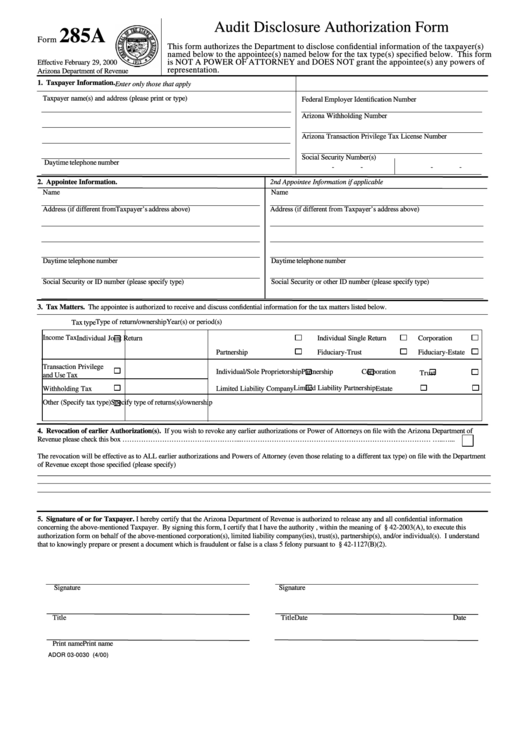

Audit Disclosure Authorization Form

285A

Form

This form authorizes the Department to disclose confidential information of the taxpayer(s)

named below to the appointee(s) named below for the tax type(s) specified below. This form

is NOT A POWER OF ATTORNEY and DOES NOT grant the appointee(s) any powers of

Effective February 29, 2000

representation.

Arizona Department of Revenue

1. Taxpayer Information.

Enter only those that apply

Taxpayer name(s) and address (please print or type)

Federal Employer Identification Number

Arizona Withholding Number

Arizona Transaction Privilege Tax License Number

Social Security Number(s)

Daytime telephone number

-

-

-

-

2. Appointee Information.

2nd Appointee Information if applicable

Name

Name

Address (if different fromTaxpayer’s address above)

Address (if different from Taxpayer’s address above)

Daytime telephone number

Daytime telephone number

Social Security or ID number (please specify type)

Social Security or other ID number (please specify type)

3. Tax Matters. The appointee is authorized to receive and discuss confidential information for the tax matters listed below.

Year(s) or period(s)

Type of return/ownership

Tax type

Income Tax

Individual Joint Return

Individual Single Return

Corporation

Partnership

Fiduciary-Trust

Fiduciary-Estate

Transaction Privilege

Individual/Sole Proprietorship

Partnership

Corporation

Trust

and Use Tax

Limited Liability Partnership

Withholding Tax

Limited Liability Company

Estate

Other (Specify tax type)

Specify type of returns(s)/ownership

4. Revocation of earlier Authorization(s). If you wish to revoke any earlier authorizations or Power of Attorneys on file with the Arizona Department of

Revenue please check this box ……………………………….…………...………………………………………………………………………....…..…...

The revocation will be effective as to ALL earlier authorizations and Powers of Attorney (even those relating to a different tax type) on file with the Department

of Revenue except those specified (please specify)

________________________________________________________________________________________________________________________________

________________________________________________________________________________________________________________________________

________________________________________________________________________________________________________________________________

5. Signature of or for Taxpayer. I hereby certify that the Arizona Department of Revenue is authorized to release any and all confidential information

concerning the above-mentioned Taxpayer. By signing this form, I certify that I have the authority , within the meaning of A.R.S. § 42-2003(A), to execute this

authorization form on behalf of the above-mentioned corporation(s), limited liability company(ies), trust(s), partnership(s), and/or individual(s). I understand

that to knowingly prepare or present a document which is fraudulent or false is a class 5 felony pursuant to A.R.S. § 42-1127(B)(2).

Signature

Signature

Title

Date

Title

Date

Print name

Print name

ADOR 03-0030 (4/00)

1

1