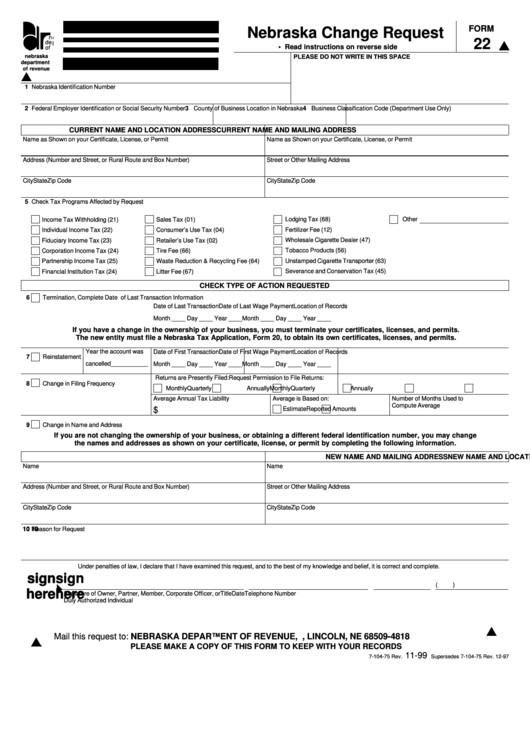

Form 22 - Nebraska Change Request

ADVERTISEMENT

FORM

Nebraska Change Request

ne

22

dep

• Read instructions on reverse side

of

nebraska

PLEASE DO NOT WRITE IN THIS SPACE

department

of revenue

1 Nebraska Identification Number

2 Federal Employer Identification or Social Security Number

3 County of Business Location in Nebraska

4 Business Classification Code (Department Use Only)

CURRENT NAME AND LOCATION ADDRESS

CURRENT NAME AND MAILING ADDRESS

Name as Shown on your Certificate, License, or Permit

Name as Shown on your Certificate, License, or Permit

Address (Number and Street, or Rural Route and Box Number)

Street or Other Mailing Address

City

State

Zip Code

City

State

Zip Code

5 Check Tax Programs Affected by Request

Lodging Tax (68)

Other

Income Tax Withholding (21)

Sales Tax (01)

Consumer’s Use Tax (04)

Fertilizer Fee (12)

Individual Income Tax (22)

Retailer’s Use Tax (02)

Wholesale Cigarette Dealer (47)

Fiduciary Income Tax (23)

Corporation Income Tax (24)

Tire Fee (66)

Tobacco Products (56)

Unstamped Cigarette Transporter (63)

Partnership Income Tax (25)

Waste Reduction & Recycling Fee (64)

Severance and Conservation Tax (45)

Financial Institution Tax (24)

Litter Fee (67)

CHECK TYPE OF ACTION REQUESTED

6

Termination, Complete Date of Last Transaction Information

Date of Last Transaction

Date of Last Wage Payment

Location of Records

Month ____ Day ____ Year ____ Month ____ Day ____ Year ____

If you have a change in the ownership of your business, you must terminate your certificates, licenses, and permits.

The new entity must file a Nebraska Tax Application, Form 20, to obtain its own certificates, licenses, and permits.

Year the account was

Date of First Transaction

Date of First Wage Payment

Location of Records

7

Reinstatement

cancelled___________

Month ____ Day ____ Year ____ Month ____ Day ____ Year ____

Returns are Presently Filed:

Request Permission to File Returns:

8

Change in Filing Frequency

Monthly

Quarterly

Annually

Monthly

Quarterly

Annually

Average Annual Tax Liability

Average is Based on:

Number of Months Used to

Compute Average

Estimate

Reported Amounts

$

9

Change in Name and Address

If you are not changing the ownership of your business, or obtaining a different federal identification number, you may change

the names and addresses as shown on your certificate, license, or permit by completing the following information.

NEW NAME AND LOCATION ADDRESS

NEW NAME AND MAILING ADDRESS

Name

Name

Address (Number and Street, or Rural Route and Box Number)

Street or Other Mailing Address

City

State

Zip Code

City

State

Zip Code

10

10

10

10

10 Reason for Request

Under penalties of law, I declare that I have examined this request, and to the best of my knowledge and belief, it is correct and complete.

sign

sign

sign

sign

sign

(

)

here

here

here

here

here

Signature of Owner, Partner, Member, Corporate Officer, or

Title

Date

Telephone Number

Duly Authorized Individual

Mail this request to: NEBRASKA DEPARTMENT OF REVENUE, P.O. BOX 94818, LINCOLN, NE 68509-4818

PLEASE MAKE A COPY OF THIS FORM TO KEEP WITH YOUR RECORDS

11-99

7-104-75 Rev.

Supersedes 7-104-75 Rev. 12-97

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1