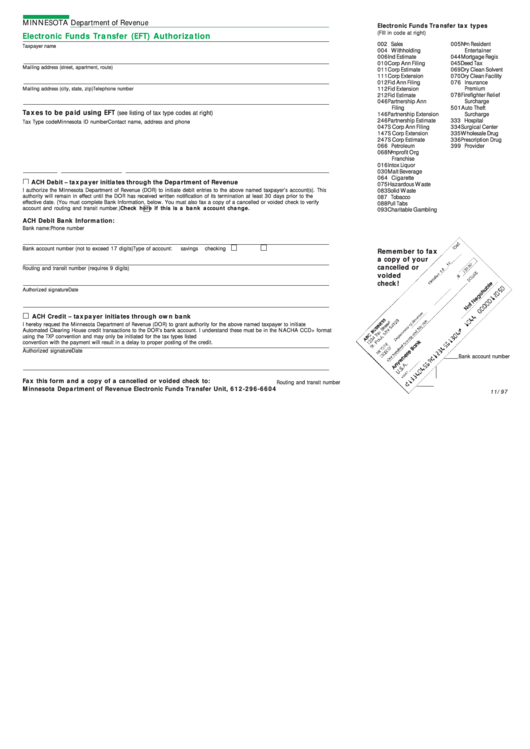

MINNESOTA Department of Revenue

Electronic Funds Transfer tax types

(FIll in code at right)

Electronic Funds Transfer (EFT) Authorization

002 Sales

005 Non Resident

Taxpayer name

004 Withholding

Entertainer

006 Ind Estimate

044 Mortgage Regis

010 Corp Ann Filing

045 Deed Tax

Mailing address (street, apartment, route)

069 Dry Clean Solvent

011 Corp Estimate

070 Dry Clean Facility

111 Corp Extension

012 Fid Ann Filing

076 Insurance

112 Fid Extension

Premium

Mailing address (city, state, zip)

Telephone number

212 Fid Estimate

078 Firefighter Relief

046 Partnership Ann

Surcharge

Filing

501 Auto Theft

Taxes to be paid using EFT

(see listing of tax type codes at right)

146 Partnership Extension

Surcharge

246 Partnership Estimate

333 Hospital

Tax Type code

Minnesota ID number

Contact name, address and phone

047 S Corp Ann Filing

334 Surgical Center

147 S Corp Extension

335 Wholesale Drug

247 S Corp Estimate

336 Prescription Drug

066 Petroleum

399 Provider

068 Nonprofit Org

Franchise

016 Intox Liquor

030 Malt Beverage

064 Cigarette

ACH Debit – taxpayer initiates through the Department of Revenue

075 Hazardous Waste

I authorize the Minnesota Department of Revenue (DOR) to initiate debit entries to the above named taxpayer’s account(s). This

083 Solid Waste

authority will remain in effect until the DOR has received written notification of its termination at least 30 days prior to the

087 Tobacco

effective date. (You must complete Bank Information, below. You must also fax a copy of a cancelled or voided check to verify

088 Pull Tabs

account and routing and transit number.)

Check here if this is a bank account change.

093 Charitable Gambling

ACH Debit Bank Information:

Bank name:

Phone number

Bank account number (not to exceed 17 digits)

Type of account:

savings

checking

Remember to fax

a copy of your

cancelled or

Routing and transit number (requires 9 digits)

voided

check!

Authorized signature

Date

ACH Credit – taxpayer initiates through own bank

I hereby request the Minnesota Department of Revenue (DOR) to grant authority for the above named taxpayer to initiate

Automated Clearing House credit transactions to the DOR’s bank account. I understand these must be in the NACHA CCD+ format

using the TXP convention and may only be initiated for the tax types listed above.Failure by the taxpayer to include a suitable TXP

convention with the payment will result in a delay to proper posting of the credit.

Authorized signature

Date

Bank account number

Fax this form and a copy of a cancelled or voided check to:

Routing and transit number

Minnesota Department of Revenue Electronic Funds Transfer Unit, 612-296-6604

11/97

1

1