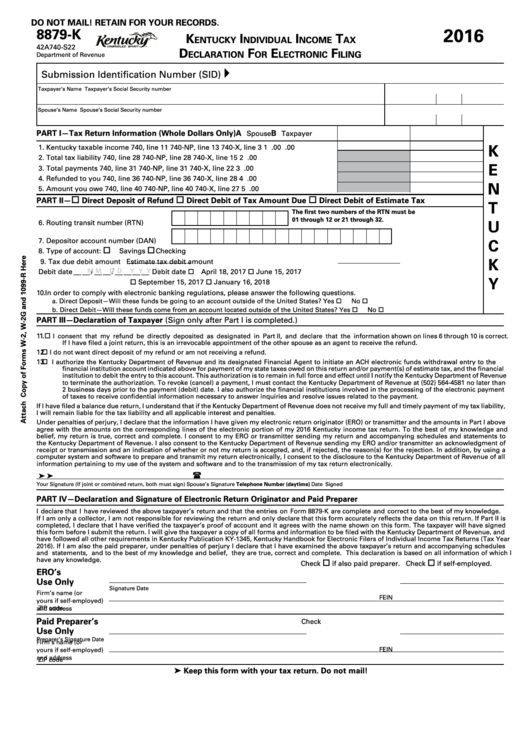

Form 8879-K - Kentucky Individual Income Tax Declaration For Electronic Filing - 2016

ADVERTISEMENT

DO NOT MAIL! RETAIN FOR YOUR RECORDS.

2016

8879-K

K

I

I

t

entucKy

ndIvIdual

ncome

ax

42A740-S22

d

F

e

F

eclaratIon

or

lectronIc

IlIng

Department of Revenue

}

Submission Identification Number (SID)

Taxpayer’s Name

Taxpayer’s Social Security number

Spouse’s Name

Spouse’s Social Security number

PART I—Tax Return Information (Whole Dollars Only)

A

B

Spouse

Taxpayer

K

1. Kentucky taxable income

740, line 11

740-NP , line 13

740-X, line 3

1

.00

.00

2. Total tax liability

740, line 28

740-NP , line 28

740-X, line 15

2

.00

E

3. Total payments

740, line 31

740-NP , line 31

740-X, line 22

3

.00

4. Refunded to you

740, line 36

740-NP , line 36

740-X, line 28

4

.00

N

5. Amount you owe

740, line 40

740-NP , line 40

740-X, line 27

5

.00

PART II—

Direct Deposit of Refund

Direct Debit of Tax Amount Due

Direct Debit of Estimate Tax

T

The first two numbers of the RTN must be

01 through 12 or 21 through 32.

U

6. Routing transit number (RTN)

7.

Depositor account number (DAN)

C

8. Type of account:

Savings

Checking

K

9. Tax due debit amount

Estimate tax debit amount

__ __ / __ __ / __ __ __ __

M M

D D

Y Y Y Y

Debit date

Debit date April 18, 2017

June 15, 2017

Y

September 15, 2017 January 16, 2018

10. In order to comply with electronic banking regulations, please answer the following questions.

a.

Direct Deposit—Will these funds be going to an account outside of the United States?

Yes No

b.

Direct Debit—Will these funds come from an account located outside of the United States?

Yes No

PART III—Declaration of Taxpayer (Sign only after Part I is completed.)

11.

I consent that my refund be directly deposited as designated in Part II, and declare that the information shown on lines 6 through 10 is correct.

If I have filed a joint return, this is an irrevocable appointment of the other spouse as an agent to receive the refund.

12.

I do not want direct deposit of my refund or am not receiving a refund.

13.

I authorize the Kentucky Department of Revenue and its designated Financial Agent to initiate an ACH electronic funds withdrawal entry to the

financial institution account indicated above for payment of my state taxes owed on this return and/or payment(s) of estimate tax, and the financial

institution to debit the entry to this account. This authorization is to remain in full force and effect until I notify the Kentucky Department of Revenue

to terminate the authorization. To revoke (cancel) a payment, I must contact the Kentucky Department of Revenue at (502) 564-4581 no later than

2 business days prior to the payment (debit) date. I also authorize the financial institutions involved in the processing of the electronic payment

of taxes to receive confidential information necessary to answer inquiries and resolve issues related to the payment.

If I have filed a balance due return, I understand that if the Kentucky Department of Revenue does not receive my full and timely payment of my tax liability,

I will remain liable for the tax liability and all applicable interest and penalties.

Under penalties of perjury, I declare that the information I have given my electronic return originator (ERO) or transmitter and the amounts in Part I above

agree with the amounts on the corresponding lines of the electronic portion of my 2016 Kentucky income tax return. To the best of my knowledge and

belief, my return is true, correct and complete. I consent to my ERO or transmitter sending my return and accompanying schedules and statements to

the Kentucky Department of Revenue. I also consent to the Kentucky Department of Revenue sending my ERO and/or transmitter an acknowledgment of

receipt or transmission and an indication of whether or not my return is accepted, and, if rejected, the reason(s) for the rejection. In addition, by using a

computer system and software to prepare and transmit my return electronically, I consent to the disclosure to the Kentucky Department of Revenue of all

information pertaining to my use of the system and software and to the transmission of my tax return electronically.

➤

➤

Your Signature (If joint or combined return, both must sign)

Spouse’s Signature

Telephone Number (daytime)

Date Signed

PART IV—Declaration and Signature of Electronic Return Originator and Paid Preparer

I declare that I have reviewed the above taxpayer’s return and that the entries on Form 8879-K are complete and correct to the best of my knowledge.

If I am only a collector, I am not responsible for reviewing the return and only declare that this form accurately reflects the data on this return. If Part II is

completed, I declare that I have verified the taxpayer’s proof of account and it agrees with the name shown on this form. The taxpayer will have signed

this form before I submit the return. I will give the taxpayer a copy of all forms and information to be filed with the Kentucky Department of Revenue, and

have followed all other requirements in Kentucky Publication KY-1345, Kentucky Handbook for Electronic Filers of Individual Income Tax Returns (Tax Year

2016). If I am also the paid preparer, under penalties of perjury I declare that I have examined the above taxpayer’s return and accompanying schedules

and statements, and to the best of my knowledge and belief, they are true, correct and complete. This declaration is based on all information of which I

have any knowledge.

Check

if also paid preparer.

Check

if self-employed.

ERO’s

Use Only

Signature

Date

I.D. Number of ERO

Firm’s name (or

FEIN

yours if self-employed)

ZIP code

and address

Paid Preparer’s

Check

if self-employed.

Use Only

Preparer’s Signature

Date

I.D. Number of Preparer

Firm’s name (or

FEIN

yours if self-employed)

and address

ZIP code

➤ Keep this form with your tax return. Do not mail!

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1