Form Sls 452 - Tennessee Consumer Use Tax

ADVERTISEMENT

STATE OF TENNESSEE

DEPARTMENT OF REVENUE

ANDREW JACKSON STATE OFFICE BUILDING

NASHVILLE, TENNESSEE 37242

TENNESSEE CONSUMER USE TAX

Tennessee, like other states that impose a sales tax, also taxes the use of property brought into the state untaxed when purchased.

This “use” tax was enacted in 1947, the same year as the sales tax, to complement the sales tax by taxing merchandise purchased

from out-of-state sources that do not collect the state’s sales tax. The use tax protects local merchants who must collect sales tax

from unfair competition from out-of-state sellers who do not collect Tennessee’s sales tax.

If Tennessee sales tax is added to the price of your purchase, you do not owe use tax. However, if you buy merchandise through the

internet, over the telephone, from mail-order catalogs, etc., and sales tax is not added to the price, then you are responsible for

paying the use tax directly to the Department of Revenue. Also, if you travel outside the state and purchase untaxed merchandise

that is shipped to your Tennessee home, you are liable for the use tax.

The use tax rate is a combination of the state tax rate of 7% (5.0% on food or food ingredients) plus the rate levied by your local

government, generally 2.25%. (A local government tax rate chart is available.) The tax is applied to the purchase price of the

merchandise plus any shipping and handling charges that the merchant adds to your bill.

Effective January 1, 2009, the local use tax rate on purchases of downloads of digital videos, digital books, and digital music, as

defined in Tenn. Code Ann. Section 67-6-102, is established at 2.50% regardless the actual local tax rate in effect in the jurisdiction of

the user and consumer.

The local rate is applicable on the first $1,600 dollars of the purchase price of any single article of tangible personal property. In

addition, there is a state single article rate of 2.75% that is applicable to the purchase price amount of any single article purchase from

$1,600.01 to a maximum of $3,200. Instructions for calculating the state and local sales tax on single article purchases are provided

on the reverse side of the return below.

Depending on the frequency of purchases, the use tax return can be filed and the tax paid either monthly, quarterly, semiannually,

or annually. The return is due on the 20

of the month following the close of the applicable period. For example, if you file an annual

th

calendar year return, the return is due on January 20. If you file quarterly, returns are due on April 20, July 20, October 20, and January

20 of the following year. For your convenience, if you are reporting use tax on items, some of which are taxed at the 5.0% state rate

and others that are taxed at the 7% rate, you may wish to file a separate return for each state tax rate.

We urge you to voluntarily report your tax liability. A consumer use tax return is attached to this letter for your convenience. If you

need additional assistance, please contact the Taxpayer Services Division at (800) 342-1003 or, in Nashville, at (615) 253-0600. The

consumer tax return and information about the use tax are also available on the Department’s Web site:

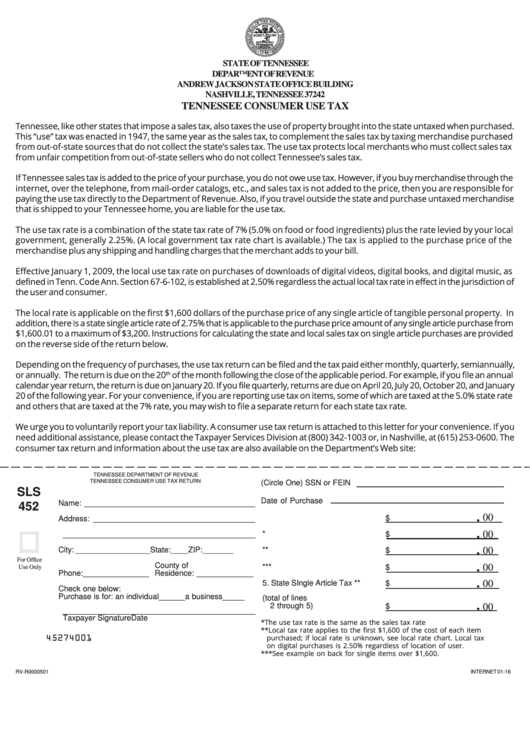

TENNESSEE DEPARTMENT OF REVENUE

TENNESSEE CONSUMER USE TAX RETURN

(Circle One) SSN or FEIN

SLS

Date of Purchase

Name: _______________________________________

452

.

1. Total Purchase Price

00

$

Address: _____________________________________

.

____________________________________________

2. State Use Tax*

$

00

.

City: _________________ State: ____ ZIP: _______

3. Local Tax - Nondigital items**

$

00

For Office

.

County of

4. Local Tax - Digital Items***

$

00

Use Only

Phone: _______________ Residence: _____________

.

5. State SIngle Article Tax **

$

00

Check one below:

Purchase is for: an individual ______ a business _____

6. Total Tax owed (total of lines

.

2 through 5)

$

00

____________________________________________

Taxpayer Signature

Date

*The use tax rate is the same as the sales tax rate

**Local tax rate applies to the first $1,600 of the cost of each item

45274001

purchased; if local rate is unknown, see local rate chart. Local tax

on digital purchases is 2.50% regardless of location of user.

***See example on back for single items over $1,600.

RV-R0000501

INTERNET 01-16

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1