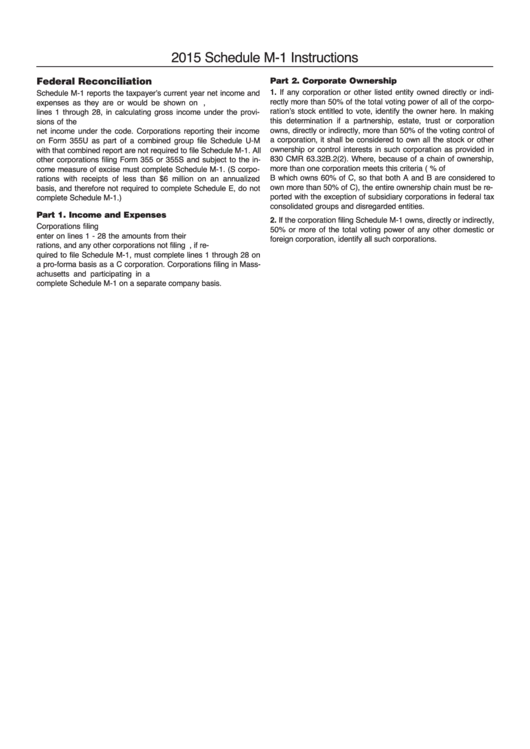

2015 Schedule M-1 Instructions

ADVERTISEMENT

2015 Schedule M-1 Instructions

Federal Reconciliation

Part 2. Corporate Ownership

1. If any corporation or other listed entity owned directly or indi-

Schedule M-1 reports the taxpayer’s current year net income and

rectly more than 50% of the total voting power of all of the corpo-

expenses as they are or would be shown on U.S. Form 1120,

ration’s stock entitled to vote, identify the owner here. In making

lines 1 through 28, in calculating gross income under the provi-

this determination if a partnership, estate, trust or corporation

sions of the U.S. IRC and the deductions allowable in calculating

owns, directly or indirectly, more than 50% of the voting control of

net income under the code. Corporations reporting their income

a corporation, it shall be considered to own all the stock or other

on Form 355U as part of a combined group file Schedule U-M

ownership or control interests in such corporation as provided in

with that combined report are not required to file Schedule M-1. All

830 CMR 63.32B.2(2). Where, because of a chain of ownership,

other corporations filing Form 355 or 355S and subject to the in-

more than one corporation meets this criteria (e.g. A owns 60% of

come measure of excise must complete Schedule M-1. (S corpo-

B which owns 60% of C, so that both A and B are considered to

rations with receipts of less than $6 million on an annualized

own more than 50% of C), the entire ownership chain must be re-

basis, and therefore not required to complete Schedule E, do not

ported with the exception of subsidiary corporations in federal tax

complete Schedule M-1.)

consolidated groups and disregarded entities.

Part 1. Income and Expenses

2. If the corporation filing Schedule M-1 owns, directly or indirectly,

Corporations filing U.S. Form 1120 on a separate company basis

50% or more of the total voting power of any other domestic or

enter on lines 1 - 28 the amounts from their U.S. return. S corpo-

foreign corporation, identify all such corporations.

rations, and any other corporations not filing U.S. Form 1120, if re-

quired to file Schedule M-1, must complete lines 1 through 28 on

a pro-forma basis as a C corporation. Corporations filing in Mass-

achusetts and participating in a U.S. consolidated return must

complete Schedule M-1 on a separate company basis.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1