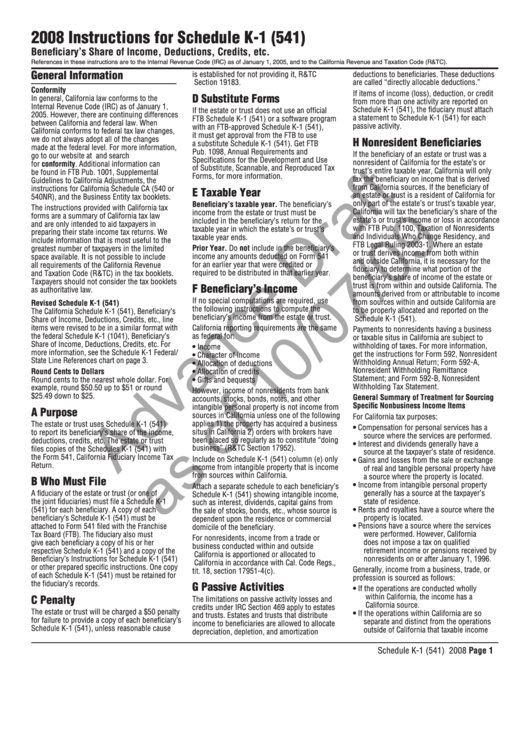

Instructions For Schedule K-1 (541) Draft - Beneficiary'S Share Of Income, Deductions, Credits, Etc. - 2008

ADVERTISEMENT

2008 Instructions for Schedule K-1 (541)

Beneficiary’s Share of Income, Deductions, Credits, etc.

References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2005, and to the California Revenue and Taxation Code (R&TC).

General Information

is established for not providing it, R&TC

deductions to beneficiaries. These deductions

Section 19183.

are called “directly allocable deductions.”

Conformity

If items of income (loss), deduction, or credit

D Substitute Forms

In general, California law conforms to the

from more than one activity are reported on

Internal Revenue Code (IRC) as of January 1,

Schedule K-1 (541), the fiduciary must attach

If the estate or trust does not use an official

2005. However, there are continuing differences

a statement to Schedule K-1 (541) for each

FTB Schedule K-1 (541) or a software program

between California and federal law. When

passive activity.

with an FTB-approved Schedule K-1 (541),

California conforms to federal tax law changes,

it must get approval from the FTB to use

we do not always adopt all of the changes

H Nonresident Beneficiaries

a substitute Schedule K-1 (541). Get FTB

made at the federal level. For more information,

Pub. 1098, Annual Requirements and

If the beneficiary of an estate or trust was a

go to our website at ftb.ca.gov and search

Specifications for the Development and Use

nonresident of California for the estate’s or

for conformity. Additional information can

of Substitute, Scannable, and Reproduced Tax

trust’s entire taxable year, California will only

be found in FTB Pub. 1001, Supplemental

Forms, for more information.

tax the beneficiary on income that is derived

Guidelines to California Adjustments, the

from California sources. If the beneficiary of

instructions for California Schedule CA (540 or

E Taxable Year

an estate or trust is a resident of California for

540NR), and the Business Entity tax booklets.

only part of the estate’s or trust’s taxable year,

Beneficiary’s taxable year. The beneficiary’s

The instructions provided with California tax

California will tax the beneficiary’s share of the

income from the estate or trust must be

forms are a summary of California tax law

estate’s or trust’s income or loss in accordance

included in the beneficiary’s return for the

and are only intended to aid taxpayers in

with FTB Pub. 1100, Taxation of Nonresidents

taxable year in which the estate’s or trust’s

preparing their state income tax returns. We

and Individuals Who Change Residency, and

taxable year ends.

include information that is most useful to the

FTB Legal Ruling 2003-1. Where an estate

Prior Year. Do not include in the beneficiary’s

greatest number of taxpayers in the limited

or trust derives income from both within

income any amounts deducted on Form 541

space available. It is not possible to include

and outside California, it is necessary for the

for an earlier year that were credited or

all requirements of the California Revenue

fiduciary to determine what portion of the

required to be distributed in that earlier year.

and Taxation Code (R&TC) in the tax booklets.

beneficiary’s share of income of the estate or

Taxpayers should not consider the tax booklets

trust is from within and outside California. The

F Beneficiary’s Income

as authoritative law.

amounts derived from or attributable to income

If no special computations are required, use

from sources within and outside California are

Revised Schedule K- (54)

the following instructions to compute the

to be properly allocated and reported on the

The California Schedule K-1 (541), Beneficiary’s

beneficiary’s income from the estate or trust.

