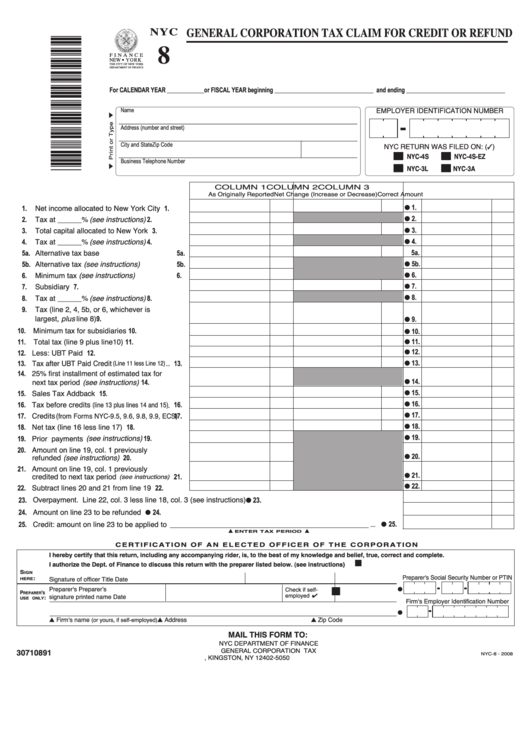

Form Nyc 8 - General Corporation Tax Claim For Credit Or Refund

ADVERTISEMENT

8

GENERAL CORPORATION TAX CLAIM FOR CREDIT OR REFUND

NYC

F I N A N C E

NEW

YORK

G

THE CITY OF NEW YORK

DEPARTMENT OF FINANCE

n y c . g o v / f i n a n c e

For CALENDAR YEAR ____________or FISCAL YEAR beginning ________________________________ and ending ________________________________

EMPLOYER IDENTIFICATION NUMBER

Name

Address (number and street)

NYC RETURN WAS FILED ON: ()

City and State

Zip Code

I I

NYC-4S

I I

NYC-4S-EZ

Business Telephone Number

I I

NYC-3L

I I

NYC-3A

COLUMN 1

COLUMN 2

COLUMN 3

As Originally Reported

Net Change (Increase or Decrease)

Correct Amount

Net income allocated to New York City ....... 1.

1.

1.

G

Tax at ______% (see instructions) .............. 2.

2.

2.

G

Total capital allocated to New York City....... 3.

3.

3.

G

Tax at ______% (see instructions) .............. 4.

4.

4.

G

5a. Alternative tax base .................................... 5a.

5a.

5b. Alternative tax (see instructions) ................. 5b.

5b.

G

Minimum tax (see instructions).................... 6.

6.

6.

G

Subsidiary capital ........................................ 7.

7.

7.

G

Tax at ______% (see instructions) .............. 8.

8.

8.

G

Tax (line 2, 4, 5b, or 6, whichever is

9.

largest, plus line 8) ...................................... 9.

9.

G

10. Minimum tax for subsidiaries .................... 10.

10.

G

11. Total tax (line 9 plus line10) ...................... 11.

11.

G

12. Less: UBT Paid Credit ............................... 12.

12.

G

13. Tax after UBT Paid Credit

.. 13.

(Line 11 less Line 12)

13.

G

14. 25% first installment of estimated tax for

next tax period (see instructions) .............. 14.

14.

G

15. Sales Tax Addback .................................... 15.

15.

G

16. Tax before credits

. 16.

(line 13 plus lines 14 and 15)

16.

G

17. Credits (

from Forms NYC-9.5, 9.6, 9.8, 9.9, ECS)

17.

17.

G

18. Net tax (line 16 less line 17) ...................... 18.

18.

G

19. Prior payments (see instructions) ............. 19.

19.

G

20. Amount on line 19, col. 1 previously

refunded (see instructions) ....................... 20.

20.

G

21. Amount on line 19, col. 1 previously

credited to next tax period

(see instructions)

21.

21.

G

22. Subtract lines 20 and 21 from line 19 ....... 22.

22.

G

23. Overpayment. Line 22, col. 3 less line 18, col. 3 (see instructions) ................................................................

23.

G

24. Amount on line 23 to be refunded ...................................................................................................................

24.

G

25. Credit: amount on line 23 to be applied to _______________________________________________________ ...

25.

G

ENTER TAX PERIOD

L

L

C E R T I F I C AT I O N O F A N E L E C T E D O F F I C E R O F T H E C O R P O R AT I O N

I hereby certify that this return, including any accompanying rider, is, to the best of my knowledge and belief, true, correct and complete.

I authorize the Dept. of Finance to discuss this return with the preparer listed below. (see instructions) ............................................YES

I I

S

IGN

Preparer's Social Security Number or PTIN

:

Signature of officer

Title

Date

HERE

Preparer's

Preparerʼs

I I

Check if self-

P

'

G

REPARER

S

signature

printed name

employed

Date

:

Firm's Employer Identification Number

USE ONLY

G

L Firm's name

L Address

L Zip Code

(or yours, if self-employed)

MAIL THIS FORM TO:

NYC DEPARTMENT OF FINANCE

30710891

GENERAL CORPORATION TAX

P.O. BOX 5050, KINGSTON, NY 12402-5050

NYC-8 - 2008

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4