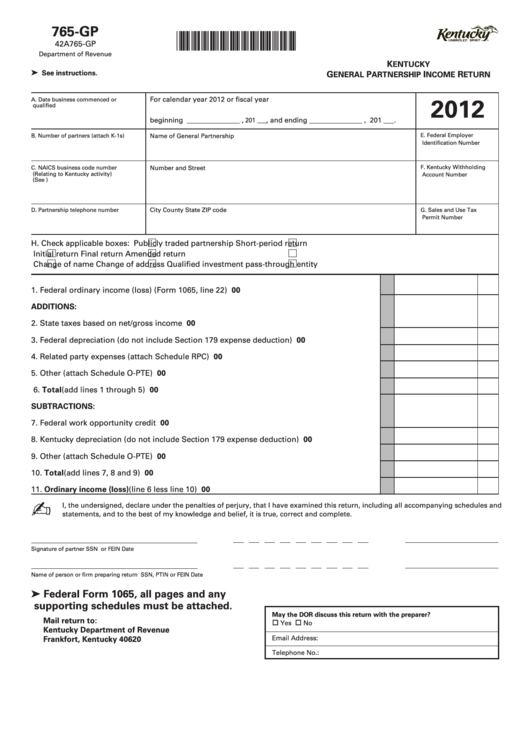

Form 765-Gp - Kentucky General Partnership Income Return - 2012

ADVERTISEMENT

765-GP

*1200010034*

42A765-GP

Department of Revenue

K

ENTUCKY

➤

See instructions.

G

P

I

R

ENERAL

ARTNERSHIP

NCOME

ETURN

For calendar year 2012 or fiscal year

2012

A.

Date business commenced or

qualified

beginning _______________ ,

, and ending _______________ , 201 ___.

201 ___

E.

Federal Employer

B.

Number of partners (attach K-1s)

Name of General Partnership

Identification Number

C.

NAICS business code number

Number and Street

F.

Kentucky Withholding

(Relating to Kentucky activity)

Account Number

(See )

City

County

State

ZIP code

D.

Partnership telephone number

G.

Sales and Use Tax

Permit Number

H. Check applicable boxes:

Publicly traded partnership

Short-period return

Initial return

Final return

Amended return

Change of name

Change of address

Qualified investment pass-through entity

1. Federal ordinary income (loss) (Form 1065, line 22) ................................................................

1

00

ADDITIONS:

2. State taxes based on net/gross income .....................................................................................

2

00

3. Federal depreciation (do not include Section 179 expense deduction) ..................................

3

00

4. Related party expenses (attach Schedule RPC) ........................................................................

4

00

5. Other (attach Schedule O-PTE) ...................................................................................................

5

00

6. Total (add lines 1 through 5) ......................................................................................................

6

00

SUBTRACTIONS:

7. Federal work opportunity credit .................................................................................................

7

00

8. Kentucky depreciation (do not include Section 179 expense deduction) ...............................

8

00

9. Other (attach Schedule O-PTE) ...................................................................................................

9

00

10. Total (add lines 7, 8 and 9) .........................................................................................................

10

00

11. Ordinary income (loss) (line 6 less line 10) ...............................................................................

11

00

✍

I, the undersigned, declare under the penalties of perjury, that I have examined this return, including all accompanying schedules and

statements, and to the best of my knowledge and belief, it is true, correct and complete.

Signature of partner

SSN or FEIN

Date

Name of person or firm preparing return

SSN, PTIN or FEIN

Date

➤ Federal Form 1065, all pages and any

supporting schedules must be attached.

May the DOR discuss this return with the preparer?

Mail return to:

Yes

No

Kentucky Department of Revenue

Email Address:

Frankfort, Kentucky 40620

Telephone No.:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4