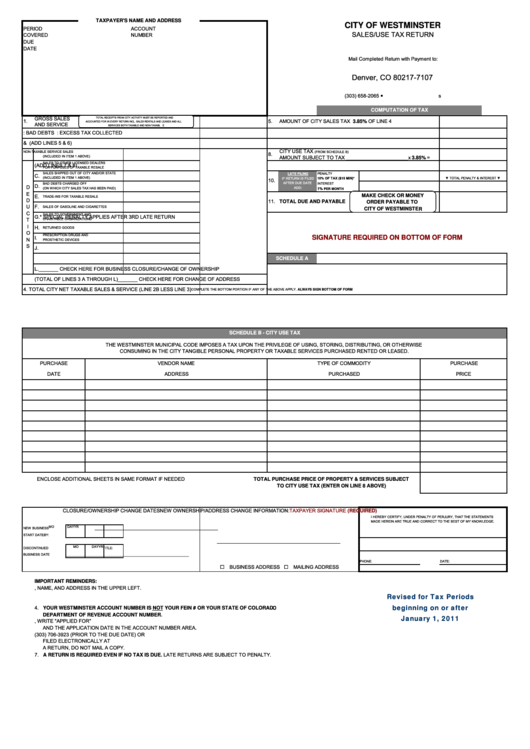

TAXPAYER'S NAME AND ADDRESS

CITY OF WESTMINSTER

PERIOD

ACCOUNT

SALES/USE TAX RETURN

COVERED

NUMBER

DUE

DATE

Mail Completed Return with Payment to:

P.O. Box 17107

Denver, CO 80217-7107

(303) 658-2065

COMPUTATION OF TAX

GROSS SALES

TOTAL RECEIPTS FROM CITY ACTIVITY MUST BE REPORTED AND

1.

5.

AMOUNT OF CITY SALES TAX 3.85% OF LINE 4

ACCOUNTED FOR IN EVERY RETURN INCL. SALES RENTALS AND LEASES AND ALL

AND SERVICE

SERVICES BOTH TAXABLE AND NON-TAXABLE

2A. ADD: BAD DEBTS COLLECTED

6.

ADD: EXCESS TAX COLLECTED

2B. TOTAL LINES 1 & 2A

7.

TOTAL CITY SALES TAX (ADD LINES 5 & 6)

CITY USE TAX

NON-TAXABLE SERVICE SALES

(FROM SCHEDULE B)

3.

A.

8.

(INCLUDED IN ITEM 1 ABOVE)

AMOUNT SUBJECT TO TAX ______________________ x 3.85% =

SALES TO OTHER LICENSED DEALERS

B.

9.

TOTAL TAX DUE (ADD LINES 7 & 8)

FOR PURPOSES OF TAXABLE RESALE

SALES SHIPPED OUT OF CITY AND/OR STATE

PENALTY

LATE FILING

C.

(INCLUDED IN ITEM 1 ABOVE)

IF RETURN IS FILED

▼ TOTAL PENALTY & INTEREST ▼

10% OF TAX ($15 MIN)*

10.

AFTER DUE DATE

BAD DEBTS CHARGED OFF

INTEREST

D.

D

ADD:

(ON WHICH CITY SALES TAX HAS BEEN PAID)

1%

PER MONTH

E

MAKE CHECK OR MONEY

E.

TRADE-INS FOR TAXABLE RESALE

D

11.

TOTAL DUE AND PAYABLE

ORDER PAYABLE TO

U

F.

SALES OF GASOLINE AND CIGARETTES

CITY OF WESTMINSTER

C

SALES TO GOVERNMENT AND

G.

* SPECIAL PENALTY APPLIES AFTER 3RD LATE RETURN

T

CHARITABLE ORGANIZATIONS

I

H.

RETURNED GOODS

O

PRESCRIPTION DRUGS AND

I.

SIGNATURE REQUIRED ON BOTTOM OF FORM

N

PROSTHETIC DEVICES

S

J.

K.

SPECIAL MESSAGE TO CITY FROM TAXPAYER

SCHEDULE A

L.

_______ CHECK HERE FOR BUSINESS CLOSURE/CHANGE OF OWNERSHIP

3. TOTAL DEDUCTIONS (TOTAL OF LINES 3 A THROUGH L)

_______ CHECK HERE FOR CHANGE OF ADDRESS

4. TOTAL CITY NET TAXABLE SALES & SERVICE (LINE 2B LESS LINE 3)

COMPLETE THE BOTTOM PORTION IF ANY OF THE ABOVE APPLY. ALWAYS SIGN BOTTOM OF FORM

SCHEDULE B - CITY USE TAX

THE WESTMINSTER MUNICIPAL CODE IMPOSES A TAX UPON THE PRIVILEGE OF USING, STORING, DISTRIBUTING, OR OTHERWISE

CONSUMING IN THE CITY TANGIBLE PERSONAL PROPERTY OR TAXABLE SERVICES PURCHASED RENTED OR LEASED.

PURCHASE

VENDOR NAME

TYPE OF COMMODITY

PURCHASE

DATE

ADDRESS

PURCHASED

PRICE

ENCLOSE ADDITIONAL SHEETS IN SAME FORMAT IF NEEDED

TOTAL PURCHASE PRICE OF PROPERTY & SERVICES SUBJECT

TO CITY USE TAX (ENTER ON LINE 8 ABOVE)

CLOSURE/OWNERSHIP CHANGE DATES

NEW OWNERSHIP/ADDRESS CHANGE INFORMATION:

TAXPAYER SIGNATURE (REQUIRED)

I HEREBY CERTIFY, UNDER PENALTY OF PERJURY, THAT THE STATEMENTS

MADE HEREIN ARE TRUE AND CORRECT TO THE BEST OF MY KNOWLEDGE.

____________________________________________

MO

DAY

YR

NEW BUSINESS

START DATE

BY:

____________________________________________

MO

DAY

YR

DISCONTINUED

TITLE:

____________________________________________

BUSINESS DATE

PHONE:

DATE:

BUSINESS ADDRESS MAILING ADDRESS

IMPORTANT REMINDERS:

1. INCLUDE WESTMINSTER ACCOUNT NUMBER, NAME, AND ADDRESS IN THE UPPER LEFT.

2. INCLUDE THE PERIOD FOR WHICH YOU ARE FILING.

Revised for Tax Periods

3. THE DUE DATE IS THE 20TH OF THE MONTH FOLLOWING THE END OF THE REPORTING PERIOD.

beginning on or after

4. YOUR WESTMINSTER ACCOUNT NUMBER IS NOT YOUR FEIN # OR YOUR STATE OF COLORADO

DEPARTMENT OF REVENUE ACCOUNT NUMBER.

January 1, 2011

5. IF YOU HAVE RECENTLY APPLIED FOR A WESTMINSTER ACCOUNT NUMBER, WRITE "APPLIED FOR"

AND THE APPLICATION DATE IN THE ACCOUNT NUMBER AREA.

6. ZERO LIABILITY RETURNS MAY BE FAXED TO (303) 706-3923 (PRIOR TO THE DUE DATE) OR

FILED ELECTRONICALLY AT IF YOU FILE ELECTRONICALLY OR FAX

A RETURN, DO NOT MAIL A COPY.

7. A RETURN IS REQUIRED EVEN IF NO TAX IS DUE. LATE RETURNS ARE SUBJECT TO PENALTY.

1

1