Form 41s - Idaho S Corporation Income Tax Return - 2002

ADVERTISEMENT

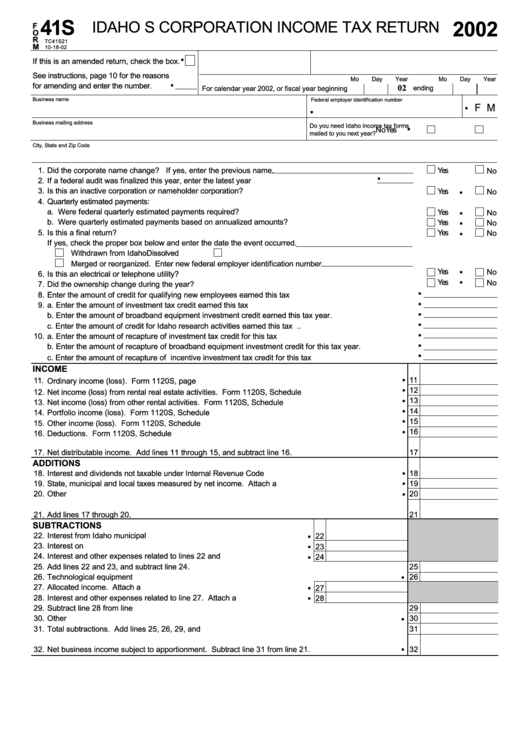

41S

IDAHO S CORPORATION INCOME TAX RETURN

2002

F

O

R

TC41S21

M

10-18-02

.

If this is an amended return, check the box.

See instructions, page 10 for the reasons

.

Mo

Day

Year

Mo

Day

Year

for amending and enter the number.

02

ending

For calendar year 2002, or fiscal year beginning

Business name

Federal employer identification number

.

.

F M

.

Business mailing address

Do you need Idaho income tax forms

Yes

No

mailed to you next year?

City, State and Zip Code

1.

Did the corporate name change? If yes, enter the previous name.

Yes

.

No

2.

If a federal audit was finalized this year, enter the latest year audited. ...........................................

.

3.

Is this an inactive corporation or nameholder corporation? ..............................................................................

Yes

No

4.

Quarterly estimated payments:

.

a. Were federal quarterly estimated payments required? .................................................................................

Yes

No

.

b. Were quarterly estimated payments based on annualized amounts? ..........................................................

Yes

No

.

5.

Is this a final return? ........................................................................................................................................

Yes

No

If yes, check the proper box below and enter the date the event occurred.

Withdrawn from Idaho

Dissolved

Merged or reorganized. Enter new federal employer identification number.

.

Yes

No

6.

Is this an electrical or telephone utility? .............................................................................................................

.

Yes

No

7.

Did the ownership change during the year? .....................................................................................................

.

8.

Enter the amount of credit for qualifying new employees earned this tax year. .................................................

.

9.

a. Enter the amount of investment tax credit earned this tax year. ....................................................................

.

b. Enter the amount of broadband equipment investment credit earned this tax year. ......................................

.

c. Enter the amount of credit for Idaho research activities earned this tax year. ................................................

.

10.

a. Enter the amount of recapture of investment tax credit for this tax year. .......................................................

.

b. Enter the amount of recapture of broadband equipment investment credit for this tax year. .........................

.

c. Enter the amount of recapture of incentive investment tax credit for this tax year. ........................................

INCOME

.

11

11.

Ordinary income (loss). Form 1120S, page 1 ...........................................................................................

.

12

12.

Net income (loss) from rental real estate activities. Form 1120S, Schedule K ...........................................

.

13

13.

Net income (loss) from other rental activities. Form 1120S, Schedule K ...................................................

.

14

14.

Portfolio income (loss). Form 1120S, Schedule K ....................................................................................

.

15

15.

Other income (loss). Form 1120S, Schedule K ........................................................................................

.

16

16.

Deductions. Form 1120S, Schedule K .....................................................................................................

17.

Net distributable income. Add lines 11 through 15, and subtract line 16.

17

ADDITIONS

.

18.

Interest and dividends not taxable under Internal Revenue Code ..............................................................

18

.

19.

State, municipal and local taxes measured by net income. Attach a schedule. .........................................

19

.

20.

Other additions .........................................................................................................................................

20

21.

Add lines 17 through 20.

21

SUBTRACTIONS

.

22.

Interest from Idaho municipal securities .........................................................

22

.

23.

Interest on U.S. Government obligations. Attach a schedule. ........................

23

.

24.

Interest and other expenses related to lines 22 and 23 ..................................

24

25.

Add lines 22 and 23, and subtract line 24. ................................................................................................

25

.

26.

Technological equipment donation ............................................................................................................

26

.

27.

Allocated income. Attach a schedule. ............................................................

27

.

28.

Interest and other expenses related to line 27. Attach a schedule. ................

28

29.

Subtract line 28 from line 27. ....................................................................................................................

29

.

30.

Other subtractions ....................................................................................................................................

30

31.

Total subtractions. Add lines 25, 26, 29, and 30. ......................................................................................

31

.

32.

Net business income subject to apportionment. Subtract line 31 from line 21.

32

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2