Form 41es - Quarterly Estimated Tax - Id State Tax Commission - 2002

ADVERTISEMENT

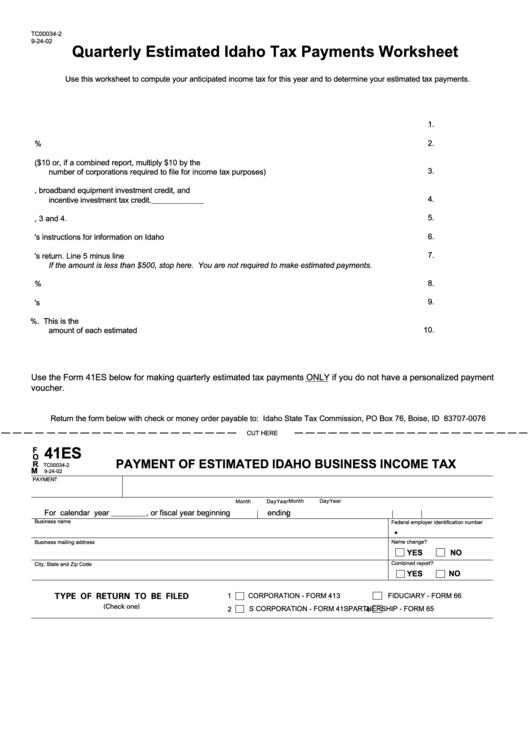

TC00034-2

9-24-02

Quarterly Estimated Idaho Tax Payments Worksheet

Use this worksheet to compute your anticipated income tax for this year and to determine your estimated tax payments.

1.

1. Anticipated Idaho taxable income this year ..........................................................................................................

_______________

2.

2. Income tax on anticipated Idaho taxable income. Multiply line 1 by 7.6%. ............................................................

_______________

3. Permanent building fund tax ($10 or, if a combined report, multiply $10 by the

3.

number of corporations required to file for income tax purposes) ........................................................................

_______________

4. Recapture of investment tax credit, broadband equipment investment credit, and

4.

incentive investment tax credit. ............................................................................................................................

_______________

5.

5. Total income tax. Add lines 2, 3 and 4. ................................................................................................................

_______________

6.

6. Anticipated credits. Refer to last year's instructions for information on Idaho credits. ...........................................

_______________

7.

7. Estimated taxes payable on this year's return. Line 5 minus line 6. ......................................................................

_______________

If the amount is less than $500, stop here. You are not required to make estimated payments.

8.

8. Multiply line 7 by 90%. ........................................................................................................................................

_______________

9.

9. Idaho income tax reported on last year's return ...................................................................................................

_______________

10. Estimated payments. Multiply the smaller of lines 8 or 9 by 25%. This is the

10.

amount of each estimated payment. ...................................................................................................................

_______________

Use the Form 41ES below for making quarterly estimated tax payments ONLY if you do not have a personalized payment

voucher.

Return the form below with check or money order payable to: Idaho State Tax Commission, PO Box 76, Boise, ID 83707-0076

CUT HERE

F

41ES

O

PAYMENT OF ESTIMATED IDAHO BUSINESS INCOME TAX

R

TC00034-2

M

9-24-02

PAYMENT

Month

Day

Year

Month

Day

Year

For calendar year ________, or fiscal year beginning

ending

Business name

Federal employer identification number

.

Business mailing address

Name change?

YES

NO

Combined report?

City, State and Zip Code

YES

NO

TYPE OF RETURN TO BE FILED

1

3

CORPORATION - FORM 41

FIDUCIARY - FORM 66

(Check one)

2

4

S CORPORATION - FORM 41S

PARTNERSHIP - FORM 65

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1