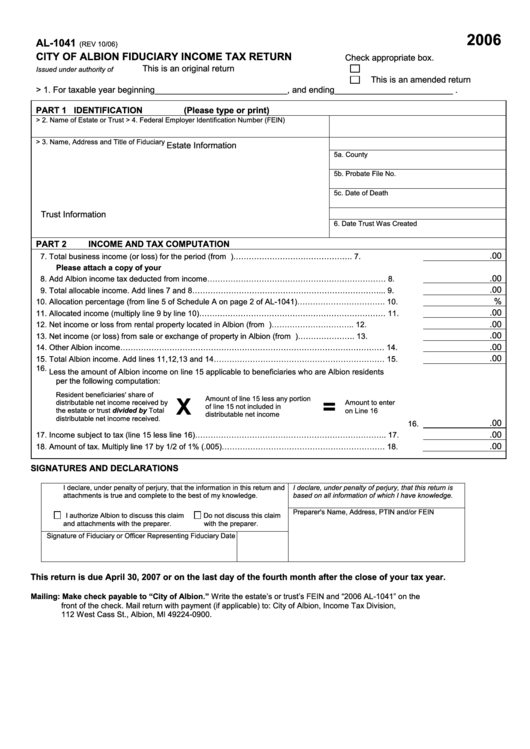

Form Al-1041 - City Of Albion Fiduciary Income Tax Return - 2006

ADVERTISEMENT

2006

AL-1041

(REV 10/06)

CITY OF ALBION FIDUCIARY INCOME TAX RETURN

Check appropriate box.

This is an original return

Issued under authority of P.A. 284 of 1964. Filing is mandatory

This is an amended return

> 1. For taxable year beginning____________________________, and ending_________________________ .

PART 1 IDENTIFICATION

(Please type or print)

> 2. Name of Estate or Trust

> 4. Federal Employer Identification Number (FEIN)

> 3. Name, Address and Title of Fiduciary

Estate Information

5a. County

5b. Probate File No.

5c. Date of Death

Trust Information

6. Date Trust Was Created

PART 2

INCOME AND TAX COMPUTATION

.00

7.

Total business income (or loss) for the period (from U.S. 1041)……………………………………….

7.

Please attach a copy of your U.S. 1041 and supporting schedules

.00

8.

Add Albion income tax deducted from income……………………………………………………………

8.

.00

9.

Total allocable income. Add lines 7 and 8………………………………………………………………...

9.

%

10.

Allocation percentage (from line 5 of Schedule A on page 2 of AL-1041)…………………………….

10.

.00

11.

Allocated income (multiply line 9 by line 10)………………………………………………………………

11.

.00

12.

Net income or loss from rental property located in Albion (from U.S. 1041)…………………………..

12.

.00

13.

Net income (or loss) from sale or exchange of property in Albion (from U.S.1041)………………….

13.

.00

14.

Other Albion income…………………………………………………………………………………………

14.

.00

15.

Total Albion income. Add lines 11,12,13 and 14…………………………………………………………

15.

16.

Less the amount of Albion income on line 15 applicable to beneficiaries who are Albion residents

per the following computation:

Resident beneficiaries' share of

Amount of line 15 less any portion

X

=

distributable net income received by

Amount to enter

of line 15 not included in

the estate or trust divided by Total

on Line 16

distributable net income

distributable net income received.

.00

16.

.00

17.

Income subject to tax (line 15 less line 16)………………………………………………………………..

17.

.00

18.

Amount of tax. Multiply line 17 by 1/2 of 1% (.005)………………………………………………………

18.

SIGNATURES AND DECLARATIONS

I declare, under penalty of perjury, that the information in this return and

I declare, under penalty of perjury, that this return is

attachments is true and complete to the best of my knowledge.

based on all information of which I have knowledge.

Preparer's Name, Address, PTIN and/or FEIN

I authorize Albion to discuss this claim

Do not discuss this claim

and attachments with the preparer.

with the preparer.

Signature of Fiduciary or Officer Representing Fiduciary

Date

This return is due April 30, 2007 or on the last day of the fourth month after the close of your tax year.

Mailing: Make check payable to “City of Albion.” Write the estate’s or trust’s FEIN and “2006 AL-1041” on the

front of the check. Mail return with payment (if applicable) to: City of Albion, Income Tax Division,

112 West Cass St., Albion, MI 49224-0900.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3