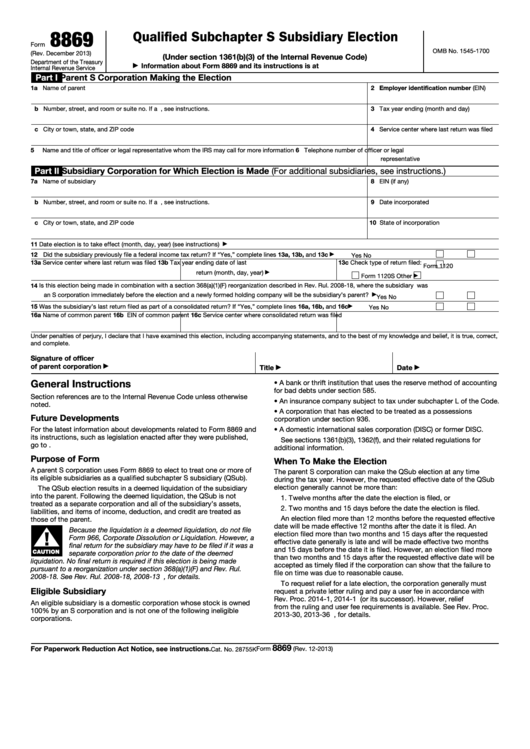

8869

Qualified Subchapter S Subsidiary Election

Form

OMB No. 1545-1700

(Rev. December 2013)

(Under section 1361(b)(3) of the Internal Revenue Code)

Department of the Treasury

Information about Form 8869 and its instructions is at

▶

Internal Revenue Service

Part I

Parent S Corporation Making the Election

1a Name of parent

2 Employer identification number (EIN)

b Number, street, and room or suite no. If a P.O. box, see instructions.

3 Tax year ending (month and day)

c City or town, state, and ZIP code

4 Service center where last return was filed

5

6 Telephone number of officer or legal

Name and title of officer or legal representative whom the IRS may call for more information

representative

Part II

Subsidiary Corporation for Which Election is Made (For additional subsidiaries, see instructions.)

7a Name of subsidiary

8 EIN (if any)

b Number, street, and room or suite no. If a P.O. box, see instructions.

9 Date incorporated

c City or town, state, and ZIP code

10 State of incorporation

11 Date election is to take effect (month, day, year) (see instructions)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

▶

12 Did the subsidiary previously file a federal income tax return? If “Yes,” complete lines 13a, 13b, and 13c

.

.

.

.

.

.

.

.

.

Yes

No

▶

13a Service center where last return was filed

13b Tax year ending date of last

13c Check type of return filed:

Form 1120

return (month, day, year)

▶

Form 1120S

Other

▶

14 Is this election being made in combination with a section 368(a)(1)(F) reorganization described in Rev. Rul. 2008-18, where the subsidiary was

an S corporation immediately before the election and a newly formed holding company will be the subsidiary’s parent?

.

.

.

.

.

▶

Yes

No

15 Was the subsidiary’s last return filed as part of a consolidated return? If “Yes,” complete lines 16a, 16b, and 16c .

.

.

.

.

.

.

Yes

No

▶

16a Name of common parent

16b EIN of common parent

16c Service center where consolidated return was filed

Under penalties of perjury, I declare that I have examined this election, including accompanying statements, and to the best of my knowledge and belief, it is true, correct,

and complete.

Signature of officer

of parent corporation

▶

Title

Date

▶

▶

General Instructions

• A bank or thrift institution that uses the reserve method of accounting

for bad debts under section 585.

Section references are to the Internal Revenue Code unless otherwise

• An insurance company subject to tax under subchapter L of the Code.

noted.

• A corporation that has elected to be treated as a possessions

Future Developments

corporation under section 936.

For the latest information about developments related to Form 8869 and

• A domestic international sales corporation (DISC) or former DISC.

its instructions, such as legislation enacted after they were published,

See sections 1361(b)(3), 1362(f), and their related regulations for

go to

additional information.

Purpose of Form

When To Make the Election

A parent S corporation uses Form 8869 to elect to treat one or more of

The parent S corporation can make the QSub election at any time

its eligible subsidiaries as a qualified subchapter S subsidiary (QSub).

during the tax year. However, the requested effective date of the QSub

election generally cannot be more than:

The QSub election results in a deemed liquidation of the subsidiary

into the parent. Following the deemed liquidation, the QSub is not

1. Twelve months after the date the election is filed, or

treated as a separate corporation and all of the subsidiary’s assets,

2. Two months and 15 days before the date the election is filed.

liabilities, and items of income, deduction, and credit are treated as

An election filed more than 12 months before the requested effective

those of the parent.

date will be made effective 12 months after the date it is filed. An

▲

Because the liquidation is a deemed liquidation, do not file

!

election filed more than two months and 15 days after the requested

Form 966, Corporate Dissolution or Liquidation. However, a

effective date generally is late and will be made effective two months

final return for the subsidiary may have to be filed if it was a

and 15 days before the date it is filed. However, an election filed more

CAUTION

separate corporation prior to the date of the deemed

than two months and 15 days after the requested effective date will be

liquidation. No final return is required if this election is being made

accepted as timely filed if the corporation can show that the failure to

pursuant to a reorganization under section 368(a)(1)(F) and Rev. Rul.

file on time was due to reasonable cause.

2008-18. See Rev. Rul. 2008-18, 2008-13 I.R.B. 674, for details.

To request relief for a late election, the corporation generally must

Eligible Subsidiary

request a private letter ruling and pay a user fee in accordance with

Rev. Proc. 2014-1, 2014-1 I.R.B. 1 (or its successor). However, relief

An eligible subsidiary is a domestic corporation whose stock is owned

from the ruling and user fee requirements is available. See Rev. Proc.

100% by an S corporation and is not one of the following ineligible

2013-30, 2013-36 I.R.B. 173, for details.

corporations.

8869

For Paperwork Reduction Act Notice, see instructions.

Form

(Rev. 12-2013)

Cat. No. 28755K

1

1 2

2