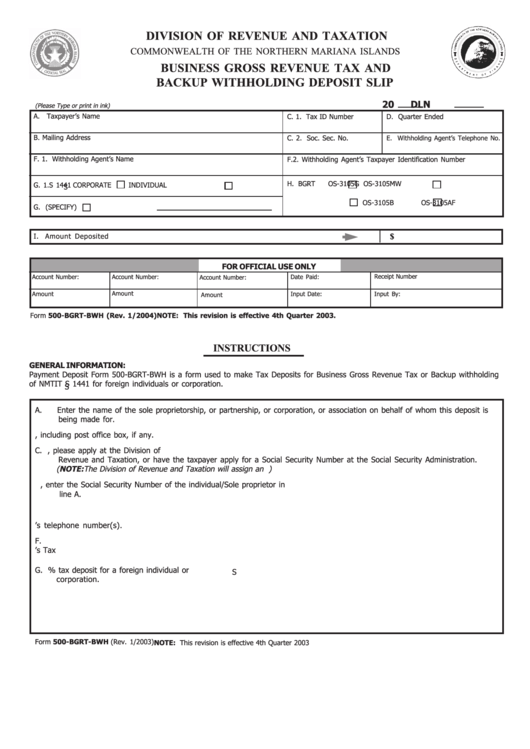

Form 500-Bgrt-Bwh - Business Gross Revenue Tax And Backup Withholding Deposit Slip

ADVERTISEMENT

DIVISION OF REVENUE AND TAXATION

COMMONWEALTH OF THE NORTHERN MARIANA ISLANDS

BUSINESS GROSS REVENUE TAX AND

BACKUP WITHHOLDING DEPOSIT SLIP

20

DLN

(Please Type or print in ink)

A.

Taxpayer’s Name

C. 1. Tax ID Number

D. Quarter Ended

B. Mailing Address

C. 2. Soc. Sec. No.

E. Withholding Agent’s Telephone No.

F. 1. Withholding Agent’s Name

F.2. Withholding Agent’s Taxpayer Identification Number

H. BGRT

OS-3105G

OS-3105MW

G. 1.

S 1441

CORPORATE

INDIVIDUAL

S

OS-3105B

OS-3105AF

G. 2.

OTHER (SPECIFY)

I.

Amount Deposited ..........................................................................................

$

FOR OFFICIAL USE ONLY

Receipt Number

Account Number:

Account Number:

Date Paid:

Account Number:

Amount

Amount

Input Date:

Input By:

Amount

Form 500-BGRT-BWH (Rev. 1/2004)

NOTE: This revision is effective 4th Quarter 2003.

INSTRUCTIONS

GENERAL INFORMATION:

Payment Deposit Form 500-BGRT-BWH is a form used to make Tax Deposits for Business Gross Revenue Tax or Backup withholding

of NMTIT S 1441 for foreign individuals or corporation.

S

A.

Enter the name of the sole proprietorship, or partnership, or corporation, or association on behalf of whom this deposit is

being made for.

B.

Enter the mailing address, including post office box, if any.

C. 1. Enter the Taxpayer I.D. Number. If the taxpayer does not have a Taxpayer I.D. Number, please apply at the Division of

Revenue and Taxation, or have the taxpayer apply for a Social Security Number at the Social Security Administration.

(NOTE: The Division of Revenue and Taxation will assign an I.D. Number for use only in reporting CNMI Taxes.)

2. If this deposit is for an individual/sole proprietorship, enter the Social Security Number of the individual/Sole proprietor in

line A.

D.

Enter the Quarter period for this deposit.

E.

Enter Withholding Agent’s telephone number(s).

F. 1.

Enter the Name of Withholding Agent making payment on behalf of Taxpayer in line A.

2.

Enter withholding Agent’s Tax I.D. Number

G. 1. Place a check mark in the applicable box. Check S 1441 if you are remitting 30% tax deposit for a foreign individual or

S

corporation.

2. Place a check mark if G.1. does not apply and specify.

H.

Place a check mark in the applicable Gross Revenue Return for credit to be applied to.

I.

Enter the amount being deposited.

Form 500-BGRT-BWH (Rev. 1/2003)

NOTE: This revision is effective 4th Quarter 2003

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1