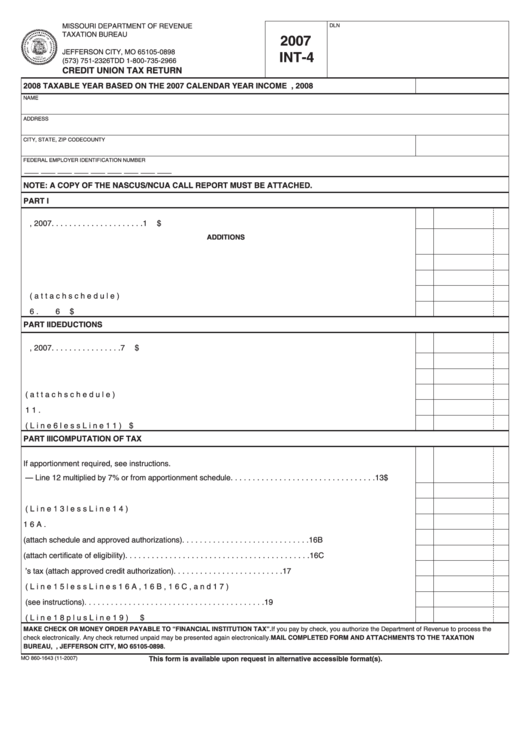

MISSOURI DEPARTMENT OF REVENUE

DLN

TAXATION BUREAU

2007

P.O. BOX 898

Reset Form

Print Form

JEFFERSON CITY, MO 65105-0898

INT-4

(573) 751-2326

TDD 1-800-735-2966

CREDIT UNION TAX RETURN

2008 TAXABLE YEAR BASED ON THE 2007 CALENDAR YEAR INCOME PERIOD.

DUE BY April 15, 2008

NAME

ADDRESS

CITY, STATE, ZIP CODE

COUNTY

FEDERAL EMPLOYER IDENTIFICATION NUMBER

___ ___ ___ ___ ___ ___ ___ ___ ___

NOTE: A COPY OF THE NASCUS/NCUA CALL REPORT MUST BE ATTACHED.

PART I

1.

Total gross income from NASCUS/NCUA Call Report as of December 31, 2007 . . . . . . . . . . . . . . . . . . . . .

1

$

ADDITIONS

2.

Recoveries of bad debts from call report . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

3.

Missouri credit union tax expensed on call report . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4.

Missouri taxes claimed as credits on this return from Schedule A . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5.

Other additions (attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

6.

Total of Lines 1 through 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

$

PART II

DEDUCTIONS

7.

Total operating expenses from NASCUS/NCUA Call Report as of December 31, 2007 . . . . . . . . . . . . . . . .

7

$

8.

Dividends and interest paid on general shares from call report . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

9.

Loans charged off as bad debts from call report . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9

10.

Other deductions (attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

11.

Total of Lines 7 through 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

11

12.

Taxable income (Line 6 less Line 11) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12 $

PART III

COMPUTATION OF TAX

If apportionment required, see instructions.

13.

Tax — Line 12 multiplied by 7% or from apportionment schedule . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13 $

14.

Tax credits from Line 4 above . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14

15.

Tax due (Line 13 less Line 14) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15

16A. Less tentative payment or amount previously paid . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16A

16B. Miscellaneous credits (attach schedule and approved authorizations) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16B

16C. Enterprise zone credit (attach certificate of eligibility) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16C

17.

Overpayment of previous year’s tax (attach approved credit authorization) . . . . . . . . . . . . . . . . . . . . . . . . .

17

18.

NET TAX DUE (Line 15 less Lines 16A, 16B, 16C, and 17) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18

19.

Plus interest for delinquent payment (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19

20.

TOTAL AMOUNT DUE (Line 18 plus Line 19) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20 $

MAKE CHECK OR MONEY ORDER PAYABLE TO “FINANCIAL INSTITUTION TAX”. If you pay by check, you authorize the Department of Revenue to process the

check electronically. Any check returned unpaid may be presented again electronically. MAIL COMPLETED FORM AND ATTACHMENTS TO THE TAXATION

BUREAU, P.O. BOX 898, JEFFERSON CITY, MO 65105-0898.

MO 860-1643 (11-2007)

This form is available upon request in alternative accessible format(s).

1

1 2

2