Form Rev 41 0065-4 - Natural Gas Use Tax Return Apr - May - Jun 2004

ADVERTISEMENT

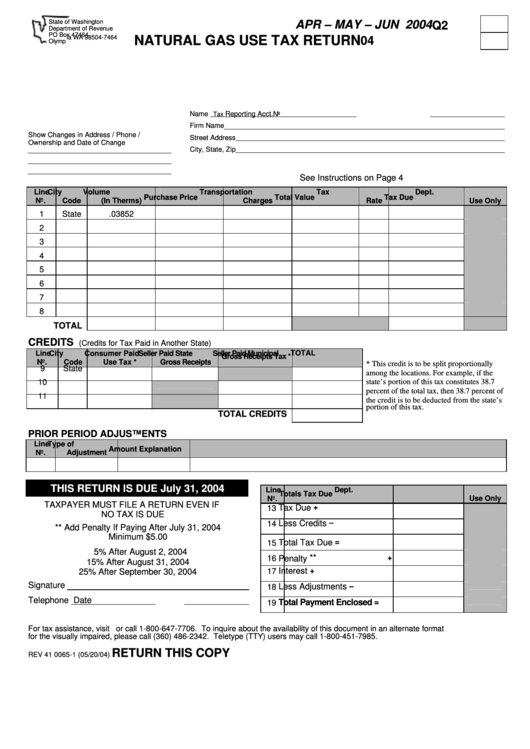

State of Washington

APR – MAY – JUN 2004

Q2

Department of Revenue

PO Box 47464

NATURAL GAS USE TAX RETURN

04

Olympia WA 98504-7464

Name

Reporting Acct. No

Tax

Firm Name

Show Changes in Address / Phone /

Street Address

Ownership and Date of Change

City, State, Zip

See Instructions on Page 4

Line

City

Volume

Transportation

Tax

Dept.

Purchase Price

Total Value

Tax Due

No.

Code

(In Therms)

Charges

Rate

Use Only

1

State

.03852

2

3

4

5

6

7

8

TOTAL

CREDITS

(Credits for Tax Paid in Another State)

Line

City

Consumer Paid

Seller Paid State

Seller Paid Municipal

TOTAL

No.

Code

Use Tax *

Gross Receipts

Gross Receipts Tax *

* This credit is to be split proportionally

among the locations. For example, if the

9

State

state’s portion of this tax constitutes 38.7

10

percent of the total tax, then 38.7 percent of

the credit is to be deducted from the state’s

11

portion of this tax.

TOTAL CREDITS

PRIOR PERIOD ADJUSTMENTS

Line

Type of

Amount

Explanation

No.

Adjustment

THIS RETURN IS DUE July 31, 2004

Dept.

Line

Totals

Tax Due

No.

Use Only

TAXPAYER MUST FILE A RETURN EVEN IF

Tax Due

+

13

NO TAX IS DUE

Less Credits

–

** Add Penalty If Paying After July 31, 2004

14

Minimum $5.00

Total Tax Due

=

15

5% After August 2, 2004

Penalty **

+

16

15% After August 31, 2004

25% After September 30, 2004

Interest

+

17

Signature

Less Adjustments

–

18

Telephone

Date

Total Payment Enclosed

=

19

For tax assistance, visit or call 1-800-647-7706. To inquire about the availability of this document in an alternate format

for the visually impaired, please call (360) 486-2342. Teletype (TTY) users may call 1-800-451-7985.

RETURN THIS COPY

REV 41 0065-1 (05/20/04)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4