Instructions For Form St-104-Mv - Sales Tax Exemption Certificate Motor Vehicle - Idaho State Tax Commission

ADVERTISEMENT

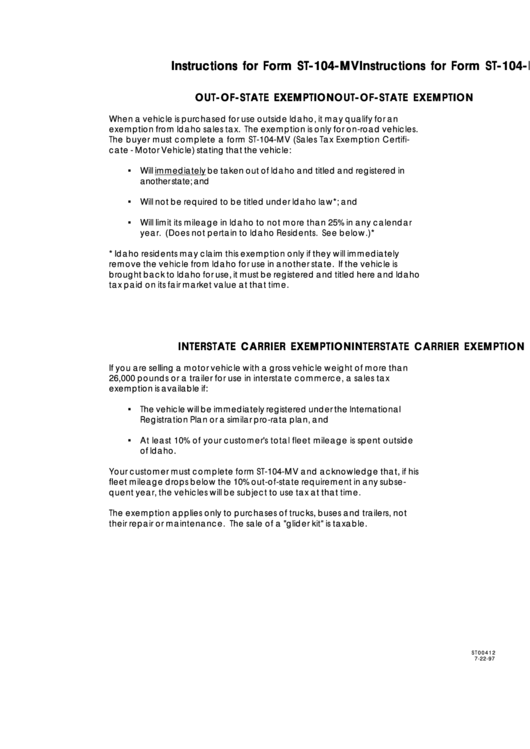

Instructions for Form ST-104-MV

Instructions for Form ST-104-MV

Instructions for Form ST-104-MV

Instructions for Form ST-104-MV

Instructions for Form ST-104-MV

OUT-OF-STATE EXEMPTION

OUT-OF-STATE EXEMPTION

OUT-OF-STATE EXEMPTION

OUT-OF-STATE EXEMPTION

OUT-OF-STATE EXEMPTION

When a vehicle is purchased for use outside Idaho, it may qualify for an

exemption from Idaho sales tax. The exemption is only for on-road vehicles.

The buyer must complete a form ST-104-MV (Sales Tax Exemption Certifi-

cate - Motor Vehicle) stating that the vehicle:

.

Will immediately be taken out of Idaho and titled and registered in

another state; and

.

Will not be required to be titled under Idaho law*; and

.

Will limit its mileage in Idaho to not more than 25% in any calendar

year. (Does not pertain to Idaho Residents. See below.)*

* Idaho residents may claim this exemption only if they will immediately

remove the vehicle from Idaho for use in another state. If the vehicle is

brought back to Idaho for use, it must be registered and titled here and Idaho

tax paid on its fair market value at that time.

INTERSTATE CARRIER EXEMPTION

INTERSTATE CARRIER EXEMPTION

INTERSTATE CARRIER EXEMPTION

INTERSTATE CARRIER EXEMPTION

INTERSTATE CARRIER EXEMPTION

If you are selling a motor vehicle with a gross vehicle weight of more than

26,000 pounds or a trailer for use in interstate commerce, a sales tax

exemption is available if:

.

The vehicle will be immediately registered under the International

Registration Plan or a similar pro-rata plan, and

.

At least 10% of your customer's total fleet mileage is spent outside

of Idaho.

Your customer must complete form ST-104-MV and acknowledge that, if his

fleet mileage drops below the 10% out-of-state requirement in any subse-

quent year, the vehicles will be subject to use tax at that time.

The exemption applies only to purchases of trucks, buses and trailers, not

their repair or maintenance. The sale of a "glider kit" is taxable.

S T 0 0 4 1 2

7-22-97

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1