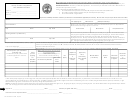

State of Illinois

Department of Human Services - Bureau of Child Care and Development

CHILD CARE APPLICATION

Parent/Guardian Name:

SECTION 5 - MONTHLY INCOME INFORMATION

Enter the average gross MONTHLY income in each box for yourself and each member you have counted in your family size.

Information from various agencies' databases and web sites will be taken into consideration when determining eligibility. If the

Type of Monthly Income does not apply, write N/A.

Applicant (YOU)

Other Family Members

Type of Monthly Income

1.

Employment Income for both parents and all family members age 19 and older

(including tips from pay stubs before deductions). Attach copies of 2 most recent

and consecutive pay stubs for each person (see FAQ #11). If you (or a family

member) are self employed, complete #2.

$

$

2.

Self Employment Income for you and family member age 19 and older. Attach

verification such as, most recent Federal tax return (IRS 1040 and all attachments),

or a copy of quarterly estimated taxes, or a listing of all business income expenses for

the last 30 days. This can be reported on your own form or a Self Employment form

$

$

which can be downloaded at:

or requested from your local CCR&R. Receipts, invoices or other

documentation must be attached.

$

$

3.

Child Support Received for all family members

$

$

4.

TANF Cash Assistance for all family members

$

$

5.

Other Federal Cash Income: for example, Social Security payments for

ALL family members and railroad benefits.

$

$

6.

Other Monthly Income for all family members; for example - unemployment

compensation, ongoing monthly adoption assistance payments from DCFS,

permanent disability payments (SSI), alimony, interest income, royalties, pension,

annuities, veteran's pension, survivor's benefits, and living expenses portion of

$

$

educational grants.

SUBTOTAL (add lines 1 - 6)

$

$

SUBTRACT Child Support Paid by you or another family member

- $

- $

TOTAL MONTHLY INCOME

$

$

If you receive any Housing Cash Assistance, including vouchers with a specific cash value, please

report the amount here. This is required for Federal reporting only, and it DOES NOT COUNT IN

TOTAL FAMILY INCOME.

$

IL444-3455 (R-6-11)

Page 10 of 17

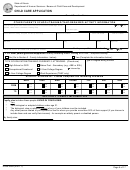

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17