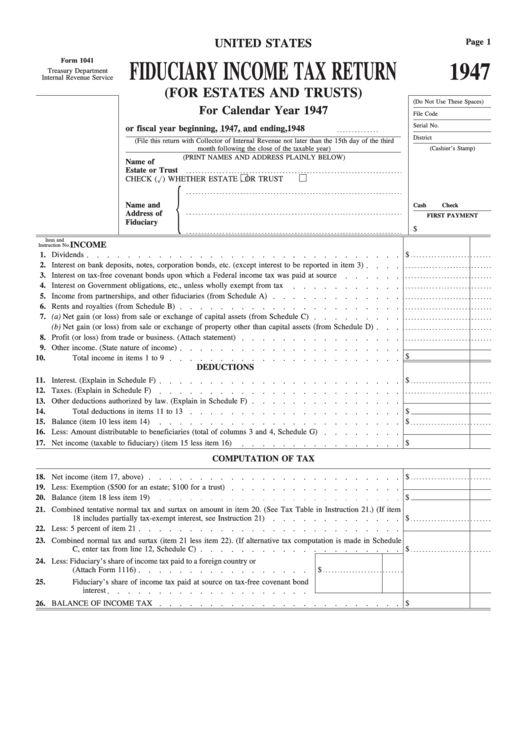

Form 1041 - Fiduciary Income Tax Return (For Estates And Trusts) - 1947

ADVERTISEMENT

UNITED STATES

Page 1

Form 1041

FIDUCIARY INCOME TAX RETURN

1947

Treasury Department

Internal Revenue Service

(FOR ESTATES AND TRUSTS)

(Do Not Use These Spaces)

For Calendar Year 1947

File Code

Serial No.

or fiscal year beginning

, 1947, and ending

,1948

District

(File this return with Collector of Internal Revenue not later than the 15th day of the third

month following the close of the taxable year)

(Cashier’s Stamp)

(PRINT NAMES AND ADDRESS PLAINLY BELOW)

Name of

Estate or Trust

CHECK ( ) WHETHER ESTATE

, OR TRUST

Name and

Cash

Check

M.O.

Address of

FIRST PAYMENT

Fiduciary

$

Item and

INCOME

Instruction No.

1.

Dividends

$

2.

Interest on bank deposits, notes, corporation bonds, etc. (except interest to be reported in item 3)

3.

Interest on tax-free covenant bonds upon which a Federal income tax was paid at source

4.

Interest on Government obligations, etc., unless wholly exempt from tax

5.

Income from partnerships, and other fiduciaries (from Schedule A)

6.

Rents and royalties (from Schedule B)

7.

(a) Net gain (or loss) from sale or exchange of capital assets (from Schedule C)

(b) Net gain (or loss) from sale or exchange of property other than capital assets (from Schedule D)

8.

Profit (or loss) from trade or business. (Attach statement)

9.

Other income. (State nature of income)

$

10.

Total income in items 1 to 9

DEDUCTIONS

11.

Interest. (Explain in Schedule F)

$

12.

Taxes. (Explain in Schedule F)

13.

Other deductions authorized by law. (Explain in Schedule F)

14.

Total deductions in items 11 to 13

$

15.

Balance (item 10 less item 14)

$

16.

Less: Amount distributable to beneficiaries (total of columns 3 and 4, Schedule G)

17.

Net income (taxable to fiduciary) (item 15 less item 16)

$

COMPUTATION OF TAX

18.

Net income (item 17, above)

$

19.

Less: Exemption ($500 for an estate; $100 for a trust)

20.

Balance (item 18 less item 19)

$

21.

Combined tentative normal tax and surtax on amount in item 20. (See Tax Table in Instruction 21.) (If item

18 includes partially tax-exempt interest, see Instruction 21)

$

22.

Less: 5 percent of item 21

23.

Combined normal tax and surtax (item 21 less item 22). (If alternative tax computation is made in Schedule

C, enter tax from line 12, Schedule C)

$

24.

Less: Fiduciary’s share of income tax paid to a foreign country or U.S. possession.

(Attach Form 1116)

$

25.

Fiduciary’s share of income tax paid at source on tax-free covenant bond

interest

26.

BALANCE OF INCOME TAX

$

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4