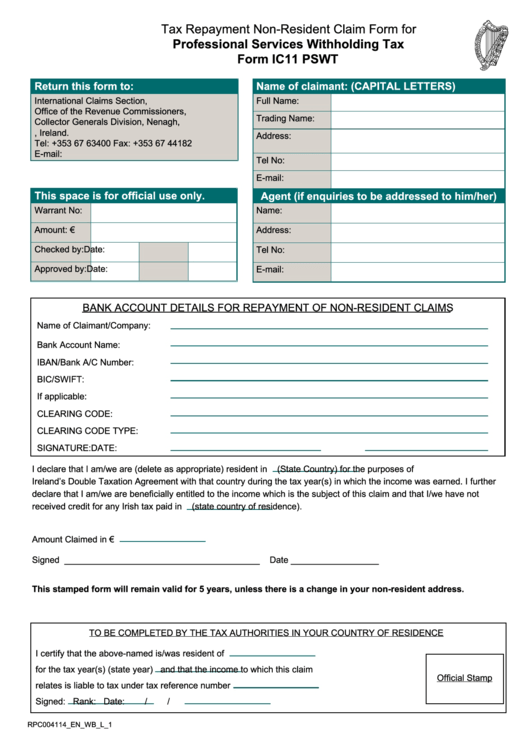

Form Ic11 Pswt - Tax Repayment Non-Resident Claim Form For Professional Services Withholding Tax

ADVERTISEMENT

Tax Repayment Non-Resident Claim Form for

Professional Services Withholding Tax

Form IC11 PSWT

Return this form to:

Name of claimant: (CAPITAL LETTERS)

International Claims Section,

Full Name:

Office of the Revenue Commissioners,

Trading Name:

Collector Generals Division, Nenagh,

Co.Tipperary, Ireland.

Address:

Tel: +353 67 63400 Fax: +353 67 44182

E-mail: intclaims@revenue.ie

Tel No:

E-mail:

This space is for official use only.

Agent (if enquiries to be addressed to him/her)

Warrant No:

Name:

Amount: €

Address:

Checked by:

Date:

Tel No:

Approved by:

Date:

E-mail:

BANK ACCOUNT DETAILS FOR REPAYMENT OF NON-RESIDENT CLAIMS

Name of Claimant/Company:

Bank Account Name:

IBAN/Bank A/C Number:

BIC/SWIFT:

If applicable:

CLEARING CODE:

CLEARING CODE TYPE:

SIGNATURE:

DATE:

I declare that I am/we are (delete as appropriate) resident in

(State Country) for the purposes of

Ireland’s Double Taxation Agreement with that country during the tax year(s) in which the income was earned. I further

declare that I am/we are beneficially entitled to the income which is the subject of this claim and that I/we have not

received credit for any Irish tax paid in

(state country of residence).

Amount Claimed in €

Signed ________________________________________

Date __________________

This stamped form will remain valid for 5 years, unless there is a change in your non-resident address.

TO BE COMPLETED BY THE TAX AUTHORITIES IN YOUR COUNTRY OF RESIDENCE

I certify that the above-named is/was resident of

for the tax year(s) (state year)

and that the income to which this claim

Official Stamp

relates is liable to tax under tax reference number

Signed:

Rank:

Date:

/

/

RPC004114_EN_WB_L_1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2