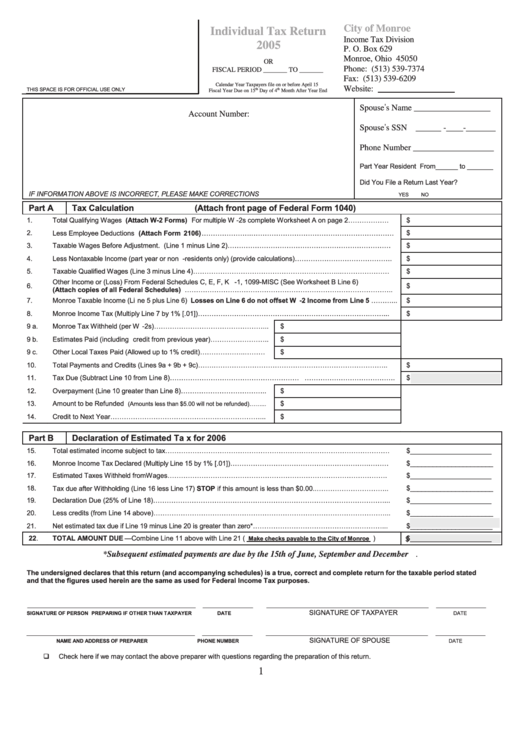

Individual Tax Return Form - City Of Monroe - 2005

ADVERTISEMENT

City of Monroe

Individual Tax Return

Income Tax Division

2005

P. O. Box 629

Monroe, Ohio 45050

OR

Phone: (513) 539 -7374

FISCAL PERIOD _______ TO _______

Fax: (513) 539 -6209

Calendar Year Taxpayers file on or before April 15

Website:

THIS SPACE IS FOR OFFICIAL USE ONLY

th

th

Fiscal Year Due on 15

Day of 4

Month After Year End

Spouse’ s Name __________________

Account Number:

Spouse’ s SSN ______ -____-_______

Phone Number ___________________

Part Year Resident From______ to _______

Did You File a Return Last Year?

IF INFORMATION ABOVE IS INCORRECT, PLEASE MAKE CORRECTIONS

YES

NO

Part A

Tax Calculation

(Attach front page of Federal Form 1040)

1.

Total Qualifying Wages (Attach W -2 Forms) For multiple W -2s complete Worksheet A on page 2………………

$

2.

Less Employee Deductions (Attach Form 2106)………………….………………………………………………………

$

3.

Taxable Wages Before Adjustment. (Line 1 minus Line 2)………………………………………………………………

$

4.

Less Nontaxable Income (part year or non -residents only) (provide calculations)…………………………………….

$

5.

Taxable Qualified Wages (Li ne 3 minus Line 4)………………………………………………………...…………………

$

Other Income or (Loss) From Federal Schedules C, E, F, K -1, 1099-MISC (See Worksheet B Line 6)

6.

$

(Attach copies of all Federal Schedules) ………………………………………………………………………………..

7.

Monroe Taxable Income (Li ne 5 plus Line 6) Losses on Line 6 do not offset W -2 Income from Line 5 ………...

$

8.

Monroe Income Tax (Multiply Line 7 by 1% [.01])………………………………………………………………….……...

$

9 a.

Monroe Tax Withheld (per W -2s)…………………………………………...

$

9 b.

Estimates Paid (including credit from previous year)……………………..

$

9 c.

Other Local Taxes Paid (Allowed up to 1% credit)………………..………

$

10.

Total Payments and Credits (Lines 9a + 9b + 9c)…….…………………………………………………………………..

$

11.

Tax Due (Subtract Line 10 from Line 8)………………………………………………… ………………………………….

$

12.

Overpayment (Line 10 greater than Line 8)………………………………..

$

13.

Amount to be Refunded

$

(Amounts less than $5.00 will not be refunded)……...

14.

Credit to Next Year…………………………………………………………...

$

Part B

Declaration of Estimated Ta x for 2006

15.

Total estimated income subject to tax………………………………………………………………………………………

$______________________

16.

Monroe Income Tax Declared (Multiply Line 15 by 1% [.01])…………………………………………………….………

$______________________

17.

Estimated Taxes Withheld from Wages…………………………………………………………………………………….

$______________________

18.

Tax due after Withholding (Line 16 less Line 17) STOP if this amount is less than $0.00..…………………………..

$______________________

19.

Declaration Due (25% of Line 18)…………………………………………………………… ……………………………...

$______________________

20.

Less credits (from Line 14 above)…………………………………………………………………………………………...

$______________________

21.

Net estimated tax due if Line 19 minus Line 20 is greater than zero* …………………………………………………...

$______________________

22.

TOTAL AMOUNT DUE —Combine Line 11 above with Line 21 (

)

$______________________

Make checks payable to the City of Monroe

$

*Subsequent estimated payments are due by the 15th of June, September and December .

The undersigned declares that this return (and accompanying schedules) is a true, correct and complete return for the taxable period stated

and that the figures used herein are the same as used for Federal Income Tax purposes.

SIGNATURE OF TAXPAYER

SIGNATURE OF PERSON PREPARING IF OTHER THAN TAXPAYER

DATE

DATE

SIGNATURE OF SPOUSE

NAME AND ADDRESS OF PREPARER

PHONE NUMBER

DATE

q

Check here if we may contact the above preparer with questions regarding the preparation of this return.

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2