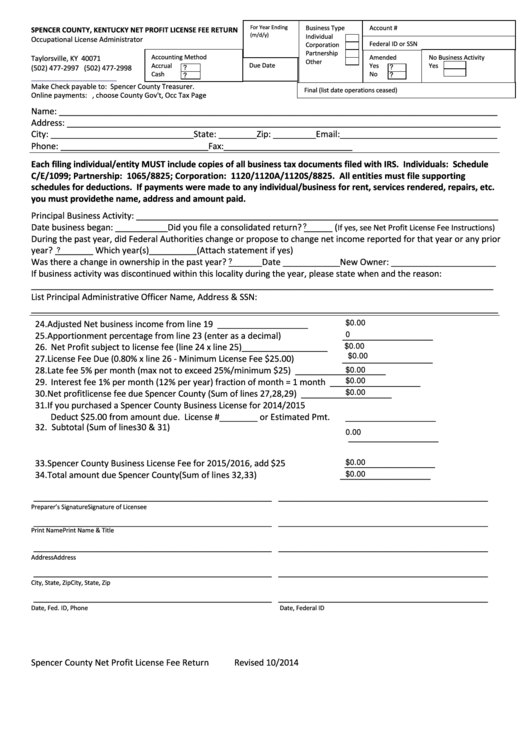

For Year Ending

Business Type

Account #

SPENCER COUNTY, KENTUCKY NET PROFIT LICENSE FEE RETURN

(m/d/y)

Individual

Occupational License Administrator

Federal ID or SSN

Corporation

P.O. Box 397

Partnership

Accounting Method

Amended

No Business Activity

Taylorsville, KY 40071

Other

Accrual

Due Date

Yes

Yes

(502) 477-2997 (502) 477-2998

?

?

Cash

No

?

?

Make Check payable to: Spencer County Treasurer.

Final (list date operations ceased)

Online payments: , choose County Gov't, Occ Tax Page

Name: ____________________________________________________________________________________________

Address: ___________________________________________________________________________________________

City: ______________________________State: ________Zip: _________ Email:_________________________________

Phone: _______________________________Fax:___________________________

Each filing individual/entity MUST include copies of all business tax documents filed with IRS. Individuals: Schedule

C/E/1099; Partnership: 1065/8825; Corporation: 1120/1120A/1120S/8825. All entities must file supporting

schedules for deductions. If payments were made to any individual/business for rent, services rendered, repairs, etc.

you must provide the name, address and amount paid.

Principal Business Activity: ____________________________________________________________________________

Date business began: ___________Did you file a consolidated return? ______ (

If yes, see Net Profit License Fee Instructions)

?

During the past year, did Federal Authorities change or propose to change net income reported for that year or any prior

year? ________ Which year(s)__________(Attach statement if yes)

?

Was there a change in ownership in the past year? _______Date ____________New Owner: ______________________

?

If business activity was discontinued within this locality during the year, please state when and the reason:

_________________________________________________________________________________________________

List Principal Administrative Officer Name, Address & SSN:

__________________________________________________________________________________________________

24. Adjusted Net business income from line 19

___________________

$0.00

25. Apportionment percentage from line 23 (enter as a decimal)

___________________

0

26. Net Profit subject to license fee (line 24 x line 25)

__________________

$0.00

27. License Fee Due (0.80% x line 26 - Minimum License Fee $25.00)

___________________

$0.00

28. Late fee 5% per month (max not to exceed 25%/minimum $25)

___________________

$0.00

29. Interest fee 1% per month (12% per year) fraction of month = 1 month

___________________

$0.00

30. Net profit license fee due Spencer County (Sum of lines 27,28, 29)

___________________

$0.00

31. If you purchased a Spencer County Business License for 2014/2015

Deduct $25.00 from amount due. License #________ or Estimated Pmt.

___________________

32. Subtotal (Sum of lines 30 & 31)

0.00

___________________

33. Spencer County Business License Fee for 2015/2016, add $25

___________________

$0.00

34. Total amount due Spencer County (Sum of lines 32,33)

___________________

$0.00

__________________________________________________ ____________________________________________

Preparer’s Signature

Signature of Licensee

__________________________________________________ ____________________________________________

Print Name

Print Name & Title

__________________________________________________ ____________________________________________

Address

Address

__________________________________________________ ____________________________________________

City, State, Zip

City, State, Zip

__________________________________________________ ____________________________________________

Date, Fed. ID, Phone

Date, Federal ID

Spencer County Net Profit License Fee Return

Revised 10/2014

1

1 2

2