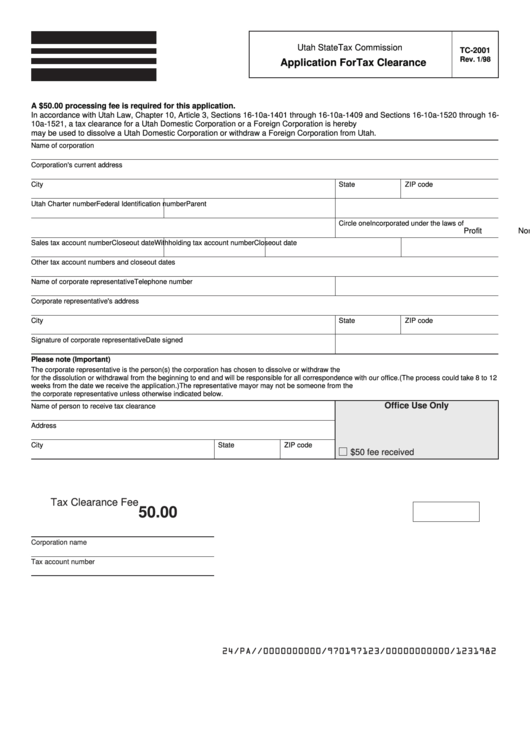

Form Tc-2001 - Application For Tax Clearance

ADVERTISEMENT

Utah State Tax Commission

TC-2001

Rev. 1/98

Application For Tax Clearance

A $50.00 processing fee is required for this application.

In accordance with Utah Law, Chapter 10, Article 3, Sections 16-10a-1401 through 16-10a-1409 and Sections 16-10a-1520 through 16-

10a-1521, a tax clearance for a Utah Domestic Corporation or a Foreign Corporation is hereby requested. The Tax Clearance Certificate

may be used to dissolve a Utah Domestic Corporation or withdraw a Foreign Corporation from Utah.

Name of corporation

Corporation's current address

City

State

ZIP code

Utah Charter number

Federal Identification number

Parent

Incorporated under the laws of

Circle one

Profit

Non-profit

Sales tax account number

Closeout date

Withholding tax account number

Closeout date

Other tax account numbers and closeout dates

Name of corporate representative

Telephone number

Corporate representative's address

City

State

ZIP code

Signature of corporate representative

Date signed

Please note (Important)

The corporate representative is the person(s) the corporation has chosen to dissolve or withdraw the corporation. The representative will be responsible

for the dissolution or withdrawal from the beginning to end and will be responsible for all correspondence with our office. (The process could take 8 to 12

weeks from the date we receive the application.) The representative mayor may not be someone from the corporation. The tax clearance will be sent to

the corporate representative unless otherwise indicated below.

Office Use Only

Name of person to receive tax clearance

Address

City

State

ZIP code

$50 fee received

TC-2001.CDR Rev. 1/98

Tax Clearance Fee

50.00

Corporation name

Tax account number

24/PA//0000000000/970197123/00000000000/1231982

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1