Denver Sales Tax - Special Event Application / Registration Form - Special Events Sales Tax Return

ADVERTISEMENT

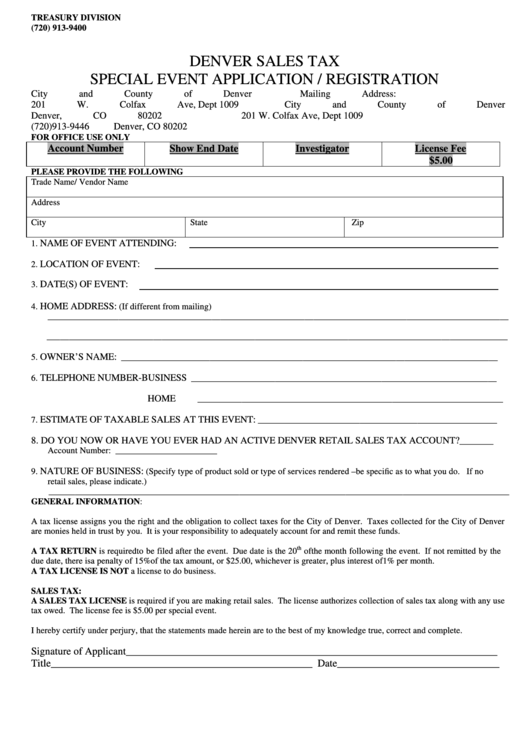

TREASURY DIVISION

(720) 913-9400

DENVER SALES TAX

SPECIAL EVENT APPLICATION / REGISTRATION

City and County of Denver

Mailing Address:

201 W. Colfax Ave, Dept 1009

City and County of Denver

Denver, CO 80202

201 W. Colfax Ave, Dept 1009

(720)913-9446

Denver, CO 80202

FOR OFFICE USE ONLY

Account Number

Show End Date

Investigator

License Fee

$5.00

PLEASE PROVIDE THE FOLLOWING

Trade Name/ Vendor Name

Address

City

State

Zip

NAME OF EVENT ATTENDING:

1.

LOCATION OF EVENT:

2.

DATE(S) OF EVENT:

3.

HOME ADDRESS:

4.

(If different from mailing)

________________________________________________________________________________________________________

________________________________________________________________________________________________________

OWNER’S NAME:

5.

_____________________________________________________________________________________

TELEPHONE NUMBER-BUSINESS

6.

_____________________________________________________________________

HOME

_____________________________________________________________________

ESTIMATE OF TAXABLE SALES AT THIS EVENT:

7.

______________________________________________________

8. DO YOU NOW OR HAVE YOU EVER HAD AN ACTIVE DENVER RETAIL SALES TAX ACCOUNT?_______

Account Number: _______________________

NATURE OF BUSINESS:

9.

(Specify type of product sold or type of services rendered –be specific as to what you do. If no

retail sales, please indicate.)

________________________________________________________________________________________________________

GENERAL INFORMATION:

A tax license assigns you the right and the obligation to collect taxes for the City of Denver. Taxes collected for the City of Denver

are monies held in trust by you. It is your responsibility to adequately account for and remit these funds.

th

A TAX RETURN is required to be filed after the event. Due date is the 20

of the month following the event. If not remitted by the

due date, there is a penalty of 15% of the tax amount, or $25.00, whichever is greater, plus interest of 1% per month.

A TAX LICENSE IS NOT a license to do business.

SALES TAX:

A SALES TAX LICENSE is required if you are making retail sales. The license authorizes collection of sales tax along with any use

tax owed. The license fee is $5.00 per special event.

I hereby certify under perjury, that the statements made herein are to the best of my knowledge true, correct and complete.

Signature of Applicant_______________________________________________________________________

Title__________________________________________________ Date_______________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3