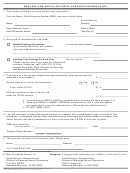

Form SSA-7050-F4 (10-2016) UF

Page 3 of 4

REQUEST FOR SOCIAL SECURITY EARNINGS INFORMATION

INFORMATION ABOUT YOUR REQUEST

You may use this form to request earnings information for only ONE Social Security Number (SSN)

How do I get my earnings statement?

Is There A Fee For Earnings Information?

You must complete the attached form. Tell us the specific

Yes. We charge a $115 fee for providing information for

years of earnings you want, type of earnings record, and

purposes unrelated to the administration of our programs.

provide your mailing address. The itemized statement of

earnings will be mailed to ONE address, therefore, if you

1. Certified or Non-Certified Itemized Statement of

want the statement sent to someone other than yourself,

Earnings

provide their address in section 3. Mail the completed form

In most instances, individuals request Itemized

to SSA within 120 days of signature. If you sign with an "X",

Statements of Earnings for purposes unrelated to our

your mark must be witnessed by two impartial persons who

programs such as a private pension plan or personal

must provide their name and address in the spaces provided.

injury suit. Bulk submitters may email

OCO.Pension.

Select ONE type of earnings statement and include the

Fund@ssa.gov

for an alternate method of obtaining

appropriate fee.

itemized earnings information.

1. Certified/Non-Certified Itemized Statement of Earnings

This statement includes years of self-employment or

We will certify the itemized earnings information for an

employment and the names and addresses of

additional $33.00 fee. Certification is usually not

employers.

necessary unless you are specifically requested to obtain

2. Certified Yearly Totals of Earnings

a certified earnings record.

This statement includes the total earnings for each year

requested but does not include the names and

Sometimes, there is no charge for itemized earnings

addresses of employers.

information. If you have reason to believe your earnings

are not correct (for example, you have previously received

If you require one of each type of earnings statement, you

earnings information from us and it does not agree with

must complete two separate forms. Mail each form to SSA

your records), we will supply you with more detail for the

with one form of payment attached to each request.

year(s) in question. Be sure to show the year(s) involved

on the request form and explain why you need the

How do I get someone else's earnings statement?

information. If you do not tell us why you need the

information, we will charge a fee.

You may get someone else's earnings information if you

meet one of the following criteria, attach the necessary

2. Certified Yearly Totals of Earnings

documents to show your entitlement to the earnings

We charge $33 to certify yearly totals of earnings.

information and include the appropriate fee.

However, if you do not want or need certification, you may

obtain yearly totals FREE of charge at

1. Someone Else's Earnings

Certification is usually not

The natural or adoptive parent or legal guardian of a

necessary unless you are advised specifically to obtain a

minor child, or the legal guardian of a legally declared

certified earnings record.

incompetent individual, may obtain earnings information

if acting in the best interest of the minor child or

Method of Payment

incompetent individual. You must include proof of your

This Fee Is Not Refundable. DO NOT SEND CASH.

relationship to the individual with your request. The proof

may include a birth certificate, court order, adoption

You may pay by credit card, check or money order.

decree, or other legally binding document.

• Credit Card Instructions

Complete the credit card section on page 4 and

2. A Deceased Person's Earnings

return it with your request form.

You can request earnings information from the record of

a deceased person if you are:

• Check or Money Order Instructions

• The legal representative of the estate;

Enclose one check or money order per request form

• A survivor (that is, the spouse, parent, child, divorced

payable to the Social Security Administration and

spouse of divorced parent); or

write the Social Security number in the memo.

• An individual with a material interest (e.g., financial)

who is an heir at law, next of kin, beneficiary under the

How long will it take SSA to process my request?

will or donee of property of the decedent.

Please allow SSA 120 days to process this request. After

You must include proof of death and proof of your

120 days, you may contact 1-800-772-1213 to leave an

relationship to the deceased with your request.

inquiry regarding your request.

1

1 2

2 3

3 4

4 5

5 6

6