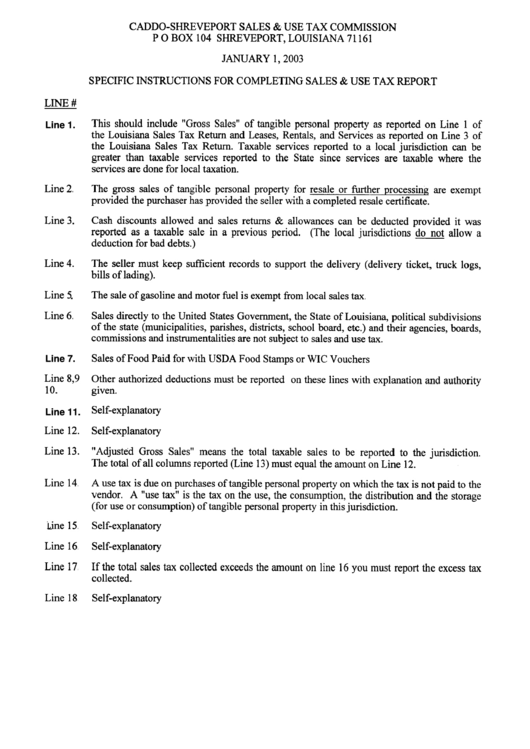

Specific Instructions For Completing Sales & Use Tax Report - Sales & Use Tax Comission - 2003

ADVERTISEMENT

CADDO-SHREVEPORT

SALES & USE TAX COMMISSION

P O BOX 104 SHREVEPORT,

LOUISIANA

71161

JANUARY

1,2003

SPECIFIC INSTRUCTIONS

FOR COMPLETING

SALES & USE TAX REPORT

LINE

#

This should include "Gross Sales" of tangible personal property as reported on Line 1 of

the Louisiana Sales Tax Return and Leases, Rentals, and Services as reported on Line 3 of

the Louisiana Sales Tax Return. Taxable services reported to a local jurisdiction can be

greater than taxable services reported to the State since services are taxable where the

services are done for local taxation.

Line

2.

The gross sales of tangible personal property for resale or further processing are exempt

provided the purchaser has provided the seller with a completed resale certificate.

Line

3

Cash discounts allowed and sales returns & allowances can be deducted provided it was

reported as a taxable sale in a previous period.

(The local jurisdictions

do not allow a

deduction for bad debts. )

Line 4.

The seller must keep sufficient records to support the delivery (delivery ticket, truck logs,

bills of lading).

Line

5

The sale of gasoline and motor fuel is exempt from local sales tax.

Line

6.

Sales directly to the United States Government, the State of Louisiana, political subdivisions

of the state (municipalities, parishes, districts, school board, etc.) and their agencies, boards,

commissions and instrumentalities are not subject to sales and use tax.

~ine

7.

Sales of Food Paid for with USDA Food Stamps or WIC Vouchers

Line 8,9

10.

Other authorized deductions must be reported on these lines with explanation and authority

given.

Self -explanatory

Line 12.

Self -explanatory

Line 13.

" Adjusted Gross Sales" means the total taxable sales to be reported to the jurisdiction.

The total of all columns reported (Line 13) must equal the amount on Line 12.

Line

14,

A use tax is due on purchases of tangible personal property on which the tax is not paid to the

vendor. A "use tax" is the tax on the use, the consumption, the distribution and the storage

(for use or consumption) of tangible personal property in this jurisdiction.

Self -explanatory

Line 16

Self -explanatory

Line 17

If the total sales tax collected exceeds the amount on line 16 you must report the excess tax

collected.

Line 18

Self -explanatory

1

Line 1.

.

.

Line 7.

Line 11.

L ine 15,

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2