Schedule K-1 (541).

Share of Income, Deductions, Credits, etc., line

items were revised to be in a similar format with

California reporting requirements are the same

Payments to nonresidents having a business

the federal Schedule K-1 (1041), Beneficiary’s

as federal for:

or taxable situs in California are subject to

Share of Income, Deductions, Credits, etc. For

withholding of taxes. For more information,

• Income

more information, see the Schedule K-1 Federal/

get the instructions for Form 592, Nonresident

• Character of income

State Line References chart on page 3.

Withholding Annual Return; Form 592-A,

• Allocation of deductions

Nonresident Withholding Remittance

Round Cents to Dollars

• Allocation of credits

Statement; and Form 592-B, Nonresident

Round cents to the nearest whole dollar. For

• Gifts and bequests

Withholding Tax Statement.

example, round $50.50 up to $51 or round

However, income of nonresidents from bank

$25.49 down to $25.

General Summary of Treatment for Sourcing

accounts, stocks, bonds, notes, and other

Specific Nonbusiness Income Items

intangible personal property is not income from

A Purpose

sources in California unless one of the following

For California tax purposes:

applies 1) the property has acquired a business

The estate or trust uses Schedule K-1 (541)

• Compensation for personal services has a

situs in California 2) orders with brokers have

to report its beneficiary’s share of the income,

source where the services are performed.

been placed so regularly as to constitute “doing

deductions, credits, etc. The estate or trust

• Interest and dividends generally have a

business” (R&TC Section 17952).

files copies of the Schedules K-1 (541) with

source at the taxpayer’s state of residence.

the Form 541, California Fiduciary Income Tax

Include on Schedule K-1 (541) column (e) only

• Gains and losses from the sale or exchange

Return.

income from intangible property that is income

of real and tangible personal property have

from sources within California.

a source where the property is located.

B Who Must File

• Income from intangible personal property

Attach a separate schedule to each beneficiary’s

A fiduciary of the estate or trust (or one of

generally has a source at the taxpayer’s

Schedule K-1 (541) showing intangible income,

the joint fiduciaries) must file a Schedule K-1

state of residence.

such as interest, dividends, capital gains from

• Rents and royalties have a source where the

(541) for each beneficiary. A copy of each

the sale of stocks, bonds, etc., whose source is

property is located.

beneficiary’s Schedule K-1 (541) must be

dependent upon the residence or commercial

• Pensions have a source where the services

attached to Form 541 filed with the Franchise

domicile of the beneficiary.

were performed. However, California

Tax Board (FTB). The fiduciary also must

For nonresidents, income from a trade or

does not impose a tax on qualified

give each beneficiary a copy of his or her

business conducted within and outside

retirement income or pensions received by

respective Schedule K-1 (541) and a copy of the

California is apportioned or allocated to

nonresidents on or after January 1, 1996.

Beneficiary’s Instructions for Schedule K-1 (541)

California in accordance with Cal. Code Regs.,

or other prepared specific instructions. One copy

Generally, income from a business, trade, or

tit. 18, section 17951-4(c).

of each Schedule K-1 (541) must be retained for

profession is sourced as follows:

the fiduciary’s records.

G Passive Activities

• If the operations are conducted wholly

within California, the income has a

C Penalty

The limitations on passive activity losses and

California source.

credits under IRC Section 469 apply to estates

The estate or trust will be charged a $50 penalty

• If the operations within California are so

and trusts. Estates and trusts that distribute

for failure to provide a copy of each beneficiary’s

separate and distinct from the operations

income to beneficiaries are allowed to allocate

Schedule K-1 (541), unless reasonable cause

outside of California that taxable income

depreciation, depletion, and amortization

Schedule K-1 (541) 2008 Page

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5