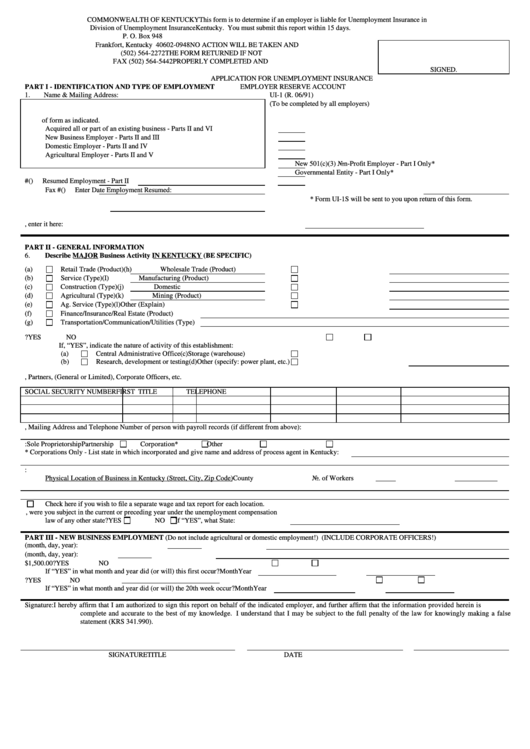

Form Ui-1 - Application For Unemployment Insurance Employer Reserve Account

ADVERTISEMENT

COMMONWEALTH OF KENTUCKY

This form is to determine if an employer is liable for Unemployment Insurance in

Division of Unemployment Insurance

Kentucky. You must submit this report within 15 days.

P. O. Box 948

Frankfort, Kentucky 40602-0948

NO ACTION WILL BE TAKEN AND

(502) 564-2272

THE FORM RETURNED IF NOT

FAX (502) 564-5442

PROPERLY COMPLETED AND

SIGNED.

APPLICATION FOR UNEMPLOYMENT INSURANCE

PART I - IDENTIFICATION AND TYPE OF EMPLOYMENT

EMPLOYER RESERVE ACCOUNT

1.

Name & Mailing Address:

UI-1 (R. 06/91)

(To be completed by all employers)

5.

Check type of employment and complete remainder

of form as indicated.

Acquired all or part of an existing business - Parts II and VI

New Business Employer - Parts II and III

Domestic Employer - Parts II and IV

Agricultural Employer - Parts II and V

New 501(c)(3) Non-Profit Employer - Part I Only*

Governmental Entity - Part I Only*

2.

Telephone #

(

)

Resumed Employment - Part II

Fax #

(

)

Enter Date Employment Resumed:

* Form UI-1S will be sent to you upon return of this form.

3.

Federal Employer ID

4.

If you have previously been assigned an Unemployment Insurance Number, enter it here:

PART II - GENERAL INFORMATION

6.

Describe MAJOR Business Activity IN KENTUCKY (BE SPECIFIC)

(a)

Retail Trade (Product)

(h)

Wholesale Trade (Product)

(b)

Service (Type)

(I)

Manufacturing (Product)

(c)

Construction (Type)

(j)

Domestic

(d)

Agricultural (Type)

(k)

Mining (Product)

(e)

Ag. Service (Type)

(l)

Other (Explain)

(f)

Finance/Insurance/Real Estate (Product)

(g)

Transportation/Communication/Utilities (Type)

7.

Is the establishment primarily engaged in performing services for other units of the company?

YES

NO

If, “YES”, indicate the nature of activity of this establishment:

(a)

Central Administrative Office

(c)

Storage (warehouse)

(b)

Research, development or testing

(d)

Other (specify: power plant, etc.)

8.

Identification of Owner, Partners, (General or Limited), Corporate Officers, etc.

SOCIAL SECURITY NUMBER

FIRST NAME

M.I.

LAST NAME

TITLE

TELEPHONE NO.

RESIDENCE ADDRESS

9.

Name, Mailing Address and Telephone Number of person with payroll records (if different from above):

10.

Type of Organization:

Sole Proprietorship

Partnership

Corporation*

Other

* Corporations Only - List state in which incorporated and give name and address of process agent in Kentucky:

11.

Provide the following information for each establishment or location in Kentucky:

Physical Location of Business in Kentucky (Street, City, Zip Code)

County

No. of Workers

Check here if you wish to file a separate wage and tax report for each location.

12.

Prior to beginning employment in Kentucky, were you subject in the current or preceding year under the unemployment compensation

law of any other state?

YES

NO

If “YES”, what State:

PART III - NEW BUSINESS EMPLOYMENT (Do not include agricultural or domestic employment!) (INCLUDE CORPORATE OFFICERS!)

13.

Date on which you first employed a worker in Kentucky (month, day, year):

14.

Date you first paid wages in Kentucky (month, day, year):

15.

Have you or do you expect to have a quarterly payroll of at least $1,500.00?

YES

NO

If “YES” in what month and year did (or will) this first occur?

Month

Year

16.

Have you or do you expect to employ at least one worker in 20 different calendar weeks during a calendar year?

YES

NO

If “YES” in what month and year did (or will) the 20th week occur?

Month

Year

Signature:

I hereby affirm that I am authorized to sign this report on behalf of the indicated employer, and further affirm that the information provided herein is

complete and accurate to the best of my knowledge. I understand that I may be subject to the full penalty of the law for knowingly making a false

statement (KRS 341.990).

SIGNATURE

TITLE

DATE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2