Form Gta-Ppd:011 - Lessor'S Application For Personal Use Leased Automobile Exemptions - 2007

ADVERTISEMENT

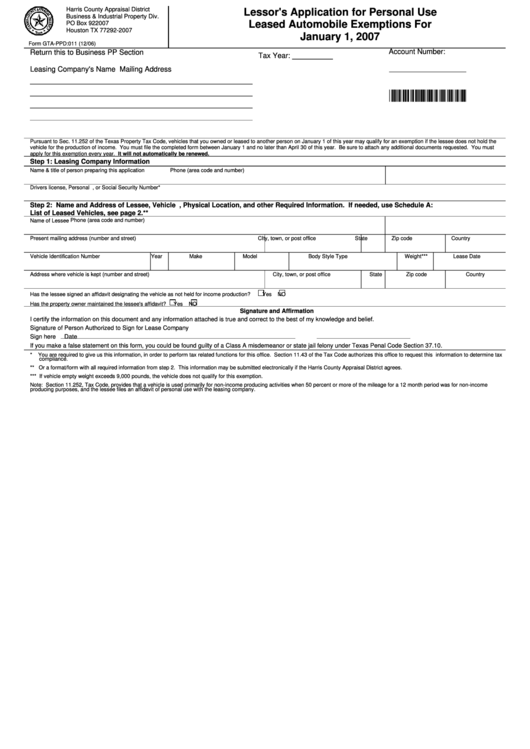

Harris County Appraisal District

Lessor's Application for Personal Use

Business & Industrial Property Div.

Leased Automobile Exemptions For

PO Box 922007

Houston TX 77292-2007

January 1, 2007

Form GTA-PPD:011 (12/06)

Account Number:

Return this to Business PP Section

Tax Year: __________

___________________

Leasing Company's Name Mailing Address

*NEWPP111*

Pursuant to Sec. 11.252 of the Texas Property Tax Code, vehicles that you owned or leased to another person on January 1 of this year may qualify for an exemption if the lessee does not hold the

vehicle for the production of income. You must file the completed form between January 1 and no later than April 30 of this year. Be sure to attach any additional documents requested. You must

apply for this exemption every year. It will not automatically be renewed.

Step 1: Leasing Company Information

Name & title of person preparing this application

Phone (area code and number)

Drivers license, Personal I.D. Certificate, or Social Security Number*

Step 2: Name and Address of Lessee, Vehicle I.D., Physical Location, and other Required Information. If needed, use Schedule A:

List of Leased Vehicles, see page 2.**

Phone (area code and number)

Name of Lessee

Present mailing address (number and street)

CIty, town, or post office

State

Zip code

Country

Vehicle Identification Number

Year

Make

Model

Body Style Type

Weight***

Lease Date

Address where vehicle is kept (number and street)

City, town, or post office

State

Zip code

Country

Has the lessee signed an affidavit designating the vehicle as not held for income production?

Yes

NO

Has the property owner maintained the lessee's affidavit?

Yes

NO

Signature and Affirmation

I certify the information on this document and any information attached is true and correct to the best of my knowledge and belief.

Signature of Person Authorized to Sign for Lease Company

Sign here

Date

If you make a false statement on this form, you could be found guilty of a Class A misdemeanor or state jail felony under Texas Penal Code Section 37.10.

*

You are required to give us this information, in order to perform tax related functions for this office. Section 11.43 of the Tax Code authorizes this office to request this information to determine tax

compliance.

** Or a format/form with all required information from step 2. This information may be submitted electronically if the Harris County Appraisal District agrees.

*** If vehicle empty weight exceeds 9,000 pounds, the vehicle does not qualify for this exemption.

Note: Section 11.252, Tax Code, provides that a vehicle is used primarily for non-income producing activities when 50 percent or more of the mileage for a 12 month period was for non-income

producing purposes, and the lessee files an affidavit of personal use with the leasing company.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2

![Form Rp-466-b [chautauqua, Oswego]- Application For Volunteer Firefighters / Ambulance Workers Exemption In Certain Additional Counties - 2007 Form Rp-466-b [chautauqua, Oswego]- Application For Volunteer Firefighters / Ambulance Workers Exemption In Certain Additional Counties - 2007](https://data.formsbank.com/pdf_docs_html/198/1984/198464/page_1_thumb.png)

![Form Rp-466-d [orleans] - Application For Volunteer Firefighters / Ambulance Workers Exemption - 2007 Form Rp-466-d [orleans] - Application For Volunteer Firefighters / Ambulance Workers Exemption - 2007](https://data.formsbank.com/pdf_docs_html/198/1984/198487/page_1_thumb.png)

![Form Rp-466-c [cattaraugus] - Application For Volunteer Firefighters / Ambulance Workers Exemption - 2007 Form Rp-466-c [cattaraugus] - Application For Volunteer Firefighters / Ambulance Workers Exemption - 2007](https://data.formsbank.com/pdf_docs_html/203/2034/203472/page_1_thumb.png)

![Form Rp-466-c [wyoming] - Application For Volunteer Firefighters / Ambulance Workers Exemption - 2007 Form Rp-466-c [wyoming] - Application For Volunteer Firefighters / Ambulance Workers Exemption - 2007](https://data.formsbank.com/pdf_docs_html/205/2053/205345/page_1_thumb.png)

![Form Rp-466-e [oneida] - Application For Volunteer Firefighters / Ambulance Workers Exemption - 2007 Form Rp-466-e [oneida] - Application For Volunteer Firefighters / Ambulance Workers Exemption - 2007](https://data.formsbank.com/pdf_docs_html/205/2053/205367/page_1_thumb.png)