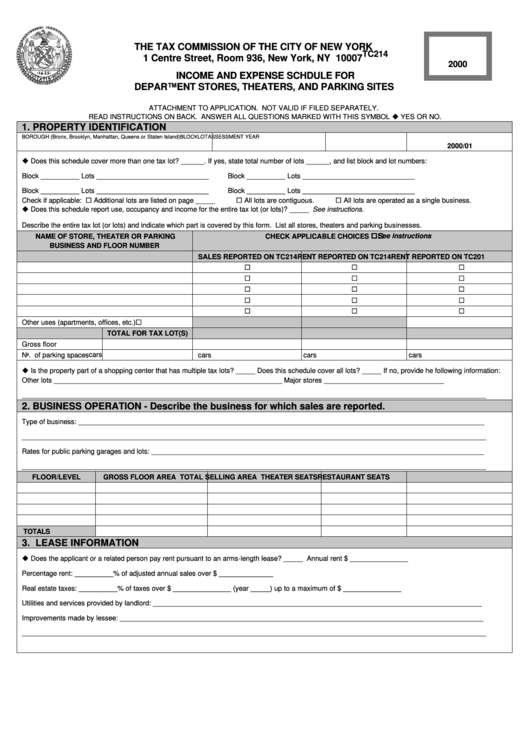

Form Tc214 - Income And Expense Schdule For Department Stores, Theaters, And Parking Sites - 2000

ADVERTISEMENT

THE TAX COMMISSION OF THE CITY OF NEW YORK

TC214

1 Centre Street, Room 936, New York, NY 10007

2000

INCOME AND EXPENSE SCHDULE FOR

DEPARTMENT STORES, THEATERS, AND PARKING SITES

ATTACHMENT TO APPLICATION. NOT VALID IF FILED SEPARATELY.

READ INSTRUCTIONS ON BACK. ANSWER ALL QUESTIONS MARKED WITH THIS SYMBOL ! YES OR NO.

1. PROPERTY IDENTIFICATION

BOROUGH (Bronx, Brooklyn, Manhattan, Queens or Staten Island)

BLOCK

LOT

ASSESSMENT YEAR

2000/01

! Does this schedule cover more than one tax lot? ______. If yes, state total number of lots ______, and list block and lot numbers:

Block __________ Lots _____________________________

Block __________ Lots _____________________________

Block __________ Lots _____________________________

Block __________ Lots _____________________________

Check if applicable: " Additional lots are listed on page _____

" All lots are contiguous.

" All lots are operated as a single business.

! Does this schedule report use, occupancy and income for the entire tax lot (or lots)? _____ See instructions.

Describe the entire tax lot (or lots) and indicate which part is covered by this form. List all stores, theaters and parking businesses.

CHECK APPLICABLE CHOICES " " " "

NAME OF STORE, THEATER OR PARKING

See instructions

BUSINESS AND FLOOR NUMBER

SALES REPORTED ON TC214

RENT REPORTED ON TC214

RENT REPORTED ON TC201

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

"

Other uses (apartments, offices, etc.)

TOTAL FOR TAX LOT(S)

Gross floor area

sq.ft.

sq.ft.

sq.ft.

sq.ft.

cars

No. of parking spaces

cars

cars

cars

! Is the property part of a shopping center that has multiple tax lots? _____ Does this schedule cover all lots? _____ If no, provide he following information:

Other lots ___________________________________________________________ Major stores _______________________________

________________________________________________________________________________________________________________________

2. BUSINESS OPERATION - Describe the business for which sales are reported.

Type of business: _________________________________________________________________________________________________________

________________________________________________________________________________________________________________________

Rates for public parking garages and lots: ______________________________________________________________________________________

________________________________________________________________________________________________________________________

FLOOR/LEVEL

GROSS FLOOR AREA SQ.FT.

TOTAL SELLING AREA SQ.FT.

THEATER SEATS

RESTAURANT SEATS

TOTALS

3. LEASE INFORMATION

! Does the applicant or a related person pay rent pursuant to an arms-length lease? _____ Annual rent $ _______________

Percentage rent: __________% of adjusted annual sales over $ ______________

Real estate taxes: __________% of taxes over $ _______________ (year _____) up to a maximum of $ _______________

Utilities and services provided by landlord: _____________________________________________________________________________________

Improvements made by lessee: ______________________________________________________________________________________________

________________________________________________________________________________________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2