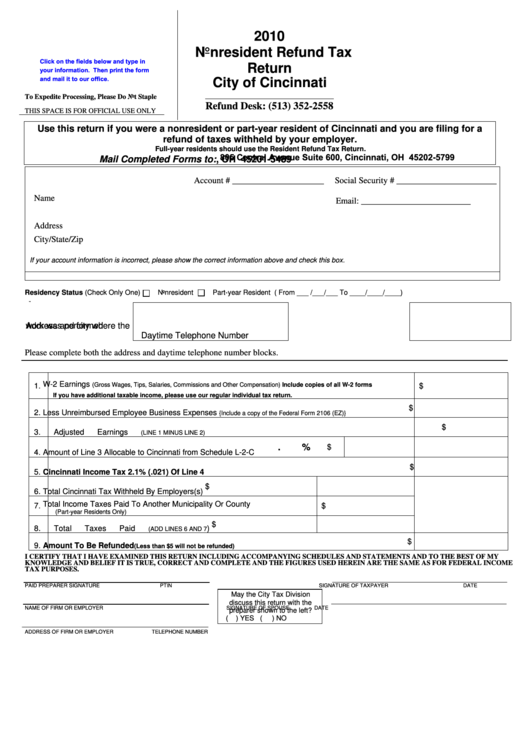

2010

Nonresident Refund Tax

Click on the fields below and type in

Return

your information. Then print the form

and mail it to our office.

City of Cincinnati

To Expedite Processing, Please Do Not Staple

Refund Desk: (513) 352-2558

THIS SPACE IS FOR OFFICIAL USE ONLY

Use this return if you were a nonresident or part-year resident of Cincinnati and you are filing for a

refund of taxes withheld by your employer.

Full-year residents should use the Resident Refund Tax Return.

805 Central Avenue Suite 600, Cincinnati, OH 45202-5799

Mail Completed Forms to: P.O. BOX 5489 CINCINNATI, OH 45201-5489

Account # _____________________

Social Security # _______________________

Name

Email: _________________________

Address

City/State/Zip

If your account information is incorrect, please show the correct information above and check this box.

Residency Status (Check Only One)

Nonresident

Part-year Resident ( From ___ /___/___ To ____/____/____)

Dayt

Address and city where the

work was performed

Daytime Telephone Number

Please complete both the address and daytime telephone number blocks.

W-2 Earnings

(Gross Wages, Tips, Salaries, Commissions and Other Compensation) Include copies of all W-2 forms

1.

$

If you have additional taxable income, please use our regular individual tax return.

$

2.

Less Unreimbursed Employee Business Expenses

{Include a copy of the Federal Form 2106 (EZ)}

$

3.

Adjusted Earnings

(LINE 1 MINUS LINE 2)

.

%

$

4.

Amount of Line 3 Allocable to Cincinnati from Schedule L-2-C

$

5.

Cincinnati Income Tax 2.1% (.021) Of Line 4

$

6.

Total Cincinnati Tax Withheld By Employers(s)

Total Income Taxes Paid To Another Municipality Or County

7.

$

(Part-year Residents Only)

$

8.

Total Taxes Paid

)

(ADD LINES 6 AND 7

$

Amount To Be Refunded

9.

(Less than $5 will not be refunded)

I CERTIFY THAT I HAVE EXAMINED THIS RETURN INCLUDING ACCOMPANYING SCHEDULES AND STATEMENTS AND TO THE BEST OF MY

KNOWLEDGE AND BELIEF IT IS TRUE, CORRECT AND COMPLETE AND THE FIGURES USED HEREIN ARE THE SAME AS FOR FEDERAL INCOME

TAX PURPOSES.

PAID PREPARER SIGNATURE

PTIN

SIGNATURE OF TAXPAYER

DATE

May the City Tax Division

discuss this return with the

NAME OF FIRM OR EMPLOYER

SIGNATURE OF SPOUSE

DATE

preparer shown to the left?

(

) YES

(

) NO

ADDRESS OF FIRM OR EMPLOYER

TELEPHONE NUMBER

1

1