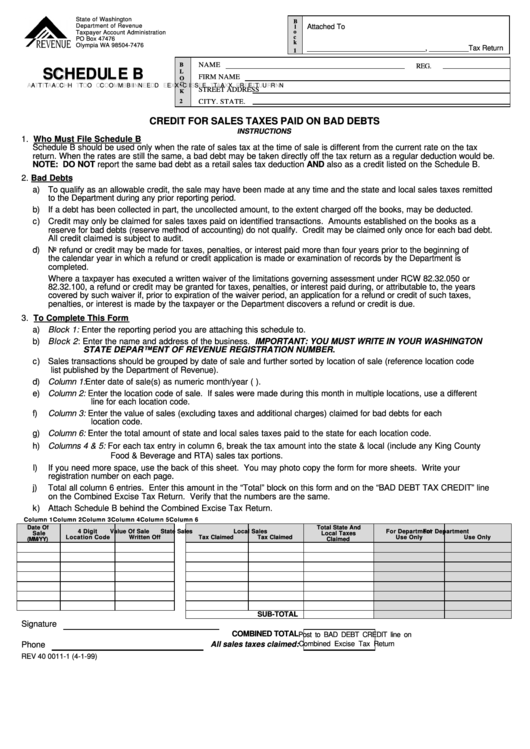

Form Rev 40 0011 - Schedule B - Credit For Sales Taxes Paid On Bad Debts

ADVERTISEMENT

State of Washington

B

Department of Revenue

Attached To

l

o

Taxpayer Account Administration

c

PO Box 47476

k

Olympia WA 98504-7476

______________________________, __________Tax Return

1

B

NAME

REG.

S

C

H

E

D

U

L

E

B

S

C

H

E

D

U

L

E

B

L

FIRM NAME

O

C

A

A

T

T

T

T

A

A

C

C

H

H

T

T

O

O

C

C

O

O

M

M

B

B

I

I

N

N

E

E

D

D

E

E

X

X

C

C

I

I

S

S

E

E

T

T

A

A

X

X

R

R

E

E

T

T

U

U

R

R

N

N

STREET ADDRESS

K

CITY, STATE,

2

CREDIT FOR SALES TAXES PAID ON BAD DEBTS

INSTRUCTIONS

1. Who Must File Schedule B

Schedule B should be used only when the rate of sales tax at the time of sale is different from the current rate on the tax

return. When the rates are still the same, a bad debt may be taken directly off the tax return as a regular deduction would be.

NOTE: DO NOT report the same bad debt as a retail sales tax deduction AND also as a credit listed on the Schedule B.

2. Bad Debts

a) To qualify as an allowable credit, the sale may have been made at any time and the state and local sales taxes remitted

to the Department during any prior reporting period.

b) If a debt has been collected in part, the uncollected amount, to the extent charged off the books, may be deducted.

c) Credit may only be claimed for sales taxes paid on identified transactions. Amounts established on the books as a

reserve for bad debts (reserve method of accounting) do not qualify. Credit may be claimed only once for each bad debt.

All credit claimed is subject to audit.

d) No refund or credit may be made for taxes, penalties, or interest paid more than four years prior to the beginning of

the calendar year in which a refund or credit application is made or examination of records by the Department is

completed.

Where a taxpayer has executed a written waiver of the limitations governing assessment under RCW 82.32.050 or

82.32.100, a refund or credit may be granted for taxes, penalties, or interest paid during, or attributable to, the years

covered by such waiver if, prior to expiration of the waiver period, an application for a refund or credit of such taxes,

penalties, or interest is made by the taxpayer or the Department discovers a refund or credit is due.

3. To Complete This Form

a) Block 1: Enter the reporting period you are attaching this schedule to.

b) Block 2: Enter the name and address of the business. IMPORTANT: YOU MUST WRITE IN YOUR WASHINGTON

STATE DEPARTMENT OF REVENUE REGISTRATION NUMBER.

c) Sales transactions should be grouped by date of sale and further sorted by location of sale (reference location code

list published by the Department of Revenue).

d) Column 1: Enter date of sale(s) as numeric month/year (e.g. 11/96).

e) Column 2: Enter the location code of sale. If sales were made during this month in multiple locations, use a different

line for each location code.

f)

Column 3: Enter the value of sales (excluding taxes and additional charges) claimed for bad debts for each

location code.

g) Column 6: Enter the total amount of state and local sales taxes paid to the state for each location code.

h) Columns 4 & 5: For each tax entry in column 6, break the tax amount into the state & local (include any King County

Food & Beverage and RTA) sales tax portions.

I)

If you need more space, use the back of this sheet. You may photo copy the form for more sheets. Write your

registration number on each page.

j)

Total all column 6 entries. Enter this amount in the “Total” block on this form and on the “BAD DEBT TAX CREDIT” line

on the Combined Excise Tax Return. Verify that the numbers are the same.

k) Attach Schedule B behind the Combined Excise Tax Return.

Column 1

Column 2

Column 3

Column 4

Column 5

Column 6

Date Of

Total State And

4 Digit

Value Of Sale

State Sales

Local Sales

For Department

For Department

Sale

Local Taxes

Location Code

Written Off

Tax Claimed

Tax Claimed

Use Only

Use Only

(MM/YY)

Claimed

SUB-TOTAL

Signature

COMBINED TOTAL

Post to BAD DEBT CREDIT line on

All sales taxes claimed:

Combined Excise Tax Return

Phone

REV 40 0011-1 (4-1-99)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2