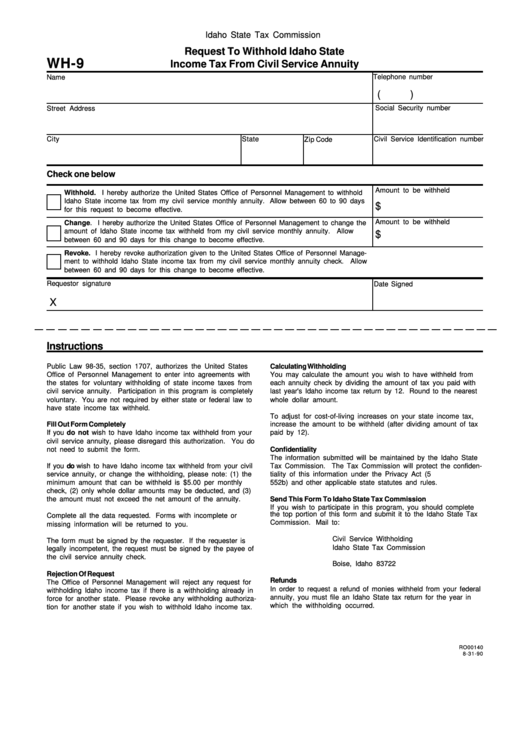

Idaho State Tax Commission

Request To Withhold Idaho State

WH-9

Income Tax From Civil Service Annuity

Telephone number

Name

(

)

Street Address

Social Security number

City

State

Zip

Code

Civil Service Identification number

Check one below

Amount to be withheld

Withhold. I hereby authorize the United States Office of Personnel Management to withhold

Idaho State income tax from my civil service monthly annuity. Allow between 60 to 90 days

$

for this request to become effective.

Amount to be withheld

Change. I hereby authorize the United States Office of Personnel Management to change the

amount of Idaho State income tax withheld from my civil service monthly annuity. Allow

$

between 60 and 90 days for this change to become effective.

Revoke. I hereby revoke authorization given to the United States Office of Personnel Manage-

ment to withhold Idaho State income tax from my civil service monthly annuity check. Allow

between 60 and 90 days for this change to become effective.

Requestor signature

Date Signed

X

Instructions

Public Law 98-35, section 1707, authorizes the United States

Calculating Withholding

Office of Personnel Management to enter into agreements with

You may calculate the amount you wish to have withheld from

the states for voluntary withholding of state income taxes from

each annuity check by dividing the amount of tax you paid with

civil service annuity. Participation in this program is completely

last year's Idaho income tax return by 12. Round to the nearest

voluntary. You are not required by either state or federal law to

whole dollar amount.

have state income tax withheld.

To adjust for cost-of-living increases on your state income tax,

Fill Out Form Completely

increase the amount to be withheld (after dividing amount of tax

If you do not wish to have Idaho income tax withheld from your

paid by 12).

civil service annuity, please disregard this authorization. You do

not need to submit the form.

Confidentiality

The information submitted will be maintained by the Idaho State

If you do wish to have Idaho income tax withheld from your civil

Tax Commission. The Tax Commission will protect the confiden-

service annuity, or change the withholding, please note: (1) the

tiality of this information under the Privacy Act (5 U.S.C. section

minimum amount that can be withheld is $5.00 per monthly

552b) and other applicable state statutes and rules.

check, (2) only whole dollar amounts may be deducted, and (3)

the amount must not exceed the net amount of the annuity.

Send This Form To Idaho State Tax Commission

If you wish to participate in this program, you should complete

the top portion of this form and submit it to the Idaho State Tax

Complete all the data requested. Forms with incomplete or

Commission. Mail to:

missing information will be returned to you.

Civil Service Withholding

The form must be signed by the requester. If the requester is

Idaho State Tax Commission

legally incompetent, the request must be signed by the payee of

P.O. Box 36

the civil service annuity check.

Boise, Idaho 83722

Rejection Of Request

Refunds

The Office of Personnel Management will reject any request for

In order to request a refund of monies withheld from your federal

withholding Idaho income tax if there is a withholding already in

annuity, you must file an Idaho State tax return for the year in

force for another state. Please revoke any withholding authoriza-

which the withholding occurred.

tion for another state if you wish to withhold Idaho income tax.

RO00140

8-31-90

1

1