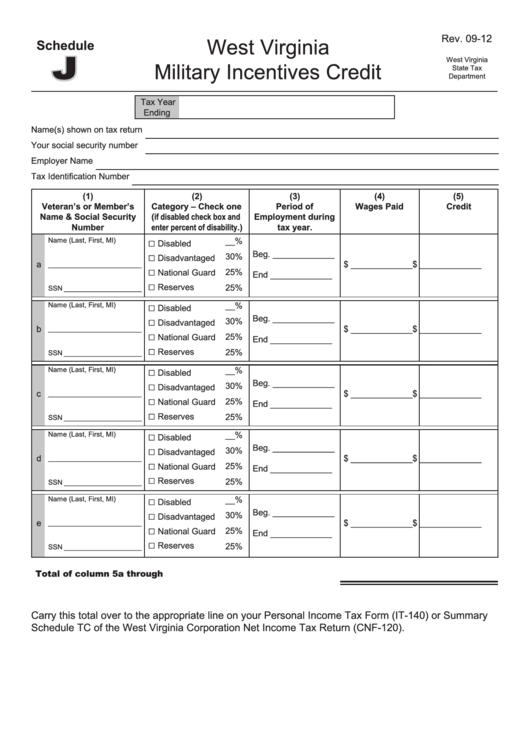

Schedule J - Military Incentives Credit - West Virginia

ADVERTISEMENT

Rev. 09-12

West Virginia

Schedule

J

West Virginia

Military Incentives Credit

State Tax

Department

Tax Year

Ending

Name(s) shown on tax return

Your social security number

Employer Name

Tax Identification Number

(1)

(2)

(3)

(4)

(5)

Veteran’s or Member’s

Category – Check one

Period of

Wages Paid

Credit

(if disabled check box and

Name & Social Security

Employment during

enter percent of disability.)

Number

tax year.

□

__%

Name (Last, First, MI)

Disabled

Beg. _____________

□

30%

Disadvantaged

a

$ _____________

$ _____________

________________________

□

25%

National Guard

End _____________

□

Reserves

25%

SSN ____________________

□

__%

Name (Last, First, MI)

Disabled

Beg. _____________

□

30%

Disadvantaged

b

$ _____________

$ _____________

________________________

□

25%

National Guard

End _____________

□

Reserves

25%

SSN ____________________

□

__%

Name (Last, First, MI)

Disabled

Beg. _____________

□

30%

Disadvantaged

c

$ _____________

$ _____________

________________________

□

25%

National Guard

End _____________

□

Reserves

25%

SSN ____________________

□

__%

Name (Last, First, MI)

Disabled

Beg. _____________

□

30%

Disadvantaged

d

$ _____________

$ _____________

________________________

□

25%

National Guard

End _____________

□

Reserves

25%

SSN ____________________

□

__%

Name (Last, First, MI)

Disabled

Beg. _____________

□

30%

Disadvantaged

e

$ _____________

$ _____________

________________________

□

25%

National Guard

End _____________

□

Reserves

25%

SSN ____________________

Total of column 5a through 5e.......................................................

Carry this total over to the appropriate line on your Personal Income Tax Form (IT-140) or Summary

Schedule TC of the West Virginia Corporation Net Income Tax Return (CNF-120).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1