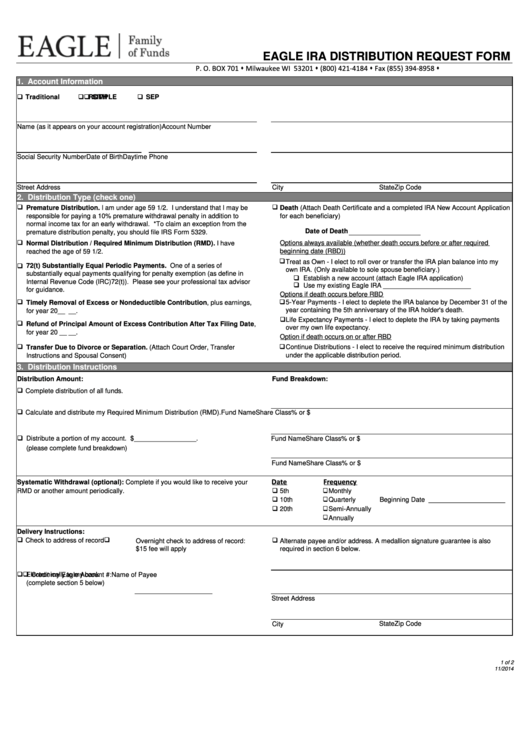

EAGLE IRA DISTRIBUTION REQUEST FORM

P. O. BOX 701 s Milwaukee WI 53201 s (800) 421-4184 s Fax (855) 394-8958 s

1. Account Information

q Traditional

q

q SIMPLE

q SEP

ROTH

Name (as it appears on your account registration)

Account Number

Social Security Number

Date of Birth

Daytime Phone

Street Address

City

State

Zip Code

2. Distribution Type (check one)

q

q

Premature Distribution. I am under age 59 1/2. I understand that I may be

Death (Attach Death Certificate and a completed IRA New Account Application

responsible for paying a 10% premature withdrawal penalty in addition to

for each beneficiary)

normal income tax for an early withdrawal. *To claim an exception from the

Date of Death

premature distribution penalty, you should file IRS Form 5329.

q

Options always available (whether death occurs before or after required

Normal Distribution / Required Minimum Distribution (RMD). I have

beginning date (RBD))

reached the age of 59 1/2.

q

Treat as Own - I elect to roll over or transfer the IRA plan balance into my

q

72(t) Substantially Equal Periodic Payments. One of a series of

own IRA. (Only available to sole spouse beneficiary.)

substantially equal payments qualifying for penalty exemption (as define in

q Establish a new account (attach Eagle IRA application)

Internal Revenue Code (IRC)72(t)). Please see your professional tax advisor

q Use my existing Eagle IRA ________________________

for guidance.

Options if death occurs before RBD

q

q

Timely Removal of Excess or Nondeductible Contribution, plus earnings,

5-Year Payments - I elect to deplete the IRA balance by December 31 of the

year containing the 5th anniversary of the IRA holder's death.

for year 20__ __.

q

Life Expectancy Payments - I elect to deplete the IRA by taking payments

q

Refund of Principal Amount of Excess Contribution After Tax Filing Date,

over my own life expectancy.

for year 20 __ __.

Option if death occurs on or after RBD

q

q

Transfer Due to Divorce or Separation. (Attach Court Order, Transfer

Continue Distributions - I elect to receive the required minimum distribution

Instructions and Spousal Consent)

under the applicable distribution period.

3. Distribution Instructions

Distribution Amount:

Fund Breakdown:

q Complete distribution of all funds.

q Calculate and distribute my Required Minimum Distribution (RMD).

Fund Name

Share Class

% or $

q

Distribute a portion of my account. $_________________.

Fund Name

Share Class

% or $

(please complete fund breakdown)

Fund Name

Share Class

% or $

Date

Frequency

Systematic Withdrawal (optional): Complete if you would like to receive your

q 5th

qMonthly

RMD or another amount periodically.

q 10th

qQuarterly

Beginning Date _____________________

q 20th

qSemi-Annually

q Annually

Delivery Instructions:

q Check to address of record

q

q

Overnight check to address of record:

Alternate payee and/or address. A medallion signature guarantee is also

$15 fee will apply

required in section 6 below.

q

q Credit my Eagle Account #:

Electronically to my bank

Name of Payee

(complete section 5 below)

Street Address

City

State

Zip Code

1 of 2

11/2014

1

1 2

2