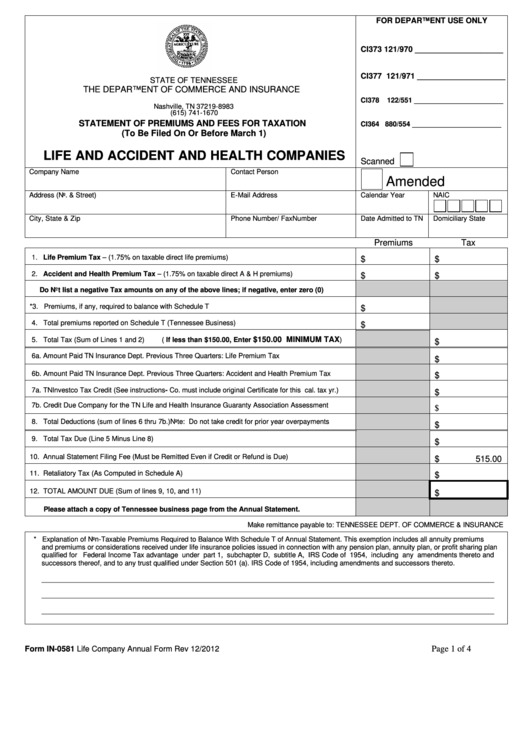

Form In-0581 - Life And Accident And Health Companies - Tennessee Department Of Commerce And Insurance

ADVERTISEMENT

FOR DEPARTMENT USE ONLY

CI373 121/970 ____________________

CI377 121/971 ____________________

STATE OF TENNESSEE

THE DEPARTMENT OF COMMERCE AND INSURANCE

P.O. BOX 198983

CI378

122/551 _______________________

Nashville, TN 37219-8983

(615) 741-1670

STATEMENT OF PREMIUMS AND FEES FOR TAXATION

CI364 880/554 _______________________

(To Be Filed On Or Before March 1)

LIFE AND ACCIDENT AND HEALTH COMPANIES

Scanned

Company Name

Contact Person

Amended

Address (No. & Street)

E-Mail Address

Calendar Year

NAIC CO.CODE

City, State & Zip

Phone Number/ Fax Number

Date Admitted to TN

Domiciliary State

Premiums

Tax

1. Life Premium Tax – (1.75% on taxable direct life premiums)

$

$

2. Accident and Health Premium Tax – (1.75% on taxable direct A & H premiums)

$

$

Do Not list a negative Tax amounts on any of the above lines; if negative, enter zero (0)

*3. Premiums, if any, required to balance with Schedule T

$

4. Total premiums reported on Schedule T (Tennessee Business)

$

$150.00 MINIMUM TAX

5. Total Tax (Sum of Lines 1 and 2)

( If less than $150.00, Enter

)

$

6a. Amount Paid TN Insurance Dept. Previous Three Quarters: Life Premium Tax

$

6b. Amount Paid TN Insurance Dept. Previous Three Quarters: Accident and Health Premium Tax

$

7a. TNInvestco Tax Credit (See instructions- Co. must include original Certificate for this cal. tax yr.)

$

7b. Credit Due Company for the TN Life and Health Insurance Guaranty Association Assessment

$

8. Total Deductions (sum of lines 6 thru 7b.) Note: Do not take credit for prior year overpayments

$

9. Total Tax Due (Line 5 Minus Line 8)

$

10. Annual Statement Filing Fee (Must be Remitted Even if Credit or Refund is Due)

$

515.00

11. Retaliatory Tax (As Computed in Schedule A)

$

12. TOTAL AMOUNT DUE (Sum of lines 9, 10, and 11)

$

Please attach a copy of Tennessee business page from the Annual Statement.

Make remittance payable to: TENNESSEE DEPT. OF COMMERCE & INSURANCE

* Explanation of Non-Taxable Premiums Required to Balance With Schedule T of Annual Statement. This exemption includes all annuity premiums

and premiums or considerations received under life insurance policies issued in connection with any pension plan, annuity plan, or profit sharing plan

qualified for Federal Income Tax advantage under part 1, subchapter D, subtitle A, IRS Code of 1954, including any amendments thereto and

successors thereof, and to any trust qualified under Section 501 (a). IRS Code of 1954, including amendments and successors thereto.

_____________________________________________________________________________________________________________________

_____________________________________________________________________________________________________________________

_____________________________________________________________________________________________________________________

Form IN-0581 Life Company Annual Form Rev 12/2012

Page 1 of 4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4