Instructions For Forms 1099-Int And 1099-Oid - 2018

ADVERTISEMENT

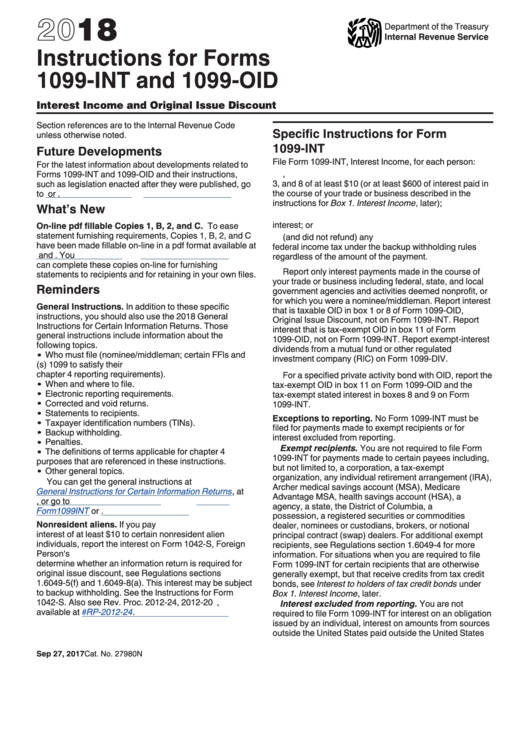

2018

Department of the Treasury

Internal Revenue Service

Instructions for Forms

1099-INT and 1099-OID

Interest Income and Original Issue Discount

Section references are to the Internal Revenue Code

Specific Instructions for Form

unless otherwise noted.

1099-INT

Future Developments

File Form 1099-INT, Interest Income, for each person:

For the latest information about developments related to

Forms 1099-INT and 1099-OID and their instructions,

1. To whom you paid amounts reportable in boxes 1,

3, and 8 of at least $10 (or at least $600 of interest paid in

such as legislation enacted after they were published, go

to

IRS.gov/Form1099INT

or IRS.gov/Form1099OID.

the course of your trade or business described in the

instructions for Box 1. Interest Income, later);

What’s New

2. For whom you withheld and paid any foreign tax on

interest; or

On-line pdf fillable Copies 1, B, 2, and C. To ease

statement furnishing requirements, Copies 1, B, 2, and C

3. From whom you withheld (and did not refund) any

have been made fillable on-line in a pdf format available at

federal income tax under the backup withholding rules

IRS.gov/Form1099INT

and IRS.gov/Form1099OID. You

regardless of the amount of the payment.

can complete these copies on-line for furnishing

Report only interest payments made in the course of

statements to recipients and for retaining in your own files.

your trade or business including federal, state, and local

Reminders

government agencies and activities deemed nonprofit, or

for which you were a nominee/middleman. Report interest

General Instructions. In addition to these specific

that is taxable OID in box 1 or 8 of Form 1099-OID,

instructions, you should also use the 2018 General

Original Issue Discount, not on Form 1099-INT. Report

Instructions for Certain Information Returns. Those

interest that is tax-exempt OID in box 11 of Form

general instructions include information about the

1099-OID, not on Form 1099-INT. Report exempt-interest

following topics.

dividends from a mutual fund or other regulated

Who must file (nominee/middleman; certain FFIs and

investment company (RIC) on Form 1099-DIV.

U.S. payers that report on Form(s) 1099 to satisfy their

chapter 4 reporting requirements).

For a specified private activity bond with OID, report the

When and where to file.

tax-exempt OID in box 11 on Form 1099-OID and the

Electronic reporting requirements.

tax-exempt stated interest in boxes 8 and 9 on Form

Corrected and void returns.

1099-INT.

Statements to recipients.

Exceptions to reporting. No Form 1099-INT must be

Taxpayer identification numbers (TINs).

filed for payments made to exempt recipients or for

Backup withholding.

interest excluded from reporting.

Penalties.

Exempt recipients. You are not required to file Form

The definitions of terms applicable for chapter 4

1099-INT for payments made to certain payees including,

purposes that are referenced in these instructions.

but not limited to, a corporation, a tax-exempt

Other general topics.

organization, any individual retirement arrangement (IRA),

You can get the general instructions at

Archer medical savings account (MSA), Medicare

General Instructions for Certain Information

Returns, at

Advantage MSA, health savings account (HSA), a U.S.

IRS.gov/1099generalinstructions, or go to

IRS.gov/

agency, a state, the District of Columbia, a U.S.

Form1099INT

or IRS.gov/Form1099OID.

possession, a registered securities or commodities

Nonresident aliens. If you pay U.S. bank deposit

dealer, nominees or custodians, brokers, or notional

interest of at least $10 to certain nonresident alien

principal contract (swap) dealers. For additional exempt

individuals, report the interest on Form 1042-S, Foreign

recipients, see Regulations section 1.6049-4 for more

Person's U.S. Source Income Subject to Withholding. To

information. For situations when you are required to file

determine whether an information return is required for

Form 1099-INT for certain recipients that are otherwise

original issue discount, see Regulations sections

generally exempt, but that receive credits from tax credit

1.6049-5(f) and 1.6049-8(a). This interest may be subject

bonds, see Interest to holders of tax credit bonds under

to backup withholding. See the Instructions for Form

Box 1. Interest Income, later.

1042-S. Also see Rev. Proc. 2012-24, 2012-20 I.R.B. 913,

Interest excluded from reporting. You are not

available at IRS.gov/irb/2012-20_IRB#RP-2012-24.

required to file Form 1099-INT for interest on an obligation

issued by an individual, interest on amounts from sources

outside the United States paid outside the United States

Sep 27, 2017

Cat. No. 27980N

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9