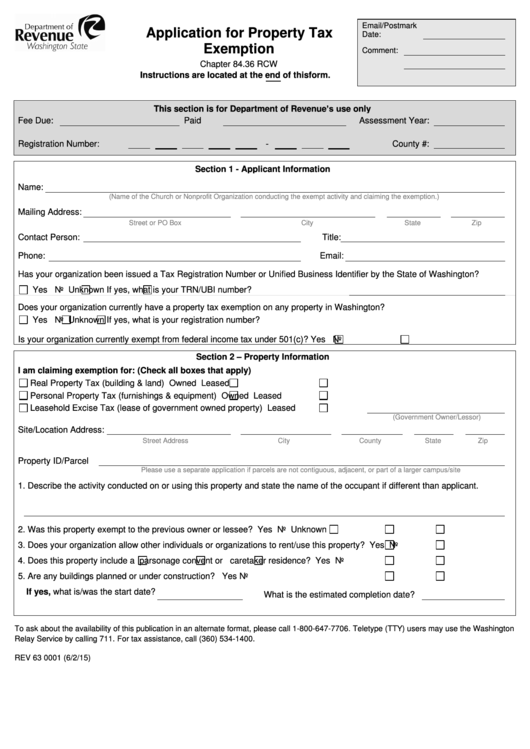

Form Rev 63 0001 - Application For Property Tax Exemption

ADVERTISEMENT

Email/Postmark

Application for Property Tax

Date:

Exemption

Comment:

Chapter 84.36 RCW

Instructions are located at the end of this form.

This section is for Department of Revenue’s use only

Fee Due:

Paid

Assessment Year:

Registration Number:

-

County #:

Section 1 - Applicant Information

Name:

(Name of the Church or Nonprofit Organization conducting the exempt activity and claiming the exemption.)

Mailing Address:

Street or PO Box

City

State

Zip

Contact Person:

Title:

Phone:

Email:

Has your organization been issued a Tax Registration Number or Unified Business Identifier by the State of Washington?

Yes

No

Unknown If yes, what is your TRN/UBI number?

-

Does your organization currently have a property tax exemption on any property in Washington?

Yes

No

Unknown If yes, what is your registration number?

-

Is your organization currently exempt from federal income tax under 501(c)?

Yes

No

Section 2 – Property Information

I am claiming exemption for: (Check all boxes that apply)

Real Property Tax (building & land)

Owned

Leased

Personal Property Tax (furnishings & equipment)

Owned

Leased

Leasehold Excise Tax (lease of government owned property)

Leased

(Government Owner/Lessor)

Site/Location Address:

Street Address

City

County

State

Zip

Property ID/Parcel

#:

Please use a separate application if parcels are not contiguous, adjacent, or part of a larger campus/site

1. Describe the activity conducted on or using this property and state the name of the occupant if different than applicant.

2. Was this property exempt to the previous owner or lessee?

Yes

No

Unknown

3. Does your organization allow other individuals or organizations to rent/use this property?

Yes

No

4. Does this property include a

parsonage

convent or

caretaker residence?

Yes

No

5. Are any buildings planned or under construction?

Yes

No

If yes, what is/was the start date?

What is the estimated completion date?

To ask about the availability of this publication in an alternate format, please call 1-800-647-7706. Teletype (TTY) users may use the Washington

Relay Service by calling 711. For tax assistance, call (360) 534-1400.

REV 63 0001 (6/2/15)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3