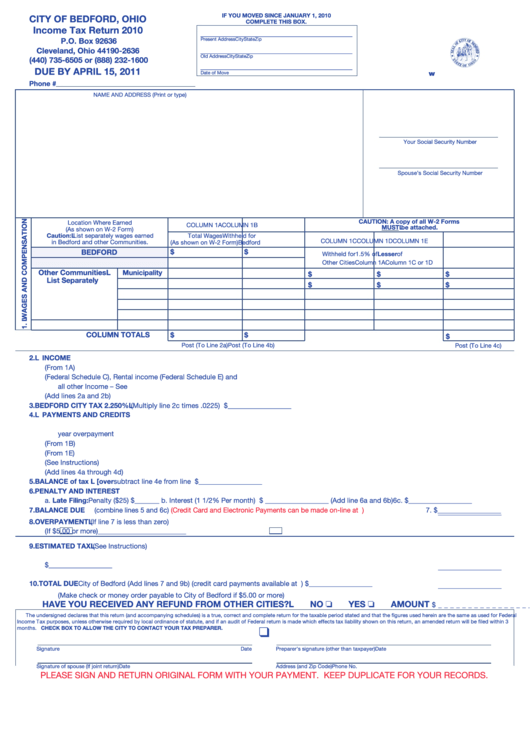

Income Tax Return - City Of Bedford - 2010

ADVERTISEMENT

IF yOU MOVeD SINCe JANUAry 1, 2010

CITy OF beDFOrD, OhIO

COMpLeTe ThIS bOx.

Income Tax return 2010

_______________________________________

p.O. box 92636

Present Address

City

State

Zip

Cleveland, Ohio 44190-2636

_______________________________________

Old Address

City

State

Zip

(440) 735-6505 or (888) 232-1600

_______________________________________

DUe by AprIL 15, 2011

Date of Move

www bedfordoh gov

phone #

NAME AND ADDRESS (Print or type)

Your Social Security Number

Spouse’s Social Security Number

CAUTION: A copy of all W-2 Forms

Location Where Earned

COLUMN 1A

COLUMN 1B

MUST be attached.

(As shown on W-2 Form)

Caution: List separately wages earned

Total Wages

Withheld for

COLUMN 1C

COLUMN 1D

COLUMN 1E

in Bedford and other Communities.

(As shown on W-2 Form)

Bedford

$

$

beDFOrD

Lesser of

Withheld for

1.5% of

Other Cities

Column 1A

Column 1C or 1D

Other Communities

Municipality

$

$

$

List Separately

$

$

$

COLUMN TOTALS

$

$

$

Post (To Line 2a)

Post (To Line 4b)

Post (To Line 4c)

2. INCOMe

a.

Total wages and compensation (From 1A) .............................................................................. 2a. _________________

b. Total other income (Federal Schedule C), Rental income (Federal Schedule E) and

all other Income – See Instructions ......................................................................................... 2b.__________________

c.

Total (Add lines 2a and 2b) ...............................................................................................................................................

2c.__________________

3. beDFOrD CITy TAx 2.250% (Multiply line 2c times .0225) ..................................................................................................

3. $__________________

4. pAyMeNTS AND CreDITS

a.

Estimated payments and prior

year overpayment credit.......................................................... 4a. ________________

b. Withheld for Bedford (From 1B) .............................................. 4b. ________________

c.

Credit for other cities (From 1E) .............................................. 4c. ________________

d. Direct payments to other cities (See Instructions) .................. 4d. ________________

e.

Total payments and credits (Add lines 4a through 4d).....................................................................................................

4e.__________________

5. bALANCe of tax due [overpaid] subtract line 4e from line 3 ................................................................................................

5. $__________________

6. peNALTy AND INTereST

a. Late Filing:

Penalty ($25) $_______ b. Interest (1 1/2% Per month) $ __________________ (Add line 6a and 6b)

6c. $__________________

7. bALANCe DUe (combine lines 5 and 6c)

(Credit Card and Electronic Payments can be made on-line at )

7. $__________________

__________________

8. OVerpAyMeNT (If line 7 is less than zero)

8a.

Refund (If $5.00 or more) _________________________ 8b.

Credit to 2011 Estimated Tax

8.__________________

9. eSTIMATeD TAx (See Instructions)

a.

Estimated tax liability for 2011

9a. ____________________

b. Quarterly estimated tax due 1/4 of 9a less credit from 8b .............................................................................................. 9b. $__________________

__________________

10. TOTAL DUe City of Bedford (Add lines 7 and 9b) (credit card payments available at )......................... 10. $__________________

__________________

(Make check or money order payable to City of Bedford if $5.00 or more)

hAVe yOU reCeIVeD ANy reFUND FrOM OTher CITIeS?

NO

yeS

AMOUNT

$ _________________

The undersigned declares that this return (and accompanying schedules) is a true, correct and complete return for the taxable period stated and that the figures used herein are the same as used for Federal

Income Tax purposes, unless otherwise required by local ordinance of statute, and if an audit of Federal return is made which effects tax liability shown on this return, an amended return will be filed within 3

months. CheCk bOx TO ALLOW The CITy TO CONTACT yOUr TAx prepArer.

K

Signature

Date

Preparer’s signature (other than taxpayer)

Date

Signature of spouse (If joint return)

Date

Address (and Zip Code)

Phone No.

PLEASE SIGN AND RETURN ORIGINAL FORM WITH YOUR PAYMENT. KEEP DUPLICATE FOR YOUR RECORDS.

PLEASE SIGN AND RETURN ORIGINAL FORM WITH YOUR PAYMENT. KEEP DUPLICATE FOR YOUR RECORDS.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1