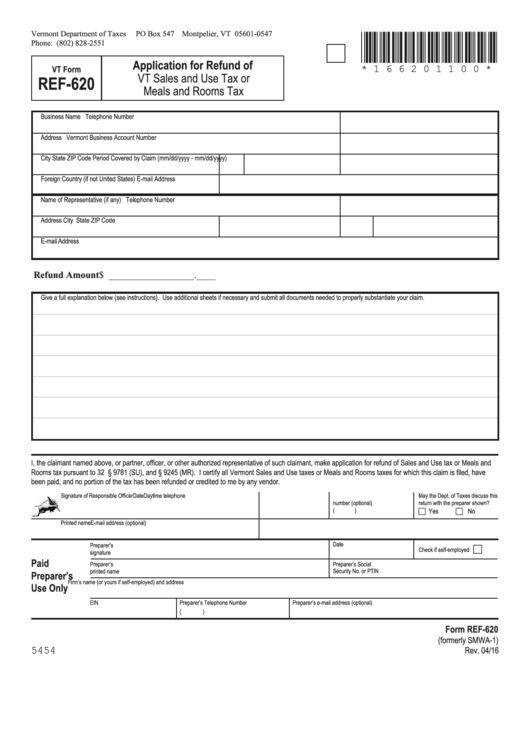

Form Ref-620 - Application For Refund Of Vt Sales And Use Tax Or Meals And Rooms Tax

ADVERTISEMENT

Vermont Department of Taxes

PO Box 547 Montpelier, VT 05601-0547

*166201100*

Phone: (802) 828-2551

Application for Refund of

* 1 6 6 2 0 1 1 0 0 *

VT Form

VT Sales and Use Tax or

REF-620

Meals and Rooms Tax

Business Name

Telephone Number

Address

Vermont Business Account Number

City

State

ZIP Code

Period Covered by Claim (mm/dd/yyyy - mm/dd/yyyy)

Foreign Country (if not United States)

E-mail Address

Name of Representative (if any)

Telephone Number

Address

City

State

ZIP Code

E-mail Address

Refund Amount . . . . . . .$ __________________ .____

Give a full explanation below (see instructions). Use additional sheets if necessary and submit all documents needed to properly substantiate your claim.

I, the claimant named above, or partner, officer, or other authorized representative of such claimant, make application for refund of Sales and Use tax or Meals and

Rooms tax pursuant to 32 V.S.A. § 9781 (SU), and § 9245 (MR). I certify all Vermont Sales and Use taxes or Meals and Rooms taxes for which this claim is filed, have

been paid, and no portion of the tax has been refunded or credited to me by any vendor.

Signature of Responsible Officer

Date

Daytime telephone

May the Dept. of Taxes discuss this

number (optional)

return with the preparer shown?

(

)

Yes

No

Printed name

E-mail address (optional)

Date

Preparer’s

Check if self-employed

signature

Paid

Preparer’s

Preparer’s Social

Security No. or PTIN

printed name

Preparer’s

Firm’s name (or yours if self-employed) and address

Use Only

EIN

Preparer’s Telephone Number

Preparer’s e-mail address (optional)

(

)

Form REF-620

(formerly SMWA-1)

5454

Rev. 04/16

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1