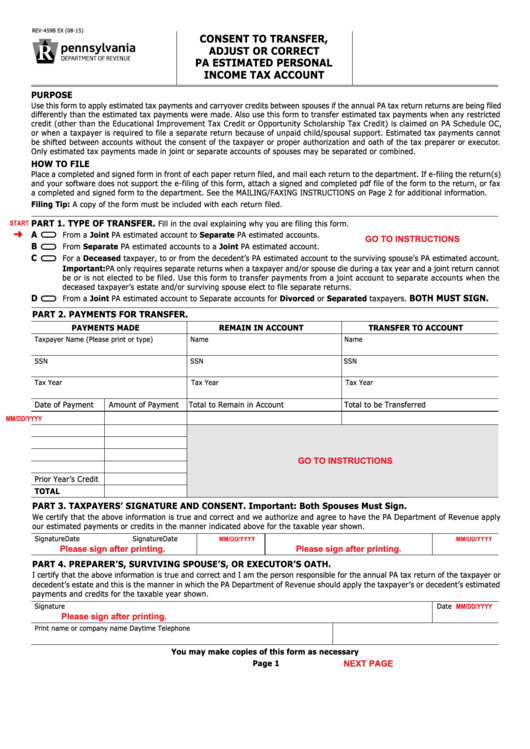

REV-459B EX (08-15)

CONSENT TO TRANSFER,

ADJUST OR CORRECT

PA ESTIMATED PERSONAL

INCOME TAX ACCOUNT

PURPOSE

Use this form to apply estimated tax payments and carryover credits between spouses if the annual PA tax return returns are being filed

differently than the estimated tax payments were made. Also use this form to transfer estimated tax payments when any restricted

credit (other than the Educational Improvement Tax Credit or Opportunity Scholarship Tax Credit) is claimed on PA Schedule OC,

or when a taxpayer is required to file a separate return because of unpaid child/spousal support. Estimated tax payments cannot

be shifted between accounts without the consent of the taxpayer or proper authorization and oath of the tax preparer or executor.

Only estimated tax payments made in joint or separate accounts of spouses may be separated or combined.

HOW TO FILE

Place a completed and signed form in front of each paper return filed, and mail each return to the department. If e-filing the return(s)

and your software does not support the e-filing of this form, attach a signed and completed pdf file of the form to the return, or fax

a completed and signed form to the department. See the MAILING/FAXING INSTRUCTIONS on Page 2 for additional information.

Filing Tip: A copy of the form must be included with each return filed.

START

PART 1. TYPE OF TRANSFER.

Fill in the oval explaining why you are filing this form.

A

From a Joint PA estimated account to Separate PA estimated accounts.

GO TO INSTRUCTIONS

B

From Separate PA estimated accounts to a Joint PA estimated account.

C

For a Deceased taxpayer, to or from the decedent’s PA estimated account to the surviving spouse’s PA estimated account.

Important: PA only requires separate returns when a taxpayer and/or spouse die during a tax year and a joint return cannot

be or is not elected to be filed. Use this form to transfer payments from a joint account to separate accounts when the

deceased taxpayer’s estate and/or surviving spouse elect to file separate returns.

D

BOTH MUST SIGN.

From a Joint PA estimated account to Separate accounts for Divorced or Separated taxpayers.

PART 2. PAYMENTS FOR TRANSFER.

PAYMENTS MADE

REMAIN IN ACCOUNT

TRANSFER TO ACCOUNT

Taxpayer Name (Please print or type)

Name

Name

SSN

SSN

SSN

Tax Year

Tax Year

Tax Year

Date of Payment

Amount of Payment

Total to Remain in Account

Total to be Transferred

MM/DD/YYYY

GO TO INSTRUCTIONS

Prior Year’s Credit

TOTAL

PART 3. TAXPAYERS’ SIGNATURE AND CONSENT. Important: Both Spouses Must Sign.

We certify that the above information is true and correct and we authorize and agree to have the PA Department of Revenue apply

our estimated payments or credits in the manner indicated above for the taxable year shown.

MM/DD/YYYY

MM/DD/YYYY

Signature

Date

Signature

Date

Please sign after printing.

Please sign after printing.

PART 4. PREPARER’S, SURVIVING SPOUSE’S, OR EXECUTOR’S OATH.

I certify that the above information is true and correct and I am the person responsible for the annual PA tax return of the taxpayer or

decedent’s estate and this is the manner in which the PA Department of Revenue should apply the taxpayer’s or decedent’s estimated

payments and credits for the taxable year shown.

MM/DD/YYYY

Signature

Date

Please sign after printing.

Print name or company name

Daytime Telephone

You may make copies of this form as necessary

NEXT PAGE

PRINT FORM

Reset Entire Form

Page 1

1

1