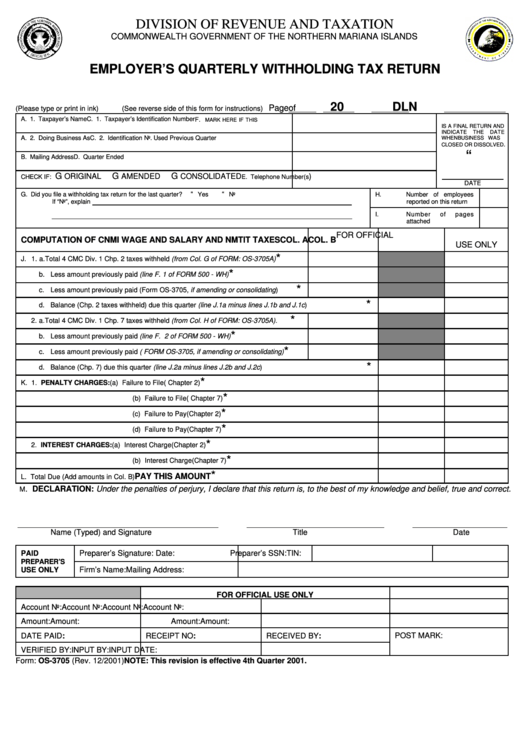

Form: Os-3705 - Employer'S Quarterly Withholding Tax Return

ADVERTISEMENT

DIVISION OF REVENUE AND TAXATION

COMMONWEALTH GOVERNMENT OF THE NORTHERN MARIANA ISLANDS

EMPLOYER’S QUARTERLY WITHHOLDING TAX RETURN

20

DLN

Page

of

(Please type or print in ink)

(See reverse side of this form for instructions)

A. 1. Taxpayer’s Name

C. 1. Taxpayer’s Identification Number

F.

MARK HERE IF THIS

IS A FINAL RETURN AND

INDICATE

THE

DATE

A. 2. Doing Business As

C. 2. Identification No. Used Previous Quarter

WHEN BUSINESS WAS

.

CLOSED OR DISSOLVED

“

B. Mailing Address

D. Quarter Ended

G

G

G

ORIGINAL

AMENDED

CONSOLIDATED

)

CHECK IF:

E. Telephone Number(s

DATE

“

“

G. Did you file a withholding tax return for the last quarter?

Yes

No

H.

Number of employees

If “No”, explain

reported on this return

I.

Number

of

pages

attached

FOR OFFICIAL

COMPUTATION OF CNMI WAGE AND SALARY AND NMTIT TAXES

COL. A

COL. B

USE ONLY

*

J. 1. a. Total 4 CMC Div. 1 Chp. 2 taxes withheld (from Col. G of FORM: OS-3705A)

*

b. Less amount previously paid (line F. 1 of FORM 500 - WH)

*

c. Less amount previously paid (Form OS-3705, if amending or consolidating)

*

d. Balance (Chp. 2 taxes withheld) due this quarter (line J.1a minus lines J.1b and J.1c)

*

2. a. Total 4 CMC Div. 1 Chp. 7 taxes withheld (from Col. H of FORM: OS-3705A).

*

b. Less amount previously paid (line F. 2 of FORM 500 - WH)

*

c. Less amount previously paid ( FORM OS-3705, if amending or consolidating)

*

d. Balance (Chp. 7) due this quarter (line J.2a minus lines J.2b and J.2c)

*

K. 1. PENALTY CHARGES:

(a) Failure to File

( Chapter 2)

*

(b) Failure to File

( Chapter 7)

*

(c) Failure to Pay

(Chapter 2)

*

(d) Failure to Pay

(Chapter 7)

*

2. INTEREST CHARGES:

(a) Interest Charge

(Chapter 2)

*

(b) Interest Charge

(Chapter 7)

*

PAY THIS AMOUNT

L. Total Due (Add amounts in Col. B)

. DECLARATION: Under the penalties of perjury, I declare that this return is, to the best of my knowledge and belief, true and correct.

M

Name (Typed) and Signature

Title

Date

PAID

Preparer’s Signature:

Date:

Preparer’s SSN:

TIN:

PREPARER’S

USE ONLY

Firm’s Name:

Mailing Address:

FOR OFFICIAL USE ONLY

Account No:

Account No:

Account No:

Account No:

Amount:

Amount:

Amount:

Amount:

POST MARK:

DATE PAID:

RECEIPT NO:

RECEIVED BY:

VERIFIED BY:

INPUT BY:

INPUT DATE:

Form: OS-3705 (Rev. 12/2001)

NOTE: This revision is effective 4th Quarter 2001.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2